Strategies for Effective Debt Management: How to Use Credit Cards Wisely and Avoid Financial Pitfalls

Welcome to the ultimate guide on navigating the treacherous waters of debt management, a journey fraught with more danger than choosing the express checkout lane at the supermarket with more than the socially acceptable number of items. It’s a tale as old as time: man meets credit card, man falls in love with credit card, credit card breaks man’s bank account. Fear not, for with a sprinkle of wisdom and a dash of humor, you can emerge victorious in the battle against debt.

Chapter 1: The Call to Arms – Recognizing the Enemy

In the left corner, weighing in at just a few grams but packing a financial punch heavier than your aunt’s fruitcake, is the Credit Card. Beloved by many, understood by few, this plastic knight can be both your fiercest ally and your most dreaded foe. The key to wielding this powerful weapon? Understanding its nature.

Chapter 2: The Art of War – Credit Card Strategies

The High Ground: Know Thyself

Before charging into battle, one must assess their financial battleground. Your spending habits are the terrain—know them like the back of your hand. Are you a strategic spender or do you charge forth with the might of a thousand impulse buys? Self-awareness is your shield; wield it well.

The Alliance: Budgeting Allies

In the war on debt, your budget is your most loyal ally. Craft it wisely, ensuring it covers your necessities, secures your future (savings), and allows for minor indulgences (because life without chocolate is a battle not worth fighting). A well-planned budget keeps you from overextending your forces.

The Trojan Horse: The Rewards Scheme

Credit card rewards can be a formidable weapon if used correctly. However, like the Trojan Horse, they come with risks. The promise of rewards can lure you into spending more than intended. Use this weapon sparingly and wisely, always ensuring your spending leads to meaningful rewards without leading you into debt.

Chapter 3: Guerrilla Tactics – Avoiding Debt Traps

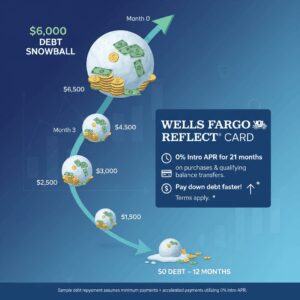

The Ambush: Minimum Payments

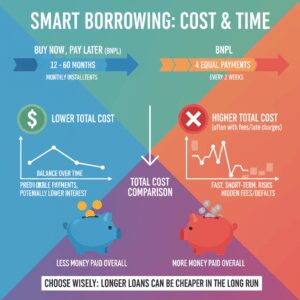

Paying only the minimum on your credit card is like trying to empty a bathtub with a teaspoon while the tap is still running. It’s a trap that will keep you in debt longer than you thought possible, amassing interest that could rival a small country’s GDP. Aim to pay more, strike hard and fast at the principal amount.

The Siege: High-Interest Rates

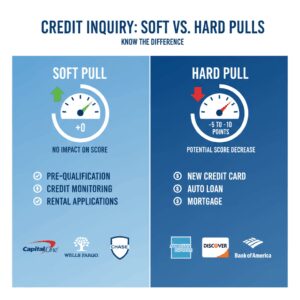

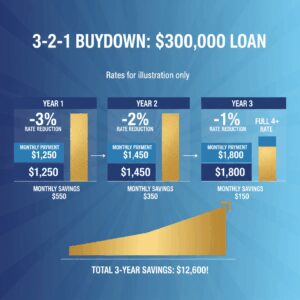

Interest rates can besiege your finances, relentlessly attacking your wallet from all sides. Your strategy? Negotiation and balance transfers. If you’ve been a loyal and timely payer, negotiate for lower rates. Alternatively, consider transferring your balance to a card with lower interest as a strategic retreat, buying you time to regroup.

The Decoy: Cash Advances

Cash advances are the decoys of the credit card world, tempting you with immediate access to funds but hiding exorbitant fees and interest rates. Avoid this ruse at all costs. If you find yourself considering a cash advance, it may be time to revisit your budget and spending.

Chapter 4: The Secret Weapon – Emergency Fund

In every hero’s arsenal, there lies a secret weapon. In the realm of personal finance, this is the emergency fund. This fund is your financial Excalibur, cutting through unexpected expenses without the need to draw on your credit card. Start small, and build it up. Like any good secret weapon, it should be kept hidden (in a savings account) and only used in times of great peril.

Chapter 5: Diplomacy – Seeking Assistance

Even the mightiest warriors need allies. If you find yourself overwhelmed, seek counsel. Financial advisors, debt counselors, and even credit card companies themselves can offer strategies and solutions to manage your debt. Remember, asking for help is not a sign of weakness but a strategic maneuver for victory.

Chapter 6: The Victory Dance – Becoming Debt-Free

Imagine the day you emerge victorious, debt a distant memory, your credit score soaring high like a majestic eagle. This is your goal, the promised land. Achieving it requires discipline, strategy, and perseverance, but the taste of victory is sweet. When that day comes, do your victory dance, for you have mastered the art of debt management.

Epilogue: The Legend Continues

As you close this tome of financial wisdom, remember that the battle against debt is ongoing. New challenges will arise, but armed with knowledge, strategy, and a healthy dose of humor, you are well-equipped to face them. Share your tales of victory so that others may learn from your journey, and together, we can all march towards a future of financial stability and prosperity.

So, brave warrior, go forth and conquer your financial foes. May your credit score rise ever higher, your debt shrink to the size of a pea, and your financial wisdom become the stuff of legend. Your quest begins now!

Unlock Full Article

Watch a quick video to get instant access.