Gaming Rigs & Creator Setups: The Insurance Nightmare Nobody Talks About (And How to Fix It)

Your $8,000 Gaming PC Isn’t Actually Covered—Here’s Why

You’ve invested thousands into your setup. A high-end gaming PC, multiple monitors, professional microphone, streaming equipment, backup hard drives—the list goes on. But here’s the uncomfortable truth: most standard renters insurance policies will leave you financially devastated if disaster strikes.

Standard renters insurance caps coverage for electronics at approximately $1,000 to $1,500 per category.[1] If you own a $3,000 gaming laptop, a $2,500 camera setup, and $1,500 in peripherals, you’re looking at a potential $5,000+ loss that your basic policy won’t cover. This is the hidden crisis facing remote workers, content creators, and serious gamers across the country.

The good news? Several top-rated insurers now offer specialized endorsements designed specifically for high-value electronics. And understanding which companies offer the best protection for complex equipment setups could save you thousands.

Why Standard Policies Fail Multi-Device Setups

The $1,500 Problem

Most renters insurance companies—including State Farm, GEICO, and Lemonade—include standard coverage that caps individual categories of valuables.[2] Electronics typically fall into this restricted category. A single fire, theft, or water damage incident could destroy your entire setup, but your insurer will only reimburse you for a fraction of the actual loss.

Consider this real scenario: A power surge damages your gaming PC ($4,200), monitor ($1,800), and audio interface ($2,100). Total loss: $8,100. Your standard policy pays $1,500 maximum. You absorb $6,600 in losses.

Off-Premises Coverage Gaps

Content creators often work from coffee shops, client offices, or while traveling. Most standard renters policies provide limited or no coverage for equipment used outside your apartment. If your laptop is stolen from a café or your camera gear is damaged during a shoot at a client location, you may have zero protection.

Business-Use Exclusions

Here’s where it gets tricky: if your equipment is used for income generation—streaming, freelance design, YouTube content creation—many insurers classify this as “business property” and explicitly exclude it from coverage.[1] Your personal gaming setup might be covered, but the moment you start monetizing, you’re on your own.

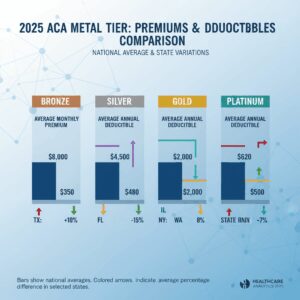

Top Renters Insurance Companies for Expensive Electronics (2026)

Amica: The Replacement Cost Champion

Amica stands out because replacement cost coverage comes standard on many of their policies—not as an expensive add-on.[1][2] This means if your 3-year-old laptop is damaged, Amica pays enough for a brand-new replacement, not depreciated value.

For expensive electronics: Amica offers optional “scheduled coverage” or “floater” endorsements specifically for valuable items. This allows you to list individual pieces of equipment with their replacement values. Average cost: $13-16/month base policy, plus $2-4/month per $1,000 of scheduled coverage.

Key advantage: Their policies include water backup protection as standard, critical for protecting electronics from burst pipes or flooding—a common cause of multi-device losses.

Nationwide: Maximum Customization for Complex Setups

If you have a truly complex setup with dozens of devices, Nationwide offers unmatched flexibility.[2][4] Their “Brand New Belongings endorsement” ensures you receive replacement value rather than actual cash value, meaning depreciation doesn’t reduce your payout.

For content creators specifically: Nationwide allows you to add credit card coverage, scheduled personal property coverage, and building alterations coverage. This is crucial if you’ve invested in acoustic panels, custom desk setups, or other semi-permanent installations in your rental.

Pricing: Slightly above average at $18-22/month, but the customization options justify the cost for high-value setups. You can add scheduled coverage for individual items without paying for blanket upgrades.

Progressive: Digital-First with Strong Endorsements

Progressive excels for renters who want to manage everything online and need flexibility.[2] Their mobile app and digital claims process are industry-leading, which matters when you need to file a claim quickly after equipment damage.

