Unlock 20%+ Yields: How Restaking & Liquid Staking 2.0 Are Redefining Max Yield Strategies in 2026

Why Traditional Staking Is Dead – Welcome to Liquid Staking 2.0

Imagine locking up your crypto for staking rewards, but instead of it sitting idle, your staked assets work overtime across multiple DeFi protocols, stacking yields up to 20% APY or more. That’s the power of liquid staking tokens (LSTs) and liquid restaking tokens (LRTs) dominating 2026. Pioneers like Lido hit $28B+ TVL, while Solana’s Jito leads with jitoSOL for seamless DeFi integration[1][2][5]. Experts call this the ‘yield revolution’ – FOMO is real as TVL surges past $40B peaks from 2024[2]. Don’t get left behind; top protocols like EigenLayer are onboarding millions in restaked assets daily.

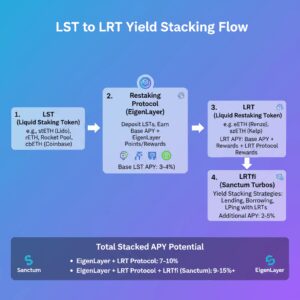

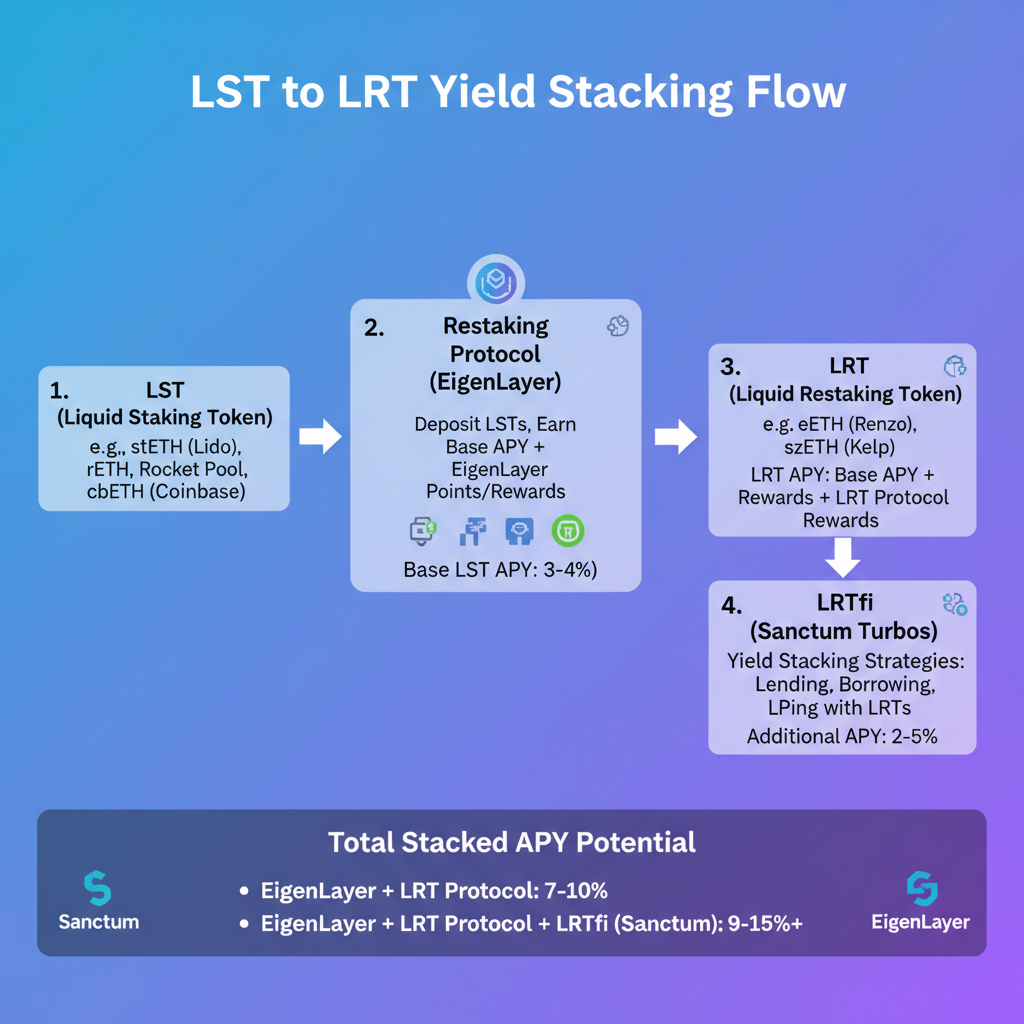

LSTs let you stake ETH or SOL and get a tradable token (stETH, jitoSOL) that accrues rewards while you use it in lending, farming, or DEXs. Restaking (LRTs) takes it further: restake your LSTs to secure other networks, earning extra ‘restaking rewards.’ Platforms like Sanctum aggregate 200+ LSTs for instant liquidity, crushing single-token lock-ins[1].

