Starting With Spare Change or Zero Fees? How to Pick the Right App When Your First ‘Portfolio’ Fits in Your Pocket

If you are starting with tiny amounts – 5, 20, maybe 50 dollars at a time – the wrong app can quietly erase years of growth in subscriptions and hidden frictions, even if trades look “free.” This is where the real trade-off between zero‑commission trading apps and micro‑investing apps appears: one gives you total control at no trade cost, the other wraps automation and coaching around your spare change for a monthly fee.

Instead of asking “What’s the best app?”, a smarter question is “Which app structure fits the way I actually behave with money?” That single shift can be worth more than chasing the next hot stock.

Zero‑Commission vs Micro‑Investing: The Core Trade‑Off

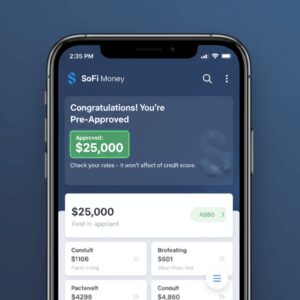

Zero‑commission trading apps like Robinhood, Webull, Fidelity, SoFi Invest, and Charles Schwab give you $0 commissions on stocks and ETFs, often with no account minimums and access to fractional shares so you can start with just a few dollars per trade. Many now also support recurring investments and basic automation, but they still expect you to choose what to buy and when. [3][4]

Micro‑investing apps like Acorns and Stash flip the model: instead of charging you per trade, they bundle everything into a flat monthly fee and focus on rounding up purchases, auto‑investing small deposits, and putting you into prebuilt, diversified portfolios. This feels effortless, but that flat fee can be surprisingly expensive on a tiny balance. [3][4]

How Fees Hit a Tiny Portfolio

When you are investing “coffee money,” the fee structure matters more than the marketing. Zero‑commission brokers charge $0 per trade and $0 account minimums, so if you are disciplined about making small, regular contributions (for example, $20 every payday into a broad ETF), your explicit cost might be close to zero. Apps like Robinhood, Webull, Fidelity, SoFi, and Schwab all fall into this camp, with no‑commission stock and ETF trades and no required minimums for standard brokerage accounts. [3][4]

Micro‑investing apps tend to use subscription pricing, such as Acorns’ flat monthly fee tiers instead of a percentage of assets. When you only have a few hundred dollars invested, that monthly amount can add up to several percent per year in effective cost, even though the app feels cheap in absolute dollars. As your account grows, that same flat fee becomes relatively less painful, but early on it can meaningfully drag returns. [3][4]

Simple Rule of Thumb for Fees

One practical approach is to compare your annual subscription fee to your expected average balance over the next year. If the fee would be more than about 1 percent of that balance, a zero‑commission broker with no platform fee usually makes more mathematical sense, as long as you are willing to set up some basic automation yourself. On the other hand, if paying a bit more in fees is the only way you will consistently invest at all, the behavioral benefits of a micro‑investing app may be worth it.

Fractional Shares: Where Both Camps Now Overlap

A few years ago, fractional shares were mostly the domain of micro‑investing specialists, but that edge has largely disappeared. Many major zero‑commission brokers now offer fractional shares, allowing you to buy just a few dollars of an ETF or stock instead of a full share, which makes it far easier to build a diversified portfolio with very small contributions. Fidelity, Schwab, Webull, SoFi, and others all support some form of fractional trading. [2][3][4]

Micro‑investing apps still lean heavily on fractional shares under the hood, typically directing your spare change into diversified ETF portfolios without you needing to pick tickers. This means the key difference is no longer “Can I buy partial shares?” but “Do I want to pick the investments myself or let the app choose for me and rebalance automatically?” [3][4]

Automation, Round‑Ups, and the ‘Lazy Genius’ Advantage

The biggest psychological edge of micro‑investing apps is not the investments; it is the automation wrapped around your everyday spending. Apps such as Acorns let you link a card, round up each purchase, and automatically invest the difference into a portfolio aligned with a chosen risk level, which is appealing if you struggle to save on purpose. Stash similarly automates recurring contributions and adds educational nudges and goal‑setting tools so that small, regular deposits feel less intimidating. [3][4]

Zero‑commission apps increasingly borrow these playbook elements by offering recurring buys, automated ETF investing, and basic robo‑advisor options, as seen with SoFi’s automated portfolios or Wealthfront’s fully managed accounts. However, these often require you to be intentional: you must log in, choose a fund or strategy, and turn on the automation rather than having it triggered by your day‑to‑day spending. [2][3][4]

Behavior Check: Which Sounds More Like You?

