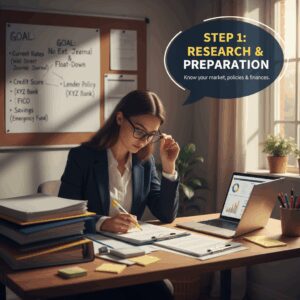

Maximize credit card rewards by examining earning rates, redemption options, and annual fees. Choose programs offering high value and flexibility.

Credit card rewards programs can be incredibly beneficial. The key is to choose one that aligns with your spending habits. Look for cards with high earning rates on your most frequent purchases. Evaluate the redemption options to ensure they fit your lifestyle.

Consider annual fees and whether the benefits outweigh the costs. Some cards offer additional perks, like travel insurance or purchase protection, which can add significant value. By carefully selecting a rewards program, you can make the most of your spending and enjoy substantial benefits. Always compare different cards to find the best match for your financial goals.

Choosing The Right Credit Card

Credit cards offer many reward programs. Some give you cash back. Others provide travel points or store discounts. Think about your spending habits. Choose a card that matches them. If you travel often, travel points are best. For everyday purchases, cash back is great. Some cards offer bonus categories. These give more rewards for certain purchases. Understand all the options. Pick what suits your lifestyle.

Annual fees can be high. Some cards charge over $100 each year. Check if the rewards outweigh the fees. No-fee cards are available too. Look at the APR or interest rate. Lower APR means less interest. This is important if you carry a balance. High APR can cost you more. Always compare fees and interest rates. Choose a card with low costs and high rewards.

Understanding Reward Categories

Cashback rewards are simple to understand. You get a percentage of what you spend. They are very flexible. You can use them for anything.

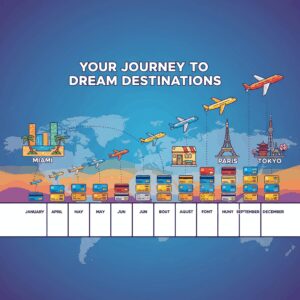

Travel points are great for those who love to travel. You can use these points for flights, hotels, and car rentals. They offer great value when redeemed for travel.

Retail discounts let you save on everyday purchases. Many cards offer discounts at popular stores. They are perfect for frequent shoppers.

Evaluating Sign-up Bonuses

Evaluate sign-up bonuses to maximize your credit card rewards. Seek substantial offers, low spending thresholds, and timeframes aligning with your spending habits.

Bonus Value

Sign-up bonuses can give you a big boost. Look for cards offering high bonus points. Some cards offer up to 100,000 points. These points can be worth hundreds of dollars. Make sure the bonus value fits your spending habits. A high bonus might not be worth it if you can’t meet the requirements.

Spending Requirements

Check the spending requirements for the sign-up bonus. Some cards require you to spend $3,000 in three months. Others might ask for $5,000 in six months. Choose a card with spending requirements you can meet. Missing the target means missing the bonus. Plan your spending to hit the target without overspending.

Maximizing Everyday Spending

Unlock the full potential of your credit card by exploring top rewards programs. Prioritize points, cashback options, and travel perks.

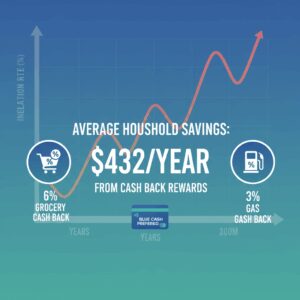

Grocery And Gas Rewards

Using your credit card for groceries can earn you great rewards. Many cards offer extra points or cash back on grocery purchases. Look for cards that give at least 2% back on groceries. Gas rewards are also important. Some cards offer higher rewards on fuel purchases. This can save you money over time. Choose a card that offers 3% or more back on gas. These rewards help reduce your monthly expenses.

Dining And Entertainment Perks

Eating out can also earn you points. Some cards give extra rewards at restaurants. Look for cards that offer 3% or more back on dining. Entertainment expenses like movies and concerts can also earn rewards. Choose cards that provide extra perks for these activities. These rewards make your outings more affordable. Always use your card for these purchases to maximize points.

Leveraging Special Promotions

Special promotions often come during holidays. Look for deals around Christmas and New Year. These times can offer extra reward points. Some cards give double points on purchases. This can help you earn more rewards quickly. Always check your card’s special offers page.

Limited-time deals are short but sweet. They can offer huge rewards. Sometimes, you get cashback or bonus points. These deals last for a few days only. Mark your calendar to not miss them. Sign up for email alerts from your card company. This way, you stay informed.

Understanding Redemption Options

Cashback is simple. You get a percentage of your spending back. This is usually in the form of a statement credit or direct deposit. Some cards offer higher cashback rates on certain categories. Examples include groceries or gas. Always check if there are limits on how much you can earn.

Travel redemptions can offer great value. Use points or miles for flights, hotels, and car rentals. Some programs have partnerships with airlines or hotel chains. This can give you more options. Always compare the cash price to the points needed. This helps you see if it’s worth it.

Points can also be used for gift cards and merchandise. This can be useful if you shop at specific stores. Check the conversion rate before redeeming. Some cards may offer better value on certain items. Always look for special promotions or discounts. This can maximize the value of your points.

Monitoring Reward Expiration

Many credit card rewards have expiration dates. Check your card’s policy to know when your rewards expire. Some cards have rewards that expire after a set time. Others reset the clock each time you earn or redeem rewards.

Redeem your rewards often. This prevents any from expiring. Set reminders to use your rewards before they expire. Some cards let you transfer points to other programs. This can help extend their life.

Avoiding Common Pitfalls

Credit cards can be tempting. Many people spend more than they can pay back. This can lead to debt. Always track your spending. Stick to a budget. Rewards are great, but not worth debt.

Some rewards programs have hidden fees. These fees can eat up your rewards. Always read the fine print. Check for restrictions on how you can use rewards. Some cards have limits or expiration dates. Knowing these can save you money.

Conclusion

Maximizing your credit card rewards starts with choosing the right program. Look for flexibility and high earning potential. Evaluate your spending habits to find the best fit. Keep an eye on bonus categories and redemption options. With the right rewards program, you can make every purchase more rewarding.

Unlock Full Article

Watch a quick video to get instant access.