How LSTs and LRTs Work: Simple Breakdown for Max Gains

Step 1: Stake → Get LST

Deposit SOL on Jito, receive jitoSOL (1:1). It earns ~7-10% base staking yield, usable anywhere on Solana[1][2]. Lido’s stETH does the same for ETH, spread across pro validators to dodge slashing[2][5]. Rocket Pool’s rETH offers ~3.27% APY with node-running options for advanced users[5].

Step 2: Liquid Use → Stack Yields

Use LSTs in DeFi: Swap jitoSOL on Jupiter for multi-LST routing, or farm stETH on Curve/Aave for 5-15% extra[1][4]. Sanctum’s INF LST backs yields with Infinity pool – instant unstake any LST with minimal fees[1].

Step 3: Restake → LRT Explosion

Feed LSTs into EigenLayer for LRTs like eETH. Restake secures AVSs (Actively Validated Services), earning 10-20% boosted APY. Ethena’s USDe stablecoin yields via hedged staking, hitting double-digits amid volatility[2].

Real stat: Lido’s $28B TVL proves dominance; Solana LSTs like Sanctum’s INF lead with aggregated liquidity beating Jito/Marinade’s single-pool limits[1][5].

Top Protocols Crushing It in 2026: Rankings & Comparisons

Here’s the elite: Sanctum (Solana king with all-LST support), Jito (largest Solana LST), Lido (ETH vet), EigenLayer (restaking boss), Rocket Pool (decentralized ETH), Ethena (yield stables).

| Platform | Key LST/LRT | APY Range (2026) | TVL | Best For |

|---|---|---|---|---|

| Sanctum | INF, jitoSOL, mSOL | 8-15% | Billions (agg.)[1] | Instant multi-LST liquidity |

| Jito | jitoSOL | 7-12% | Largest Solana[1][2] | Solana DeFi integration |

| Lido | stETH | 3-8% + DeFi | $28B+[2][5] | ETH liquid staking pioneer |

| EigenLayer | eETH (LRT) | 10-20% restake | Exploding[2] | Yield multipliers |

| Rocket Pool | rETH | ~3.27% | Growing[5] | Decentralized nodes |

| Ethena | USDe | 10-25% hedged | High[2] | Stable yields |

Sanctum edges out with Infinity pool – unstake ANY LST instantly vs. Jito’s jitoSOL-only[1]. Lido’s validator spread minimizes risks[2].

Actionable Multi-Step Yield Strategies: Copy-Paste Profits

Strategy 1: Solana LST → Restake Turbo (15%+ APY)

- Connect Phantom wallet to Sanctum.so, stake SOL → INF or jitoSOL (0% entry fee)[1].

- Route jitoSOL via Jupiter DEX for best liquidity, swap to Marinade mSOL if decentralized[1].

- Restake INF/jitoSOL on EigenLayer-compatible AVSs for +5-10% points (check dashboard for active ones).

- Farm LRTs on Pendle for future yield trading – lock now before rates drop[4].

- Tip: Monitor APYs live; Sanctum shows comparisons[1]. Exit anytime via Infinity pool.

Strategy 2: ETH Liquid → Stable Farm (12-18% APY)

- Stake ETH on Lido → stETH (any amount, no 32 ETH min)[2].

- Deposit stETH to Aave/Curve for lending/farming boosts[4].

- Restake via EigenLayer → eETH LRT for AVS rewards.

- Hedge with Ethena USDe: Mint via staked collateral for delta-neutral yields[2].

- Pro move: Use Rocket Pool rETH if running mini-nodes (lower capital)[5].

Social proof: Thousands stake via Phantom’s native integration for wallet simplicity, but Sanctum/Jupiter optimize fees[1][3]. Urgency: Solana LST TVL exploding – join before congestion hikes fees.

Risks Exposed: Slashing, Depegs, Smart Contracts – Don’t Blindly HODL

No free lunch. Slashing: Validator penalties hit 1-5% in extremes; Lido/Rocket spread across 100s cuts this to <0.1%[2][5]. Depegs: LSTs trade 1-5% below peg during stress – Sanctum’s agg. liquidity minimizes[1]. Smart contract bugs: Audited like Rocket Pool (Sigma Prime, etc.), but EigenLayer’s novelty adds restaking risks[5].

Pros/Cons Quick Hit:

- Sanctum: Pros: All LSTs, instant out. Cons: Tiny agg. fee.

- Jito: Pros: Deep jitoSOL pool. Cons: Lock-in.

- EigenLayer: Pros: Massive multipliers. Cons: Newer risks.

Expert rec: Start small (e.g., $1K SOL), diversify LSTs via Sanctum. Track with CoinTracker[3].

Start Stacking Yields Today – Your 3-Step Launch

1. Wallet: Phantom for Solana, MetaMask for ETH.

2. Pick: Sanctum for flex, Jito/Lido for simple.

3. Execute: Stake → LST → DeFi/Restake. Monitor on DefiLlama.

CTA: Head to Sanctum.so or Lido.fi NOW – limited-time high APYs won’t last amid 2026 bull runs. Maximize or miss out!

Unlock Full Article

Watch a quick video to get instant access.