If you frequently forget to transfer money into savings or investing, a round‑up or auto‑draft micro‑investing app can act like a financial “background app,” turning everyday transactions into a steady drip of investing. If, instead, you already have a habit of moving money on payday or following a simple plan, a free broker with recurring ETF purchases can give you similar long‑term results with lower explicit costs.

Control, Choice, and the Risk of Over‑Trading

Zero‑commission apps feel powerful because they offer wide choice: individual stocks, ETFs, and sometimes options or crypto, often combined with real‑time quotes, watchlists, and news feeds. Robinhood, Webull, and Public emphasize active trading, fractional shares, and social features, which can be exciting for beginners but may tempt you into frequent trading instead of patient investing. [2][3][4]

Micro‑investing apps intentionally reduce choice. Acorns and similar services typically funnel you into a small set of diversified portfolios based on your risk tolerance and goals, automatically rebalancing as markets move. This limitation can be frustrating if you want to pick individual companies, but for someone starting with very small amounts, it can prevent emotional, FOMO‑driven trades that might otherwise hurt long‑term results. [3][4]

Quick Personality Match Guide

If you are curious and hands‑on, enjoy learning about companies, and can resist the urge to check your portfolio every hour, a zero‑commission app with fractional ETFs and a simple, rules‑based plan may be ideal. If you prefer a “set it and forget it” approach and know that too many options will paralyze or distract you, a micro‑investing app that asks only a few questions and then runs in the background is often better aligned with your temperament.

How to Test Both Approaches Without Wasting Money

You do not have to marry the first app you download. A practical strategy is to pick one zero‑commission broker and one micro‑investing app and run a 90‑day experiment with small, separate amounts in each, treating the total as your “tuition.” During this period, send fixed amounts to each account, such as 20 dollars a week to the broker via a recurring ETF purchase and automatic round‑ups plus an extra 10 dollars a week into the micro‑investing app. [3][4]

At the end of three months, review: Which app did you actually use and ignore least? Which made it easier to forget you were investing so the money could grow undisturbed? How much of your contributions went to fees versus investments? Then consolidate new contributions into the app that best matched your behavior while keeping the other open only if it offers unique features you genuinely value.

Concrete Example Setup

One realistic starting combo is pairing a free broker with a diversified ETF (for example, a broad U.S. market fund) purchased via recurring buys, alongside a micro‑investing app that captures your card round‑ups. The broker gives you efficient long‑term exposure with near‑zero ongoing platform costs, while the micro‑investing app scoops up “found money” you would never otherwise see. Over time, as your habits improve, you can gradually shift more toward the lower‑cost solution.

Where the Market Is Heading Next

Competition between zero‑commission brokers and micro‑investing apps has pushed features closer together: more automation and education inside free trading apps, and more diversified, goal‑based tools inside micro‑investing platforms. Robo‑advisor style offerings from companies such as Betterment and Wealthfront now sit in the middle, combining low‑cost automated portfolios with goal tracking and tax features, usually for a modest percentage fee on assets. [3][4]

This convergence means that the “best” app for someone starting with very small amounts increasingly depends less on a single killer feature and more on fit: your discipline level, your desire for control, your sensitivity to monthly fees, and how much value you place on built‑in coaching and automation. As fees fall and features overlap, your own behavior becomes the main edge that cannot be commoditized.

Action Plan: Choose Your Starting Path Today

To avoid staying stuck in analysis mode, commit to one of two clear starting paths today. If you are fee‑sensitive and willing to spend an hour setting things up, open a zero‑commission brokerage account that offers fractional shares and set up an automatic, recurring investment into a diversified ETF aligned with your time horizon, starting with whatever amount feels small but noticeable each month. If, instead, your biggest problem is “I never get around to it,” download a reputable micro‑investing app, connect your primary spending card, choose a balanced portfolio, and let round‑ups plus a small recurring transfer run for at least 90 days before you reconsider. [3][4]

The real cost of waiting is far larger than any difference between good apps. By choosing a structure that matches your personality and letting it operate in the background, you convert spare change and small, regular deposits into a habit that can compound for years. Start now with the tool you are most likely to keep using, not the one that looks mathematically perfect but will sit untouched on your home screen.

Unlock Full Article

Watch a quick video to get instant access.