Navigating the world of insurance can often feel like learning a new language. Policy documents are filled with terms that might seem confusing at first glance.

Let’s break down the complex language barriers and make sense of insurance jargon together. Ever found yourself scratching your head at words like “deductible” or “premium”? You’re not alone. Many people find insurance documents daunting. This guide is here to help you understand common policy terms in simple language.

Think of it as a friendly chat to decode those puzzling phrases. By the end of this article, terms like “liability” and “coverage” will make perfect sense. So, let’s get started on making insurance language less intimidating and more accessible.

Demystifying Insurance Language

Insurance has special words. These words can confuse people. Let’s make them easy. Jargon means special words that only some people know. Insurance companies use jargon. They talk about your policy, which is your insurance plan. A premium is the money you pay for your policy. If something bad happens, you pay a deductible first. Then, the insurance helps. Claims are requests for help when things go wrong. Understanding these words helps you know your benefits.

Types Of Insurance Policies

Understanding insurance can be simple. Let’s look at two main types: Life and Non-Life coverage. Life insurance is for when a person passes away. It helps their family with money. Non-Life insurance, also called General insurance, covers things like cars, homes, and health.

Now, let’s explore specialized insurance options. These are for specific needs. For example, travel insurance is for trips, and pet insurance is for your furry friends. They protect you from unique risks. It’s important to pick the right one for your needs.

| Insurance Type | What It Covers |

|---|---|

| Life Insurance | Supports family after death |

| Car Insurance | Fixes car after accidents |

| Home Insurance | Repairs home from damage |

| Health Insurance | Pays for medical bills |

| Travel Insurance | Helps with trip troubles |

| Pet Insurance | Covers pet health costs |

Choose what fits your life. Each type has a purpose. Get the one that makes sense for you.

Key Components Of An Insurance Policy

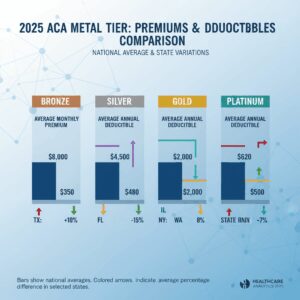

Let’s break down insurance talk into easy bits. Premiums are the money you pay for your insurance. You pay this regularly. It could be each month or once a year.

Next, we have deductibles. This is the cash you pay before your insurance does. Think of it like a door. You need to unlock it with your key, your cash, to get help from your policy.

Lastly, policy limits and coverage. Limits are the max your policy will pay. Coverage is what the policy takes care of. It’s like a blanket. Bigger blankets cover more of your bed. Same with policies. Bigger limits, more coverage.

The Role Of The Policyholder

Being a policyholder means you own the insurance policy. You have duties and rights. Let’s talk about what you can do and what you should do.

Filing a claim is a key right. It means asking for money when something bad happens. For example, if your car gets hit, you can file a claim to get money for repairs.

Your responsibilities include paying your premium on time. The premium is the money you pay to keep the insurance. You also need to tell the truth when applying for insurance and after an accident.

Remember, always read your policy well. It tells you what is covered and what is not. Knowing this helps you understand what you can claim for.

Insurance Claims And Payouts

Understanding insurance can be tricky. Claims and payouts are two key parts. A claim is what you file after a loss. It tells the insurance company you need money. To start, you report the loss to them. Then, they check if your policy covers it.

Many things can trigger a payout. It depends on your policy. For example, a car accident may lead to a payout under auto insurance. A house fire might trigger a payout for home insurance. Each policy has its own rules for what is covered.

It is vital to know these rules. They guide you on what will get a payout. Always read your policy carefully. Ask questions if something is not clear. This way, you know what to expect. And you can be ready if you need to file a claim.

Riders And Endorsements

Understanding your insurance policy is key. Riders and endorsements let you add extra benefits. Think of them like custom options for a car. They make your policy fit your needs better. You get to pick and choose what you add on.

Riders are extras you can add to your insurance. They might cover things like a serious illness or give you extra cash if you get hurt. Endorsements change the terms in your policy. They can add or take away coverage.

Need more protection? Consider these add-ons. Say you’re a mountain climber. You want coverage for risky hobbies. A rider can help with that. Or, you run a home business. An endorsement can protect your work gear.

Insurance can be confusing. But adding the right riders and endorsements? That can give you peace of mind. It’s like a safety net for the unexpected. And who doesn’t want that?

Renewals And Cancellations

To keep your insurance active, never miss a payment. This keeps you safe without a break. Missed payments can lead to loss of coverage. This means no protection for you.

Want to leave your policy? Talk to your insurance company. They will guide you on how to do it properly. Leaving without notice can cause problems. It’s important to follow the right steps.

Navigating Policy Comparisons

Choosing the right insurance can be tricky. Compare policies with care. Look at coverage, limits, and exclusions. Check the premiums – that’s what you pay. Notice the deductible too. This is what you pay before the insurance does.

Ask for help if you need it. Use simple comparison tools online. Read reviews and ratings. They show what others think. Always read the fine print. It has important details. Ask questions until you understand.

Take your time. Do not rush. A good choice now can save trouble later. Understanding your options is key. Use these tips to help you decide.

Conclusion

Navigating insurance terms doesn’t have to be daunting. This guide breaks down complex policies into plain language. Understanding these terms empowers you to make informed choices about your coverage. You now have the tools to read and interpret policy details with confidence.

Remember, knowledge is your best ally in the world of insurance. Keep this guide handy, and you’ll never feel lost in insurance lingo again. Stay informed, stay protected, and take charge of your insurance needs.

Unlock Full Article

Watch a quick video to get instant access.