Dynamic Rewards: Crafting Your 2–3 Card Strategy to Maximize Online Shopping Rewards in 2025

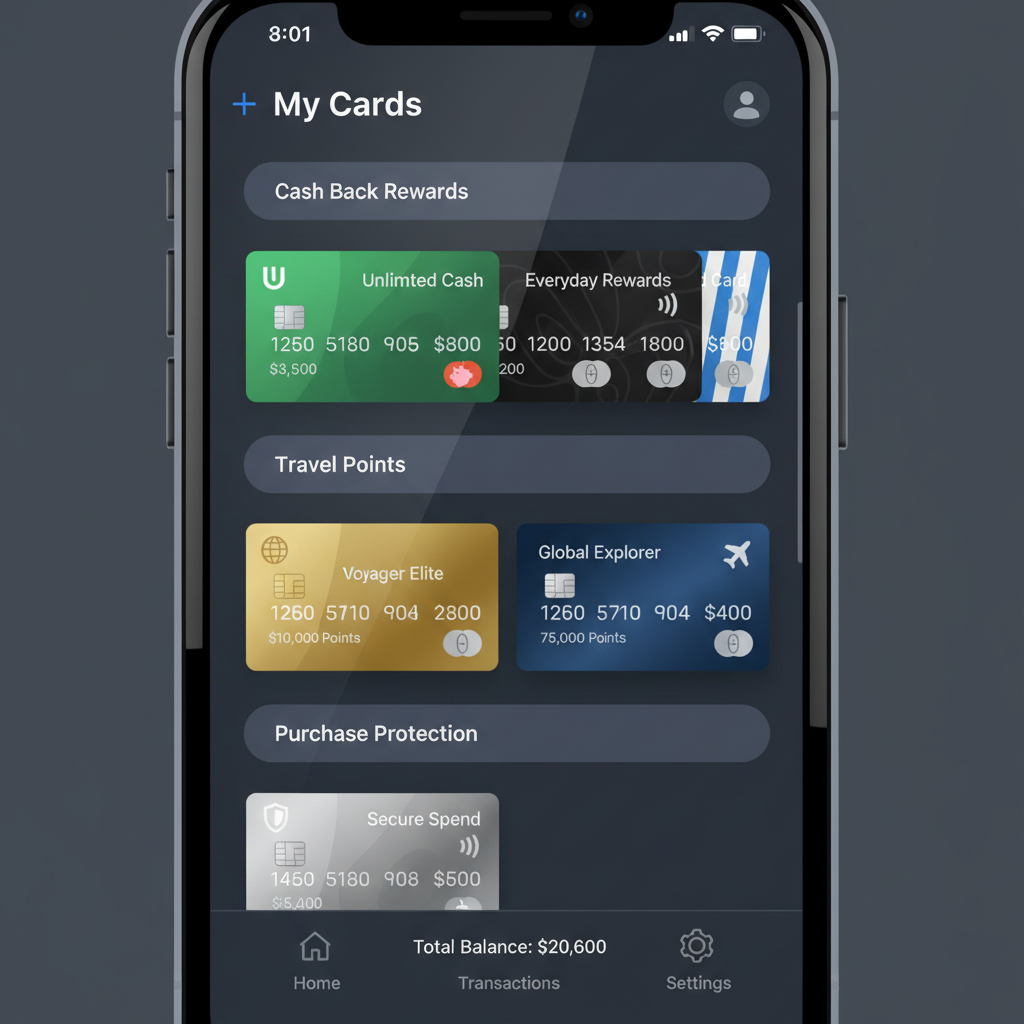

In 2025, savvy online shoppers are moving beyond searching for a single “best rewards credit card” and instead building a dynamic, multi-card strategy to maximize cashback and points on every purchase. This strategic wallet setup typically combines a reliable flat-rate rewards card with one or two specialized cards tailored to particular online retailers, rotating categories, or shopping portals.

Why a Multi-Card Strategy Makes Sense for Online Shopping

Online shopping is diverse: groceries, electronics, clothes, travel bookings, and more. No single credit card delivers top rewards on every category. By strategically combining cards, you can earn maximized returns—typically 2% or more—on nearly all your digital purchases.

Experts recommend carrying one flat-rate card (usually offering 2% cashback on all purchases) plus one or two specialized cards that boost rewards in select categories or stores. This layered approach reduces complexity while ensuring you never miss out on category-specific bonuses or exclusive cashback deals.

Step 1: Choose Your Reliable Flat-Rate Rewards Card (The Backbone)

The foundation of any rewards wallet is a dependable no-fuss card that rewards every purchase at a solid rate. In 2025, the Wells Fargo Active Cash® Card is a standout choice:

- Earns 2% unlimited cash back on all purchases

- No annual fee

- Current promotion: an additional 1.5% cash back on all purchases in the first year when applying through select links (totaling 3.5% back for newcomers)

- Easy-to-use flat rate simplifies everyday spending and covers purchases outside your specialty cards

Price anchor: No annual fee and a $200 signup bonus make it a cost-effective, powerful base card for any budget.

