To avoid debt traps, use personal loans wisely by borrowing only what you need and ensuring repayment capability. Plan and budget effectively.

Personal loans can be a valuable financial tool when managed correctly. They offer flexibility and can help cover unexpected expenses or consolidate high-interest debt. It’s crucial to borrow only what you need and ensure you can repay the loan comfortably.

Creating a detailed budget helps in planning repayment without straining your finances. Always compare loan options, interest rates, and terms before committing. Responsible borrowing and disciplined repayment can prevent debt from spiraling out of control. This approach ensures personal loans serve as a beneficial financial resource rather than a burden.

Smart Borrowing

Think about why you need the loan. Is it for a necessary expense? Avoid borrowing for things you don’t really need. Make a list of your needs and wants. This helps you see what is most important. Ask yourself if you can wait to buy it. Sometimes waiting is a good idea. Borrow only for important things.

Decide how much you can afford to borrow. Look at your income and expenses. Make sure you can pay back the loan on time. Set a limit on how much you will borrow. Stick to this limit no matter what. Remember, borrowing too much can lead to debt problems. Borrow wisely and stay safe.

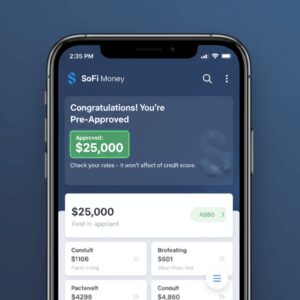

Choosing The Right Loan

Low interest rates can save you money. Compare rates from different lenders. A lower rate means you pay less over time. High rates can make a loan expensive. Always check the annual percentage rate (APR). This shows the true cost of the loan.

Loan terms can vary. Shorter terms mean higher payments but less interest. Longer terms have lower payments but more interest. Find a balance that suits your budget. Always read the fine print. Some loans have hidden fees or penalties.

Managing Repayments

Creating a budget helps you track your money. Write down your income. List all your expenses. Make sure to include loan repayments. This way, you see where your money goes. Adjust your spending to avoid debt. Use apps or spreadsheets to help. Stick to your budget every month.

Automating payments ensures you never miss a due date. Set up automatic transfers from your bank. Many banks offer this service for free. This helps avoid late fees. It also improves your credit score. Make sure you have enough money in your account. Check your bank statements regularly. This helps you stay on top of your finances.

Avoiding Pitfalls

Personal loans may seem easy, but watch out for hidden fees. These fees can add up fast. Some lenders charge fees for loan processing or early repayment. Always read the fine print. Ask the lender about all possible charges before signing. Knowing the full cost helps you plan better.

Debt consolidation can simplify your bills. But it has risks too. Combining debts may lead to bigger loans. This means more interest payments. Sometimes, people spend more because they feel they have less debt. This can trap you in a cycle of borrowing. Keep track of your spending. Make sure to stick to a budget to avoid new debt.

Building Financial Health

A personal loan can affect your credit score. Paying on time can help improve it. Missed payments can lower your score. Always check your loan details before applying. Understand the interest rates and fees. This knowledge helps you make smart decisions.

Plan your finances for the long-term. Create a budget that includes your loan payments. Always aim to pay more than the minimum amount. This reduces the total interest you pay. Avoid taking multiple loans at once. It can lead to a debt trap. Stay focused on your financial goals.

Conclusion

Using personal loans wisely can improve your financial health. Borrow only what you need and plan repayments carefully. Stay informed and make sound decisions. This way, you can avoid debt traps and achieve financial stability. Remember, responsible borrowing is key to maintaining a healthy financial future.

Unlock Full Article

Watch a quick video to get instant access.