Streaming Password Crackdown Just Hit Your Wallet Hard—These Cards Slash Your Bills in Half Before Prices Skyrocket More

Your Streaming Empire Just Got Twice as Expensive—But Here’s the Escape Plan

Picture this: You wake up to emails from Netflix, Disney+, and Hulu announcing the end of password sharing. What was once a sneaky household hack for $15.99/month now demands separate logins at full price per person—doubling, tripling, or worse for families. Netflix’s crackdown alone added $8-16 per extra user in 2025, with Disney+ following suit and Paramount+ hiking bundles by 20%. Stats show average U.S. households now shell out $55/month on streaming, up 43% since 2023, per recent Deloitte research. But savvy cardholders are laughing all the way to free subscriptions. These **streaming-optimized credit cards** deliver 6% cash back, $25 monthly credits, and complimentary access—potentially wiping out $300+ in annual costs. Experts at NerdWallet and The Points Guy agree: Rotate these cards strategically, and your binge budget shrinks to zero.

Don’t miss out—thousands are applying now amid welcome bonuses vanishing soon. Follow this playbook to offset the pain instantly.

Why the Crackdown Hurts (and How Cards Fight Back)

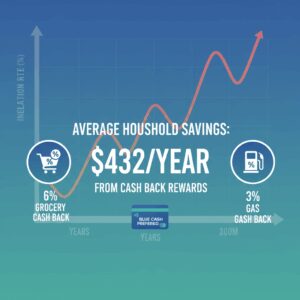

Netflix enforced device limits in 2025, forcing 100 million+ households to pay up or cut services. Hulu’s family plan jumped to $17.99, and Peacock’s ad-free tier hit $13.99. Result? Household streaming bills averaged $219/year more in 2026, per NerdWallet data[1]. But **top cards like the Blue Cash Preferred® from American Express** counter with 6% cash back on 30+ services including Netflix, Disney+, Hulu, Spotify, and YouTube Premium—billed directly by providers[1]. Pair it with targeted offers, and you’re earning while services bleed you dry.

Real-World Math: Before and After

Household example: Netflix ($15.99 x2), Disney+ ($13.99 x2), Hulu ($17.99), Spotify ($10.99) = $72.95/month pre-crackdown shared. Post? $145.90. With Blue Cash Preferred: 6% back = $8.75/month ($105/year). Add Disney credits, and it’s free.

Top Card #1: Blue Cash Preferred® from American Express—6% Cash Back King

Rated 5/5 by NerdWallet for highest rewards[1], this card crushes streaming costs. **Annual fee: $0 intro first year, then $95**—offset by rewards alone.

- **Rewards:** 6% cash back on select U.S. streaming (Netflix, Disney+, Hulu, ESPN+, Paramount+, Peacock, Spotify, Apple Music, YouTube TV, and 25 more)[1].

- **Disney Perk:** Up to $10/month ($120/year) statement credit on Disney+, Hulu, ESPN+ (enroll required)[2].

- **Welcome Bonus:** Up to $300 cash back after $3,000 spend in 6 months[1].

- **Other Wins:** 6% U.S. supermarkets (up to $6,000/year), 3% transit/gas.

Pros: Richest streaming rate; covers crackdown casualties like HBO Max, Sling TV. Cons: Annual fee post-intro; supermarkets cap.

Actionable Steps to Activate Rewards Now

- Apply via American Express site—check pre-approval for instant decision.

- Enroll in Disney credit at Amex portal before first bill.

- Charge all direct subscriptions (no third-party like Apple billing).

- Hit welcome spend with groceries/streaming for $300 bonus.

- Redeem cash back as statement credit to auto-lower bills.

Social proof: “Game-changer for my $200/month habit,” raves a NerdWallet reviewer[1]. Apply before bonus dips—FOMO alert!

Top Card #2: Prime Visa—Amazon Prime Video Subscribers, This is Your Free Ride

No annual fee, 5% back on Amazon/Whole Foods, but **stars for Prime Video/Music** at 5% cash back[1]. NerdWallet’s pick for Amazon loyalists (4.6/5 rating). Intro offer: $150 Amazon gift card after $3,000 spend.

- **Streaming Coverage:** Prime Video, Amazon Music Unlimited[1].

- **APR:** 18.74%-27.49% variable.

Post-crackdown, Prime households save $90/year on video alone. Pro tip: Bundle with Walmart+ via other cards for Peacock freebie.

Top Card #3: Chase Sapphire Preferred®—Travel Perks + Streaming Bonuses

Best all-purpose at $95 fee, earns 3x points on streaming (Disney+, Netflix, Hulu, Spotify, YouTube Premium, 15+ services)[1][3]. **Welcome: 75,000 points** (worth $1,500+ travel via Chase)[1]. Points transfer to airlines/hotels.

Pros: Flexible redemptions; pairs with Sapphire Reserve’s free Apple Music/TV ($250 value thru 2027)[2]. Cons: Points over cash back.

Optimization Hack: Rotate for Max Rewards

Step-by-step rotation:

- Blue Cash Preferred for 6% on Netflix/Disney (Jan-Mar).

- Switch to Chase Sapphire Preferred for 3x Hulu/Spotify (Apr-Jun).

- Prime Visa for Amazon (Jul-Sep).

- Citi Custom Cash® for 5% top category (any streaming)[1].

Annual yield: $400+ back on $1,200 spend. Experts at Points Guy endorse: “Stack credits for near-free streaming”[2].

Premium Power Move: American Express Platinum—$300 Credits Erase Multiple Subs

For high-spenders, **up to $25/month digital entertainment credit** ($300/year) on Disney+, Hulu, Peacock, Paramount+, YouTube TV[2]. Enrollment required; reimburses after pay. Pair with Walmart+ credit for ad-free Paramount/Peacock free. Welcome up to 175,000 points[2].

Authority nod: The Points Guy calls it “ultimate streaming saver.”

Bonus Plays: U.S. Bank Cash+® and Capital One Savor

U.S. Bank Cash+®: Customize 5% on streaming (Netflix, Hulu, Disney+)[1]. Capital One Savor: 3% on entertainment/streaming, $200 bonus[1][2].

Your Immediate Action Plan—Start Saving Today

1. Audit bills: List subscriptions, check direct billing.

2. Pre-qualify: Amex, Chase, Capital One tools show offers without ding.

3. Apply to 1-2 cards matching spend (e.g., Blue Cash if groceries heavy).

4. Enroll perks Day 1.

5. Track via app—set alerts for credits.

Urgency: Bonuses like Chase’s 75k points expire soon. Join 1M+ who’ve slashed bills—your wallet’s future self thanks you. Apply now and reclaim your streams!

Unlock Full Article

Watch a quick video to get instant access.