Step 2: Add Specialized Cards for Online Shopping Staples

Next, identify your top online shopping categories or stores and pair your flat-rate card with specialty rewards cards. Three popular choices in 2025 include:

Amazon Prime Rewards Visa Signature Card

- 5% back on all Amazon.com and Whole Foods purchases (with active Amazon Prime membership)

- No annual fee beyond Prime membership cost

- 2% back at restaurants and gas stations, 1% on all other purchases

- Current limited-time $250 Amazon gift card bonus on approval for Prime members

This card is ideal if Amazon is your primary online shopping platform, especially during heavy spending seasons like holidays.

Chase Freedom Flex® Card

- 5% cash back on rotating quarterly categories (activation required), often including online shopping portals

- 5% back on travel purchased through Chase

- 3% back on dining and drugstores, 1% on everything else

- No annual fee and a $200 signup bonus after $500 spend in 3 months

This card is perfect for those who want to chase rotating high-earning categories and combine these with travel and dining rewards.

Bank of America Customized Cash Rewards Card

- 3% cash back on your choice of one category, including online shopping

- 2% back at grocery stores and wholesale clubs

- No annual fee and $200 intro bonus

- Flexible category selection allows tailoring to your spending habits

This card is a great fit if you want customization to maximize specific categories like online shopping or dining.

Step 3: Optimize Usage With Store-Specific Cards or Online Shopping Portals

To complete your strategy, consider adding a store-specific card for frequent merchants such as Target, Walmart, or Kroger if you shop there online regularly.

| Card | Rewards | Annual Fee |

|---|---|---|

| Target Circle™ Credit Card | 5% off Target.com purchases + free shipping | $0 |

| Walmart OnePay CashRewards Card (with Walmart+) | 5% cashback on Walmart.com for members | $0 |

| Kroger Rewards World Elite Mastercard | 5% cashback using mobile wallet or Kroger Pay app | $0 |

These cards frequently offer perks like free shipping, extended returns, and discounts exclusive to their online platforms—important added value beyond simple cashback.

Strategic Tips for Maximizing Your 2–3 Card Rewards Wallet

- Activate Rotating Categories: Cards like Chase Freedom Flex and Discover it® require quarterly activation of bonus categories—set calendar reminders to never miss out.

- Leverage Signup Bonuses: Time your applications to maximize welcome offers, often worth hundreds of dollars in rewards.

- Use Online Shopping Portals: Access credit card portals or third-party portals (like Rakuten, Capital One Shopping) for extra cashback layered on top of card rewards.

- Track Your Spending: Use apps or spreadsheets to monitor which card gives the highest return for each purchase type and adjust usage accordingly.

- Mind Annual Fees: Choose cards whose benefits outweigh fees. Many excellent rewards cards have no annual fees, perfect for budget-conscious shoppers.

Example Wallet Setups Tailored to Different Shoppers

The Amazon Power User (Budget $0-100 Annual Fees)

- Amazon Prime Rewards Visa (5% on Amazon & Whole Foods)

- Wells Fargo Active Cash (2% flat-rate for all other purchases)

This duo covers almost all purchases with minimal annual fees and strong rewards on Amazon.

The Rotator & Travel Enthusiast (Willing to Pay Moderate Fees)

- Chase Freedom Flex (5% rotating categories)

- Capital One Venture X Rewards Card ($395 annual fee; premium travel perks, 2x miles on online travel bookings)

- Wells Fargo Active Cash (2% flat-rate backup)

This wallet blends strong online shopping rewards with travel benefits and a flat-rate card for simplicity.

The Store-Specific Shopper

- Target Circle™ Credit Card (5% off Target purchases)

- Bank of America Customized Cash Rewards (3% online shopping category)

- Wells Fargo Active Cash (flat 2%)

Great for shoppers loyal to one or two retailers who want to squeeze maximum savings in those ecosystems.

Final Call to Action: Start Building Your Rewards Wallet Today

Don’t fall behind in 2025’s evolving online shopping landscape. Begin by selecting your flat-rate backbone card, then layer in specialty cards tailored to your online habits. Apply strategically to capture lucrative signup bonuses and keep an eye on rotating categories. With this 2–3 card dynamic strategy, you’ll stretch every dollar spent online into meaningful rewards—whether it’s cash back, points, or exclusive discounts.

Take action now: evaluate your current shopping patterns, pick your cards from the top choices above, and start applying for the rewards combo that fits your lifestyle and budget. Your future self will thank you at checkout.

Unlock Full Article

Watch a quick video to get instant access.