Electronics coverage: Progressive offers scheduled personal property endorsements and water backup coverage. Their partnership structure sometimes varies by location, but most policies include options for high-value item coverage.

Cost: Around $20/month base, with endorsements adding $1-3/month depending on coverage limits.

Liberty Mutual: Specialty Coverage Focus

Liberty Mutual specifically emphasizes specialty coverage options, including scheduled valuables and inflation protection.[2] Inflation protection is particularly valuable for expensive electronics—it automatically increases your coverage limits annually to account for equipment cost increases.

For gamers and creators: Liberty Mutual allows you to add coverage for individual devices without affecting your base premium structure. They also offer identity theft protection, which is essential if your equipment is stolen and used fraudulently.

Pricing: Higher than average at $21/month base, but includes strong discount options for bundling, autopay, and claims-free history.

Allstate: Retirees and Serious Hobbyists

While positioned for retirees in Colorado, Allstate’s customizable coverage works exceptionally well for anyone with expensive hobbies.[3] Their structure allows you to add electronic data recovery coverage—critical if your hard drives contain irreplaceable content, client files, or creative work.

Unique advantage: Allstate offers portable device coverage, meaning your equipment is protected even when you’re traveling for work or pleasure.

Cost in Colorado: $17/month average, though rates vary by location.

The Scheduled Coverage Strategy: Your Protection Plan

Step 1: Create a Complete Equipment Inventory

List every device with its purchase price and current replacement cost. Include:

• Desktop PC or laptop (with specs)

• Monitors (quantity and specs)

• External hard drives and SSDs

• Audio equipment (microphone, mixer, headphones)

• Cameras and lenses

• Networking equipment (router, switches)

• Cables and adapters

• Peripherals (keyboard, mouse, streaming deck)

Step 2: Calculate Total Coverage Needed

Add up replacement costs, not original purchase prices. A $4,000 gaming PC from 3 years ago might cost $5,200 to replace today with equivalent specs. This is your scheduled coverage target.

Step 3: Choose Your Insurer Based on Endorsement Availability

Contact each company and ask specifically about “scheduled personal property” or “floater” endorsements. Ask about per-item limits, deductibles, and whether business-use exclusions apply to your specific situation.

Step 4: Bundle for Maximum Savings

Most insurers offer 10-25% discounts for bundling renters with auto insurance.[1] If you have a car, this alone could save you $30-50/year on renters coverage, offsetting the cost of valuable items endorsements.

