The $200+ Annual Subscription Trap: How Smart Apps Are Saving People From ‘Set-and-Forget’ Charges

The $200+ Annual Subscription Trap: How Smart Apps Are Saving People From ‘Set-and-Forget’ Charges

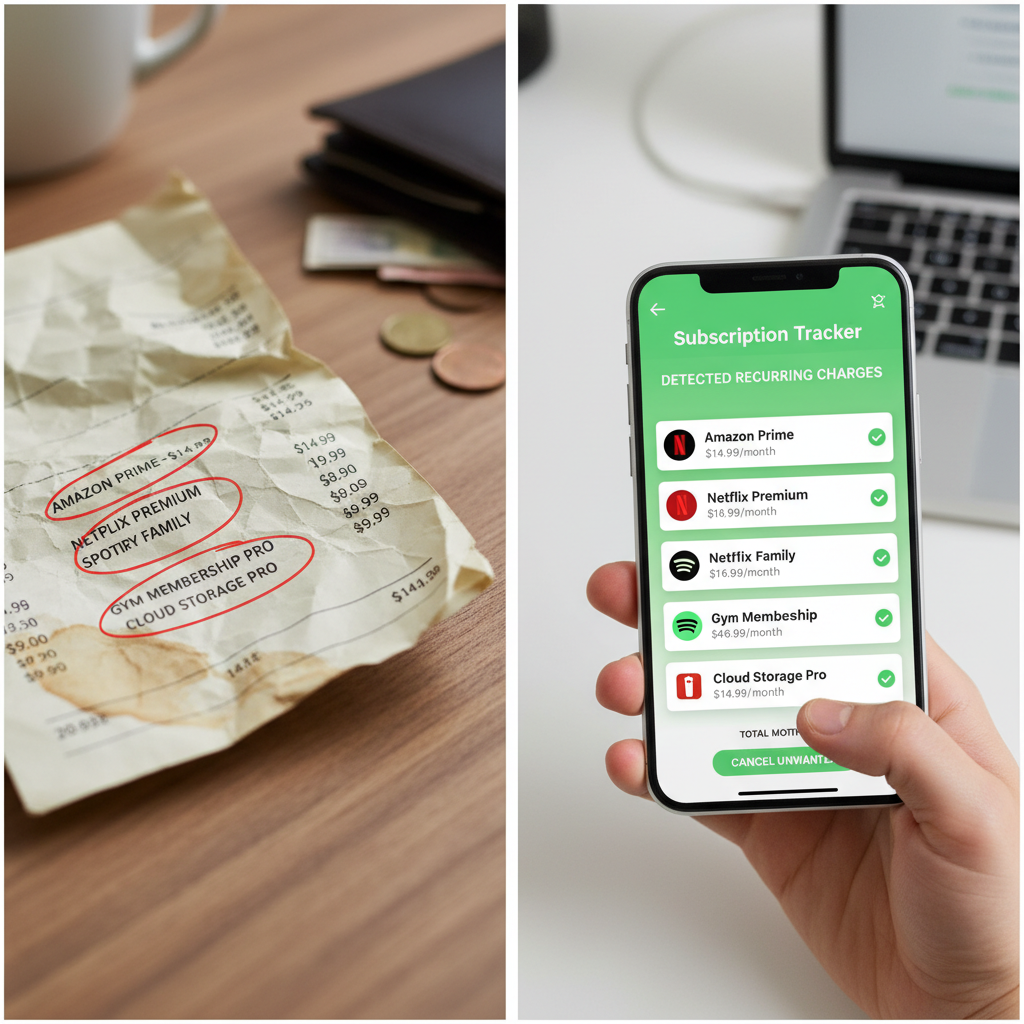

You signed up for a free trial. Maybe it was a streaming service, a productivity tool, or a meal kit delivery. You told yourself you’d cancel before the trial ended. Then life happened. Six months later, you glance at your bank statement and notice $14.99 charged every month for something you haven’t used since February.

You’re not alone. The average American has forgotten about at least three recurring subscriptions they’re actively paying for, according to consumer spending trends. Some people are hemorrhaging $200, $300, or even $500 annually to forgotten charges. The worst part? Most of these subscriptions could be eliminated in minutes if you knew they existed.

This is where subscription tracking and budgeting apps step in—not as a luxury, but as a financial necessity in 2026.

Why We Fall Into the Subscription Trap

Free trials are engineered to make cancellation difficult. Companies require you to navigate buried settings, confirm your cancellation through email, or call customer service directly. By contrast, signing up takes seconds. This friction gap is intentional, and it works. Subscription businesses rely on this “set-and-forget” behavior to boost their recurring revenue.

The math is brutal: A single forgotten $12.99 monthly subscription costs you $155.88 per year. Add five forgotten subscriptions, and you’re at nearly $800 annually—money that could go toward actual savings goals, emergency funds, or investments.

The solution isn’t willpower. It’s visibility. And that’s exactly what modern subscription tracking apps provide.

Meet the Apps That Stop the Bleeding

Rocket Money: The Subscription Detective

Rocket Money has become synonymous with subscription management for good reason. The app connects to your bank accounts and automatically detects every recurring charge—even the ones buried in your transaction history that you’ve completely forgotten about.[1]

Price: Free to $14/month[1]

Best for: Anyone drowning in forgotten subscriptions

App Rating: 4.5/5 stars[1]

Here’s what makes Rocket Money stand out: It doesn’t just identify subscriptions. It actively helps you cancel them. The app can contact merchants on your behalf to negotiate cancellations or lower rates. This feature alone has saved users thousands collectively.[3]

The free version gives you subscription detection and tracking. The paid plans ($4.99 to $14/month) unlock bill negotiation and advanced spending insights.[1] For most people, the free tier is sufficient to solve the core problem.

