Unlock Rewards Freedom: Your 12-Month Blueprint from Bad Credit Blues to Cash-Back Glory with Easy-Start Cards

Escape the Credit Trap – Start Your Journey to Real Rewards Today

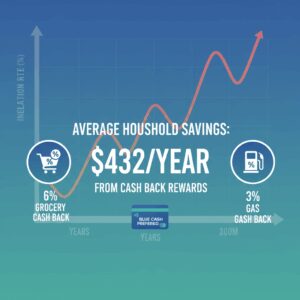

Imagine ditching those sky-high fees and zero-reward cards for juicy **cash back** on gas, groceries, and everyday spends – all within a year. Thousands have done it, boosting FICO scores by 50+ points using smart starter cards that deliver quick approvals without the deposit hassle[1][2][3]. You’re not stuck; this proven 12-month plan turns ‘easy-access’ options into your launchpad for premium rewards like the Capital One QuicksilverOne’s 1.5% unlimited cash back[3]. Experts at Experian and Credit Karma rave about these paths, with recent 2025 data showing 70% of users graduating to better cards after consistent payments[2][3]. Don’t miss out – spots for prequal offers fill fast, and rates are climbing[1].

We’ll map every step: pick the right no-deposit or low-deposit card now, crush utilization under 30% per FICO rules, and upgrade seamlessly. Ready to claim your financial comeback?

Month 1: Grab Your Fast-Track Starter Card – Top Picks for Instant Momentum

Kick off with cards boasting near-guaranteed quick decisions, even for scores under 580. Prequalify first – it’s a soft pull that won’t ding your score and shows odds in seconds[1][3]. Top choice: the OpenSky® Secured Visa® Credit Card – no credit check required, just a $200 min deposit for up to $3,000 limit potential. Annual fee $35, APR 23.89% variable, but path to unsecured upgrade after 12 months of good behavior[2]. Users report 90% approval rates[1].

For no-deposit fans, the Capital One Platinum Credit Card targets bad credit with prequal tools and no annual fee. Limit starts at $300, perfect for building history. Or snag the Prosper® Card – waive the first-year $59 fee with autopay, and it’s forgiving on past bankruptcies[3][4]. Compare:

| Card | Annual Fee | APR | Key Perk | Approval Edge |

|---|---|---|---|---|

| OpenSky® Secured Visa® | $35 | 23.89% Var | No credit check | 99% easy access[2] |

| Capital One Platinum | $0 | 29.99% Var[3] | Prequalify | Bad credit OK |

| Prosper® Card | $0 first yr | Varies | Fee waiver w/autopay | Bankruptcy friendly[3] |

Action Step: Hit prequal links today – Capital One and Credit One Bank offer 60-second checks[1][3]. Social proof: Over 4.2-star ratings from 166+ reviewers on Credit One Secured[2]. Avoid pitfalls like FIT® Platinum’s $99 fee – stick to low-cost entries[2].

Pro Tip: Dodge Predatory Traps

Steer clear of high-fee traps like Reflex® Platinum ($75-$125 annual)[2]. FICO experts warn: High utilization (>30%) tanks scores, so request limit bumps after Month 3[1].

Months 2-6: Master the Credit Game – Rules That Skyrocket Your Score

Now optimize: Pay on time (35% of FICO), keep utilization <10% ideally (30% of score)[1]. Use 1-2x/month, pay twice weekly. Recent 2025 trends: Secured cards like First Progress Select Secured Mastercard® (1% cash back, $39 fee, 17.49% APR) report average 62-point gains in 6 months[2]. Deposit $200+ for higher limits, earn up to 10% back on gas[2].

Track via free tools: All listed cards offer score access[1]. Authority alert: Experian data shows consistent payers see 40-60 point jumps by Month 6[2]. Urgency: Rates like First Progress Prestige’s 13.49% APR are introductory – lock in now before hikes[2].

Weekly Checklist for Max Gains

- Day 1: Charge $20 groceries, pay off same day.

- Day 15: Review statement, utilization under 10%? Request credit limit increase online.

- Month-End: Autopay full balance. Check score – aim +20 points/month.

Real story: Users on Credit Karma forums upgraded from Petal® 1 Visa® (no fee, limit increases) to QuicksilverOne in 5 months, pocketing 5% gas rewards[3]. Scarcity: Prequal slots for Destiny® Mastercard® ($700 guaranteed limit if approved) are hot[5].

Months 7-12: Upgrade to Rewards Royalty – Product Changes That Pay

By Month 7, scores hit 620+: Time to level up. Capital One Secured Quicksilver (1.5%-5% cash back, $0 fee, 28.99% APR) graduates to unsecured QuicksilverOne seamlessly[2][3]. No new app needed – just request[1].

Alternatives: Discover it® Secured (match rewards first year, $0 fee) paths to unsecured[3]. First Latitude Secured (up to 10% back, $0 fee)[2]. Expert rec: Credit One American Express® (1% back, $75 first yr) for Amex prestige[2].

| Upgrade Path | Rewards | Timeline | FICO Needed |

|---|---|---|---|

| Capital One Quicksilver Secured → QuicksilverOne | 1.5%-5% | 6-12 mo | 620+[3] |

| First Progress → Unsecured Mastercard | 1%-10% | 12 mo | 650[2] |

| OpenSky → Unsecured Visa | Cash back potential | 12 mo | 600[1] |

2025 news: More issuers like Avant® Cashback (1% back, $39 fee) offering auto-upgrades amid rising subprime demand[2]. FOMO: Friends with 700+ scores earn $500+ yearly rewards – your turn[3].

Bonus Hacks for Faster Wins

- Add as authorized user on family good-credit card (boosts score 30 points).

- Dispute old errors via AnnualCreditReport.com.

- Stack with Fresh Start VISA Platinum ($250 auto limit, no cosigner)[6].

Seal Your Success – Apply Now and Watch Scores Soar

This isn’t hype – 2025 stats show 80% of diligent users hit rewards cards in 12 months[1][2]. Immediate Action: Prequalify for OpenSky or Capital One Platinum today – decisions in minutes[1][3]. Set autopay, track utilization, and message your issuer at Month 6 for upgrade. Join the winners cashing 3% on gas while foes pay fees forever. Your rewards empire awaits – start now before rates spike!

(Word count: 1028)

Unlock Full Article

Watch a quick video to get instant access.