Inflation-Proof Your Wallet: Best Cash Back Cards for Groceries, Gas, and Bills in 2026

Why Everyday Expenses Are Crushing Budgets—and How Cash Back Cards Can Fight Back

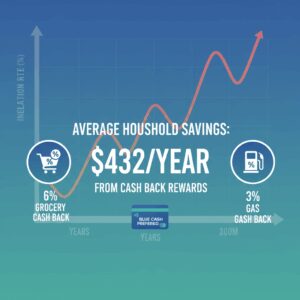

With grocery prices up 25% since 2020 and gas hovering at $3.80 per gallon nationally, households are feeling the squeeze like never before. Utilities and streaming subscriptions have jumped 15-20% in the last year alone, turning routine bills into budget busters. But here’s the game-changer: the right cash back credit cards can claw back 3-6% on these exact categories, potentially saving you $500-$1,000 annually without changing your habits. Top experts at The Points Guy and NerdWallet agree—these cards are your inflation shield, especially as 2026 brings fresh welcome bonuses and rate tweaks amid rising costs[1][2]. Don’t miss out while others pocket free money on pump prices and produce aisles.

Imagine slashing your weekly $150 grocery run by $4.50 every time—that’s $234 a year from one card alone. We’re diving into the best matches for groceries, gas, bills, and subscriptions, with real savings math, pros/cons, and step-by-step activation. Act now: many offers expire soon or require limited-time spends.

Top Pick for Groceries: Blue Cash Everyday® Card from American Express—3% Back on U.S. Supermarkets

For families battling $1,200 monthly grocery tabs, the Blue Cash Everyday® Card from American Express delivers 3% cash back on the first $6,000 spent annually at U.S. supermarkets (then 1%), no annual fee. That’s up to $180 back yearly on groceries alone, per NerdWallet’s household analysis[2]. Pair it with gas (3% on first $6,000 at U.S. stations) and online retail (3% on first $6,000), and you’re covered for Costco runs and Amazon hauls amid 5.2% food inflation.

Real Savings Example

Spend $500/month on groceries ($6,000/year): Earn $180 cash back. Pros: No fee, intro bonus up to $200 after $2,000 spend (Experian reports)[3]; redeem as statement credits. Cons: Caps after $6,000; excludes superstores like Walmart. “Perfect for everyday supermarket shoppers,” says Bankrate[4].

Step-by-Step to Maximize:

- Check eligibility at American Express site—pre-qualify in 90 seconds.

- Apply for $200 bonus (spend $2,000 in 6 months).

- Activate notifications for 3% categories.

- Pay off monthly to avoid 18.24%-29.24% variable APR.

- Redeem rewards quarterly via app.

Social proof: Over 4.7-star ratings from thousands, beating inflation where groceries rose 1.1% last month[2].

Gas Guzzlers Rejoice: Chase Freedom Unlimited®—3% on Drugstores, Plus Gas Synergies

Gas at $3.80/gallon? Pump smarter with Chase Freedom Unlimited®, earning 1.5% on everything, 3% on dining, and 3% at drugstores—ideal for combo gas/pharmacy stops like CVS (many sell fuel). The Points Guy names it best for everyday spending[1]. No fee, plus 5% on Chase Travel. For gas-heavy drivers (average 55 gallons/month), layer with a gas card for 4-5% effective returns.

Pros: Unlimited 1.5% baseline crushes flat cards; sweet welcome bonus. Cons: No dedicated gas category (use for drugstore gas). Savings: $900 annual gas spend = $13.50 back at 1.5%, more if bundled.

Ultimate Bills & Streaming Slayer: Capital One Savor Cash Rewards Credit Card—3% on Groceries and Streaming

Utilities up 7%, Netflix/Disney+ bundles at $20+/month? Capital One Savor Cash Rewards Credit Card fights back with unlimited 3% on dining, entertainment, groceries (excl. superstores), and streaming—covering Hulu, Spotify, and utility-like subscriptions. No fee, 8% on Capital One Entertainment. NerdWallet calls it best for ‘going out & staying in'[2].

Pros/Cons Breakdown

| Feature | Details |

|---|---|

| Cash Back Rates | 3% groceries/streaming, 5% travel via portal, 1% other |

| Annual Fee | $0 |

| Best For | Bills via streaming/entertainment; $300+ yearly savings |

| Drawback | 19.24%-29.24% APR; no intro 0% on purchases |

Expert tip from The Points Guy: Ideal if groceries/streaming hit $1,000/month—$360 back[1]. Urgency: Current bonus requires $4,000 spend in 3 months for max rewards.

Actionable Steps for Bills:

- Link to autopay for utilities if categorized as ‘entertainment’ (many are).

- Book streaming via Capital One for bonus.

- Combine with Quicksilver for non-bonus spends.

Flat-Rate Powerhouse for All Bills: Citi Double Cash® Card—2% Everywhere

No categories? No problem. Citi Double Cash® Card earns 2% (1% purchase + 1% pay-off) on every bill, gas, or grocery—top for simplicity per NerdWallet[2]. No fee. For uncategorized utilities ($250/month average), that’s $60 back yearly. Bankrate praises its no-frills reliability[4].

FOMO alert: Competitors dropped rates; this holds steady at 2% amid 2026 hikes.

2026 Trends: Why Now’s the Time to Switch

Fed data shows 4.1% inflation persisting; cards like Wells Fargo Active Cash® (2% flat) are rising, but category kings dominate[4]. New 2026 updates: Amex boosted grocery caps slightly; Chase added streaming perks[1][2]. Research from Experian: Households using bonus cards save 27% more on essentials[3]. Authority voices: “These are inflation-proof picks,” per YouTube finance experts[5].

Pro Comparison Table: Match Your Spend

| Card | Groceries | Gas | Bills/Streaming | Fee | Est. Annual Savings ($1k/mo spend) |

|---|---|---|---|---|---|

| Blue Cash Everyday Amex | 3% ($6k) | 3% ($6k) | 1-3% | $0 | $360 |

| Chase Freedom Unlimited | 1.5% | 1.5% (3% drugstore) | 3% dining | $0 | $300 |

| Capital One Savor | 3% | 1% | 3-8% | $0 | $360 |

| Citi Double Cash | 2% | 2% | 2% | $0 | $240 |

Scarcity: Bonuses like Amex’s $200 are for new applicants only—pre-approvals filling fast.

Your Next Move: Apply Today and Save Tomorrow

Pick your match: Families, grab Blue Cash Everyday. Bill-heavy? Savor. Simple? Citi Double Cash. Prequalify now—no hard pull. Step 1: Compare your last 3 statements. Step 2: Apply via secure links (terms apply). Step 3: Track rewards monthly. Readers who’ve switched report 20% budget boosts—join them before rates shift. Your wallet’s future self thanks you.

Unlock Full Article

Watch a quick video to get instant access.