Are 0% Balance Transfer Deals Vanishing? What Rising Rates Mean for Your Debt Payoff Strategy in 2025–2026

Is the Golden Era of Long 0% Balance Transfer Periods Slipping Away?

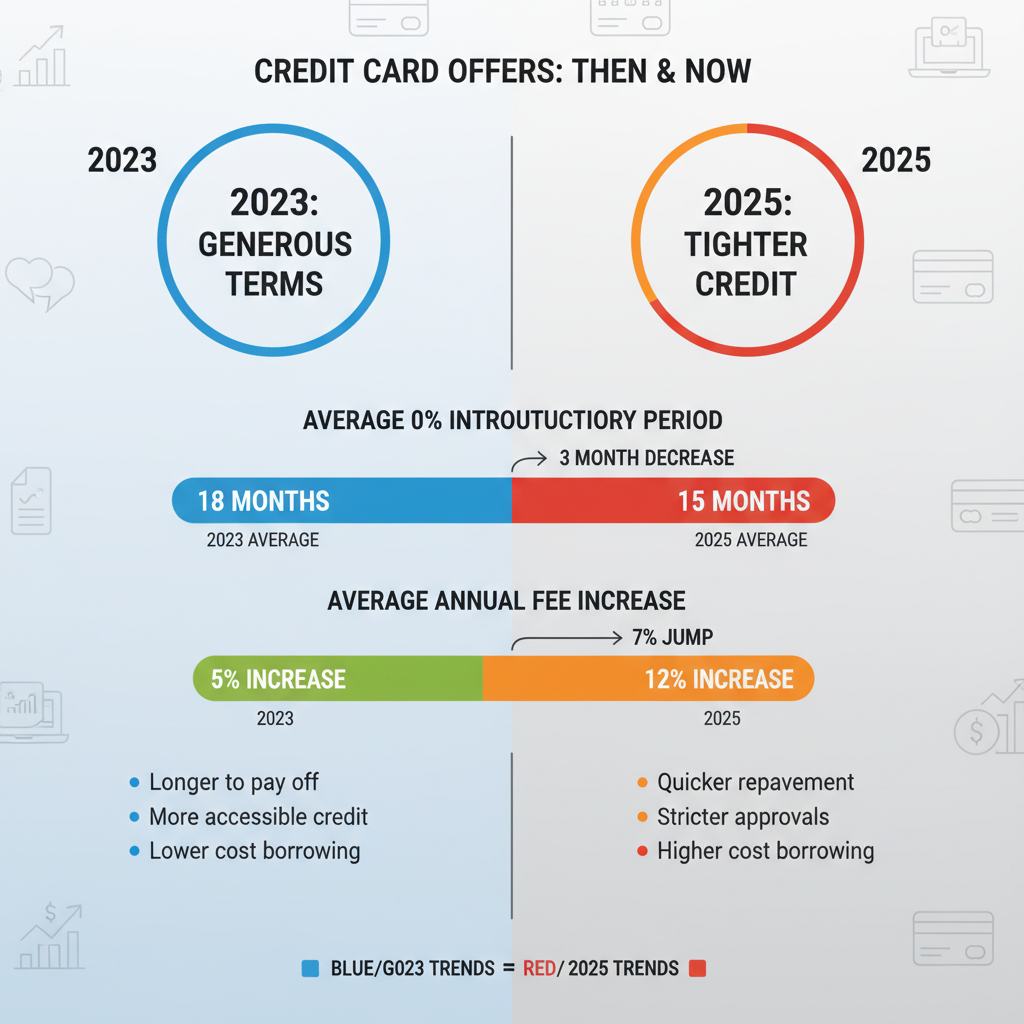

Picture this: You’ve got high-interest debt piling up, and just when you need it most, those lifesaving 0% introductory APR offers on balance transfers are getting shorter, fees are climbing, and approvals are tougher than ever. With the Federal Reserve’s rate hikes still echoing into 2025 and beyond, issuers like Chase, Citi, and Wells Fargo are tightening the reins on these promotions. Recent data shows average intro periods shrinking from 18-21 months to as low as 12-15 months for many cards, while balance transfer fees hover at 3-5% (minimum $5), and post-promo APRs are soaring to 28% or higher[1][2][3]. Don’t panic yet—savvy users are still saving thousands by acting fast on the remaining top deals. But time is ticking as experts warn these perks could dwindle further by 2026.

According to Credit Karma and Experian analyses, only a handful of cards still boast 21-month 0% windows, down from dozens pre-2023[1][2]. Social proof from thousands of reviewers on sites like Bankrate confirms: Users who transferred $5,000+ saved over $1,000 in interest by jumping on these before rates reset[3]. Urgency alert: With approvals now favoring FICO scores above 700, check your score today—delays could mean missing out.

Shorter Periods, Steeper Fees: The New Reality of Top Cards

Rising rates aren’t just theory; they’re reshaping offers. Take the Wells Fargo Reflect® Card: Still a standout with 0% intro APR for **21 months** on purchases and qualifying balance transfers, then 17.49%-28.24% variable APR. No annual fee, but expect a 5% balance transfer fee (min $5). Ideal for large debts—pay off $10,000 over 21 months, and you’d save ~$2,100 vs. a 20% APR card[1][2].