Monarch Money: The Comprehensive Approach

If you want subscription tracking bundled with serious budgeting tools, Monarch Money offers a more robust solution.[2]

Price: $14.99/month or $99.99/year (50% off first year with code MONARCHVIP)[1]

Best for: Complete financial organization

App Rating: 4.9/5 stars[1]

Monarch goes beyond simple subscription detection. It offers “Flex Budgeting,” which categorizes expenses into fixed, non-monthly, and flexible groups to match how spending actually happens in real life.[1] You can track subscriptions alongside investments, savings goals, and net worth—all in one place.[2]

The app also lets you collaborate with household members, set automatic savings notifications, and review transactions with a simple swipe.[1] For families managing multiple accounts, this integration is invaluable.

PocketGuard: The Minimalist Option

If you want simplicity without overwhelming features, PocketGuard offers a focused approach to spending and subscription tracking.[2]

Price: $12.99/month or $74.99/year[1]

Best for: Quick snapshot of available spending

App Rating: 4.6/5 stars[1]

PocketGuard’s “In My Pocket” feature calculates exactly how much you have available to spend after accounting for bills, subscriptions, and savings goals.[1] It sends alerts when spending hits 50% or 75% of your budget, giving you real-time control.[1]

The Step-by-Step Process: From Discovery to Cancellation

Step 1: Connect Your Accounts

Download your chosen app and connect your bank accounts, credit cards, and payment methods. This takes about 5-10 minutes and uses bank-level security encryption. You’re not sharing passwords; you’re granting read-only access to your transaction history.

Step 2: Let the App Scan for Subscriptions

Most apps automatically scan your last 90 days of transactions to identify recurring charges. This is where the magic happens. You’ll likely discover subscriptions you’d completely forgotten about.[1]

Step 3: Set Trial-End Alerts

If you’re actively using a free trial, mark it in the app and set a reminder for two days before the trial ends. This prevents the “oops, I forgot to cancel” scenario that traps millions of people annually.

Step 4: Review and Cancel Ruthlessly

Go through each subscription and ask: “Have I used this in the last 30 days?” If the answer is no, cancel it. Apps like Rocket Money can handle the cancellation process for you, contacting merchants directly.[3] This saves you the frustration of navigating buried cancellation pages.

Step 5: Review Monthly

Set a calendar reminder for the first of each month to review new subscriptions. This 5-minute habit prevents future accumulation of forgotten charges.

The Numbers: What You’ll Actually Save

Let’s be concrete. The average person using subscription tracking apps discovers 4-6 forgotten subscriptions. Here’s a realistic scenario:

– Streaming service you haven’t watched: $14.99/month = $179.88/year

– Productivity app you switched away from: $9.99/month = $119.88/year

– Meal kit service from last year: $12.99/month = $155.88/year

– Gym membership (used twice): $49.99/month = $599.88/year

– Cloud storage you don’t need: $4.99/month = $59.88/year

Total annual waste: $1,115.40

Even if you only find half of these, you’re looking at $500+ in recoverable spending. The app costs $0-$180/year. The ROI is immediate and substantial.

Beyond Subscriptions: Budgeting Integration

The best subscription tracking apps don’t stop at cancellations. They integrate subscription data into broader budgeting frameworks.[1][2]

Once you’ve eliminated wasteful subscriptions, these apps help you allocate that recovered money toward goals: emergency savings, debt payoff, or investments. YNAB, for example, uses “zero-based budgeting,” meaning every dollar gets assigned a purpose before you spend it.[1] Monarch Money’s flexible approach works for people who prefer less rigid budgeting structures.[2]

Which App Should You Choose?

Choose Rocket Money if: You want the most aggressive subscription cancellation support and don’t need comprehensive budgeting features. The free version is genuinely useful.[1]

Choose Monarch Money if: You want subscription tracking plus serious budgeting, investment tracking, and household collaboration. The 50% first-year discount makes it compelling.[1]

Choose PocketGuard if: You want a simple snapshot of available spending without complexity. It’s the “set it and forget it” budgeting option that still catches subscriptions.[1]

The Real Cost of Inaction

Here’s the uncomfortable truth: Every month you delay implementing subscription tracking, you’re losing money. If you have just three forgotten subscriptions at $15/month each, that’s $45 monthly or $540 annually.

Installing an app takes 10 minutes. Connecting your accounts takes another 10 minutes. Finding and canceling forgotten subscriptions takes 30 minutes. That’s 50 minutes of work to potentially recover hundreds of dollars.

The question isn’t whether you can afford to use a subscription tracking app. It’s whether you can afford not to.

Getting Started Today

Your next action is simple: Download Rocket Money (free), Monarch Money (with the MONARCHVIP code for 50% off), or PocketGuard this week. Spend 30 minutes connecting accounts and reviewing subscriptions. You’ll likely recover enough money to cover the app’s annual cost within the first month.

The subscription trap is real, but it’s completely avoidable with the right tools and habits. Start today. Your future self—and your bank account—will thank you.

Unlock Full Article

Watch a quick video to get instant access.