Six Times I Learned More About Business From My Mortgage Than My MBA

You expect an MBA to teach you how to analyze markets, build business models, and lead teams. And it does. But nothing has taught me more about running a business—my business—than dealing with my mortgage.

Yes, that dreaded monthly bill and all the bureaucracy that surrounds it. Owning a home is often called the American dream, but for me, it became an unexpected crash course in entrepreneurial survival, decision-making, and financial resilience. Here’s how.

1. Cash Flow Is King (and Queen and Emperor)

There’s no forgiveness in homeownership. The mortgage is due whether you’re sick, business is slow, or a client ghosts you. Missing one payment can tank your credit or worse.

As an entrepreneur, that same discipline is crucial. Business owners often wait until the end of the month to “see what’s left” before they pay themselves. But a mortgage doesn’t work like that—and neither should your business. Prioritize your own pay and build everything else around it.

Lesson: Build your business to support your life, not the other way around.

2. Fixed vs. Variable Costs Shape Everything

When I locked in a fixed-rate mortgage, I suddenly saw the wisdom in predictable costs. In business, it’s tempting to chase low introductory offers or take on contract workers without understanding the long-term commitment.

But variable costs—rent that rises, software that scales per user, or marketing that’s performance-based—can destroy your margins if not carefully managed. My mortgage taught me to favor stability and scalability in business decisions.

Lesson: Know your baseline and budget around it ruthlessly.

3. Equity Is Earned, Not Just Inherited

Every payment I made chipped away at the loan and built equity—ownership. I wasn’t just paying to live somewhere. I was investing in my future.

That hit hard in business. For years, I did contract work that paid the bills but built no equity. No brand, no client retention, no assets.

Now, every project I take on is designed to build equity—whether through IP, client relationships, or systems I can eventually scale or sell.

Lesson: Stop trading hours for dollars. Start building something that outlives your effort.

4. Maintenance Costs Are Silent Killers

Owning a house means roof leaks, appliance failures, and surprise HOA fees. In business, it’s the same: tools break, staff turnover, compliance rules change.

I used to get frustrated by these “interruptions,” until I reframed them as part of the cost of staying in the game.

Lesson: Budget for ongoing maintenance—both at home and in business. Ignoring it costs more later.

5. The Paper Trail Is Power

I learned to keep every receipt, document every expense, and track every transaction tied to the house. That diligence transferred to my business life.

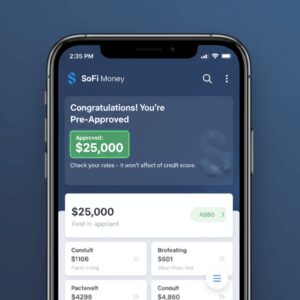

When it came time to apply for a loan, show proof of income, or file taxes, my paper trail spoke for me. It wasn’t glamorous, but it was powerful.

Lesson: Good documentation doesn’t just save time—it opens doors.

6. Interest Can Work Against You—or For You

Mortgage interest felt like a penalty. It made me think hard about what debt I carry and why.

That lesson applied to business, too. Using credit to grow is smart—if what you’re buying grows your business faster than the interest accumulates. If not, it’s just financial quicksand.

Lesson: Not all leverage is good. Use debt as a strategy, not a habit.

My MBA gave me frameworks. My mortgage gave me real life. Both matter, but only one keeps me up at night—and it’s the one that shaped how I build, budget, and believe in my business.

If you’re trying to grow a business while keeping a roof over your head, you don’t need a fancy degree to start learning. Sometimes, the bills you dread are the best business teachers you’ll ever have.

Unlock Full Article

Watch a quick video to get instant access.