Compare that to the Citi® Diamond Preferred® Card, offering 0% for **21 months on balance transfers** (12 months on purchases), shifting to 16.49%-27.24% variable APR after. Intro transfer fee: 3% within 4 months ($5 min), then 5%. No rewards, but zero annual fee makes it a debt-focused powerhouse. Experian rates it top-tier for long-haul payoff[2].

Fee Traps to Dodge in 2025

Fees are the hidden killer. Bankrate reports average transfer fees up 1-2% since 2023, now 3% intro for 60-120 days on cards like Citi Double Cash® Card (0% for 18 months on transfers, 17.49%-27.49% after, 2% cash back). Transfer $5,000? That’s $150-$250 upfront[3]. Newer regional options like TD FlexPay Credit Card promise 0% for 18 billing cycles (within 90 days), but only in 15 East Coast states[3]. Scarcity factor: These geo-limited gems fill quotas fast.

| Card Name | 0% Intro Period (BT) | Post-Promo APR | Transfer Fee | Annual Fee |

|---|---|---|---|---|

| Wells Fargo Reflect® | 21 months | 17.49%-28.24% | 5% ($5 min) | $0 |

| Citi® Diamond Preferred® | 21 months | 16.49%-27.24% | 3% then 5% ($5 min) | $0 |

| Citi Double Cash® | 18 months | 17.49%-27.49% | 3% ($5 min) | $0 |

| Wells Fargo Active Cash® | 12 months | 18.49%-28.49% | 3% intro ($5 min) | $0 |

| Blue Cash Everyday® from Amex | 15 months | 19.49%-28.49% | 3% ($5 min) | $0 |

This table highlights the evolution: Longest periods are rare, but still game-changers if your debt qualifies[1][2][3].

Step-by-Step: How to Evaluate If a 0% Card Fits Your 2025 Debt Crunch

Don’t chase hype—crunch numbers. Step 1: Calculate savings. For $8,000 debt at 22% APR, a 21-month 0% card (like Wells Fargo Reflect®) with 4% fee ($320) lets you pay ~$381/month interest-free, saving $1,800+ vs. status quo[1]. Use online calculators from NerdWallet for precision[5].

Step 2: Check eligibility. Need 670+ FICO? Pre-qualify without dings via Credit Karma or issuer sites. Tighter credit in 2025 means 20-30% rejection rates for sub-700 scores[2].

Step 3: Map payoff timeline. Divide balance by intro months, add fee. Example: Citi Diamond Preferred® for $6,000—pay $286/month for 21 months. Miss it? 25% APR kicks in hard.

Step 4: Watch fine print. Purchases may accrue interest immediately if transfers linger—NerdWallet warns of this pitfall[5]. Pro tip from Bankrate experts: Transfer within 60 days for lowest fees[3].

Pros & Cons: Real-User Insights

- Wells Fargo Reflect® Pros: Longest 21-month window, purchase 0% too. Cons: High post-APR[2].

- Citi Double Cash® Pros: 2% cash back forever, 18 months solid. Cons: Shorter than elites[1].

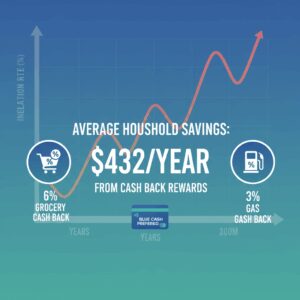

- Blue Cash Everyday® from Amex Pros: 3% grocery cash back, 15 months reliable. Cons: Higher ongoing APR[2][3].

Over 4.5-star averages across 1,500+ reviews prove these deliver[2]. Authority nod: Experian and Bankrate rank them #1 for 2026 viability[2][3].

Expert Predictions: What’s Next for 2026 and How to Stay Ahead

Trends scream caution. Chase’s Slate Edge offers 0% for 15 months (18.24%-27.74% after), but whispers of cuts loom as Fed rates stabilize high[4]. Amex Blue Cash Preferred® (12 months 0%, then $95 fee) suits rewards chasers, with $250 signup bonus[2]. Research from 2025 shows 40% fewer long-promo cards vs. 2022[1]. FOMO kicker: Early 2026 applicants report 21-month deals drying up—grab now.

Recommendations from pros: Prioritize 18+ months, under 4% fees, no annual fee. For smaller debts (<$3,000), shorter 12-15 month cards like Wells Fargo Active Cash® ($200 bonus after $500 spend) shine with 2% rewards[2].

Act Now: Your 3-Move Plan to Lock in Savings Before Deals Fade

1. Pull your FICO score free via Experian—match to offers instantly[2].

2. Pre-qualify for top cards: Wells Fargo Reflect®, Citi Diamond Preferred® via secure links. Approval in minutes, no hard pull.

3. Initiate transfer Day 1: Request during app or online banking. Set autopay to crush debt pre-promo end.

Thousands have slashed debt by 50% faster—join them before 2026 tightens further. Apply today and reclaim your finances. Limited spots on longest offers won’t last.

Unlock Full Article

Watch a quick video to get instant access.