The Real Numbers: What You’ll Actually Pay

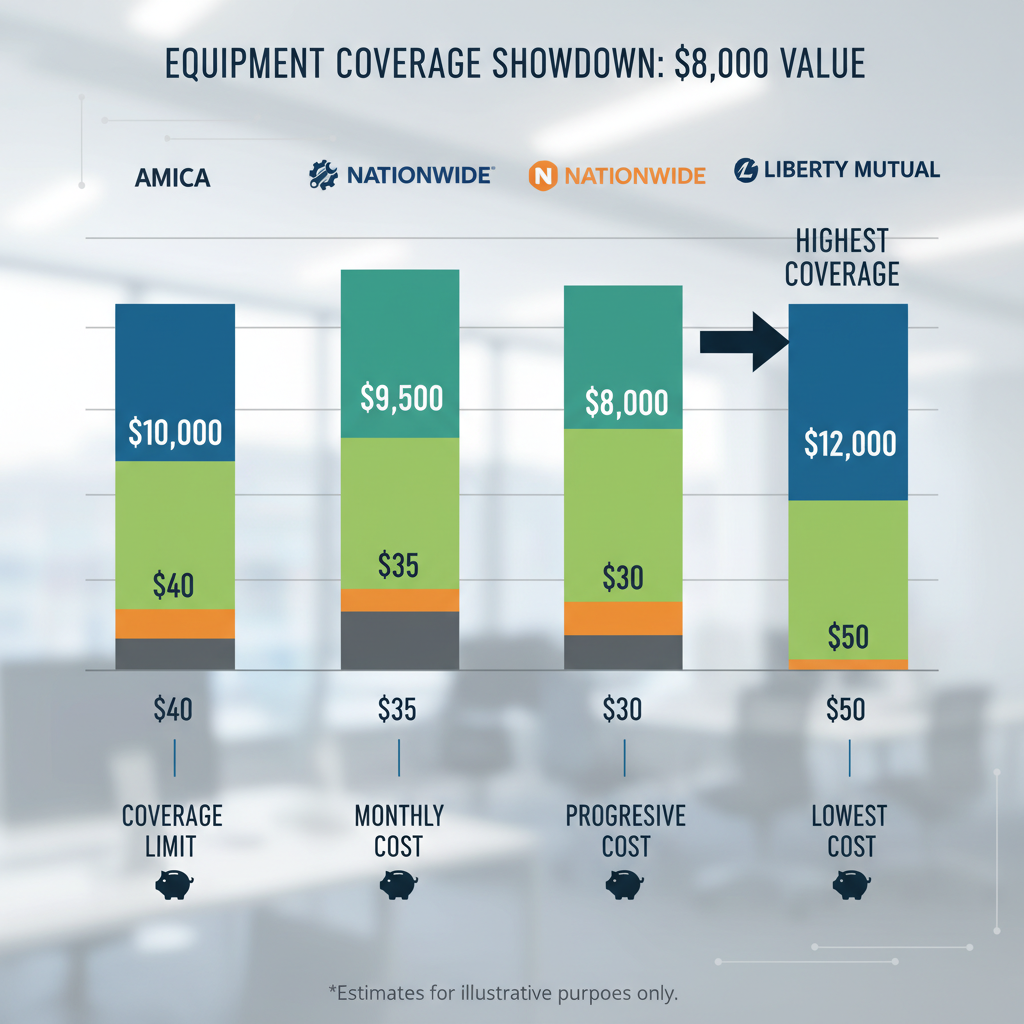

Scenario: $8,000 in equipment (gaming PC, monitors, camera setup, audio gear)

Amica with scheduled coverage: $15/month base + $8/month for $8,000 scheduled coverage = $23/month ($276/year)

Nationwide with brand new belongings endorsement: $20/month base + $6/month for $8,000 coverage = $26/month ($312/year)

Progressive with scheduled personal property: $20/month base + $5/month for $8,000 coverage = $25/month ($300/year)

For less than $35/month, you can have comprehensive protection for a $8,000+ equipment setup. Without this protection, a single incident could cost you thousands.

Critical Questions to Ask Before Purchasing

1. Does this policy cover equipment used for income? If you stream, create content, or work remotely, clarify whether business-use exclusions apply. Some insurers are more flexible than others.

2. What’s the deductible on scheduled items? Some companies charge higher deductibles for valuable items coverage. A $500 deductible on an $8,000 claim means you pay more out-of-pocket.

3. Is off-premises coverage included? Ask specifically about protection for equipment used outside your apartment. This is often limited or excluded.

4. How does the claims process work for electronics? Do they require replacement receipts? Can you choose your own repair vendor? Digital claims tools matter here—Progressive and Lemonade excel at this.

5. Are there annual coverage limit increases? As you upgrade equipment, does your coverage automatically increase, or do you need to manually update your policy?

The Bottom Line: Don’t Gamble With Your Setup

Your gaming rig, streaming setup, or creative workstation represents years of investment and, potentially, your income stream. Standard renters insurance leaves you catastrophically underprotected. The solution isn’t expensive—it’s strategic.

Amica offers the best combination of standard replacement cost coverage and flexible endorsements. Nationwide wins for maximum customization. Progressive excels for digital-first claims management. But all of them beat the alternative: losing thousands in equipment with no insurance recovery.

The time to act is now, before disaster strikes. Get quotes from at least three companies, ask specifically about scheduled coverage for your equipment, and add those endorsements. For $25-35/month, you’ll sleep better knowing your expensive electronics are actually protected.

Unlock Full Article

Watch a quick video to get instant access.