Buying your first home is an exciting milestone, but it can also be daunting, especially when it comes to understanding and navigating the mortgage process. From choosing the right mortgage to understanding the terms and preparing for the financial commitment, there’s a lot to consider. Here’s a straightforward guide to help first-time homebuyers manage the journey from application to closing.

1. Understand Your Financial Health

Before you even start looking at houses, it’s crucial to assess your financial situation. This means checking your credit score, reviewing your savings, and evaluating your budget. Your credit score will directly impact the interest rates you’re offered, so it’s important to check your score well in advance to clear up any errors and make improvements if needed.

- Credit Score: Aim for a score of 670 or higher to qualify for better rates.

- Budget: Determine how much you can realistically afford to spend on a mortgage payment each month without straining your finances.

- Savings: Ensure you have enough saved not only for a down payment but also for closing costs, moving expenses, and an emergency fund.

2. Get Pre-Approved for a Mortgage

Getting pre-approved is a crucial step in the home-buying process. This involves a lender checking your financial background and determining how much they’re willing to lend you. A pre-approval letter can make you a more attractive buyer when you make an offer on a home. It shows sellers that you are serious and capable of completing the purchase.

- Documentation: You will need to provide financial documents like pay stubs, tax returns, and bank statements for mortgage pre-approval.

- Lender Selection: Shop around with different lenders to find the best rates and terms that fit your needs.

3. Understand Different Types of Mortgages

First-time homebuyers have a variety of mortgage options:

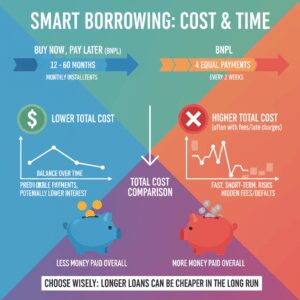

- Fixed-Rate Mortgages: These loans have the same interest rate for the entire repayment term, making monthly payments predictable.

- Adjustable-Rate Mortgages (ARMs): These loans have a fixed interest rate for a certain number of years, after which the rate adjusts annually based on market trends.

- FHA Loans: These loans are insured by the Federal Housing Administration and typically require lower down payments and credit scores.

- VA Loans: Available to veterans, active-duty service members, and some members of the National Guard and Reserves, these loans offer competitive terms and require no down payment.

Understanding the pros and cons of each type will help you choose the best one for your financial situation.

4. Choose the Right Mortgage for Your Needs

Consider how long you plan to stay in your home and how much you can afford in monthly payments. For example, a fixed-rate mortgage might be a better choice if you plan on staying in your home for many years. On the other hand, an ARM might be suitable if you plan to move or refinance before the rate adjusts.

5. Budget for Closing Costs and Other Expenses

Closing costs can range from 2% to 5% of the loan amount and include fees for loan origination, inspections, title searches, and more. Make sure you budget for these costs in addition to your down payment. Don’t forget to account for ongoing costs like property taxes, homeowners insurance, and maintenance.

6. Attend Homebuying and Mortgage Classes

Many communities offer classes for first-time homebuyers. These can be incredibly valuable as they help you understand the home buying and mortgage processes in depth. These classes often cover topics like choosing a mortgage, finding a home, the closing process, and managing your finances as a homeowner.

7. Negotiate Where You Can

You can negotiate on more than just the price of the house. Sometimes you can also negotiate your closing costs or the terms of your mortgage. Your realtor can help you understand where there might be room for negotiation.

8. Read Everything Carefully

Once your mortgage application is approved, you’ll receive a loan estimate form outlining the details of your mortgage. Read this document carefully to ensure there are no surprises. Check the loan amount, interest rate, monthly payments, and any fees or penalties detailed in the document. Don’t hesitate to ask your lender to explain anything that doesn’t make sense.

9. Prepare for the Closing

The closing is the final step in the home-buying process. This is when you sign all the paperwork to complete the purchase and legally take ownership of the home. Make sure you understand what documents you’ll be signing and what they mean. It’s also important to know what you’ll need to pay at closing and to confirm how you’ll make these payments.

10. Maintain Your Financial Stability

Once you’ve purchased your home, continue to manage your finances responsibly. Keep saving, maintain good credit, and budget appropriately to ensure you can comfortably make your mortgage payments. Also, keep an eye on your

home’s value and your mortgage terms, as there might be opportunities to refinance in the future to a better rate or terms.

Buying your first home is an exciting step, and understanding the mortgage process is key to navigating it successfully. By taking the time to understand your finances, exploring different mortgage options, and preparing for the costs associated with buying a home, you’ll be in a much better position to make smart decisions that pave the way to homeownership. Remember, this is a significant commitment, and getting educated on the process will help you take it on with confidence.

Unlock Full Article

Watch a quick video to get instant access.