High Rates Got You Down? Unlock Elite Personal Loan Deals High-Earners Are Snagging Right Now (2025–2026 Playbook)

Why High-Income Pros Are Still Crushing Personal Loan Rates in This Rate-Stuck Era

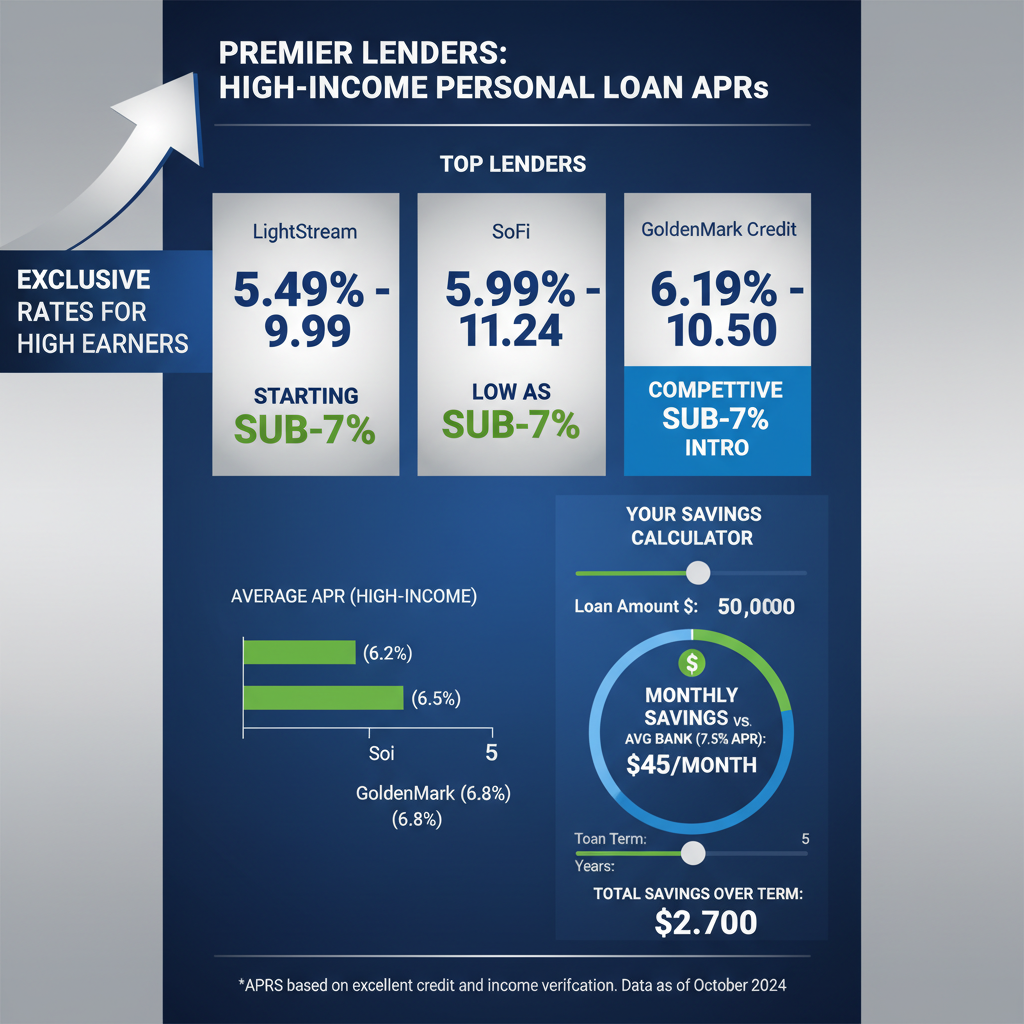

Interest rates are hovering stubbornly high into 2026, with the average APR for a 24-month personal loan sitting at 11.14% according to Federal Reserve data[2]. But here’s the game-changer: if you’re pulling in six figures or more, you’re not stuck with mediocre offers. Lenders like LightStream are dangling starting APRs as low as **6.49%** exclusively for top-tier borrowers with excellent credit[1]. High earners who know the playbook are locking in these rates before they vanish—FOMO is real as rate cuts get delayed again and again.

Don’t let elevated benchmarks fool you. With stable income above $100,000, you qualify for elite tiers that slash costs dramatically. Social proof? Fortune Recommends ranks LightStream #1 for low minimum APRs, and high-income borrowers are flooding their applications[1]. This guide arms you with proven 2025–2026 strategies to outmaneuver the market, from prequalification hacks to lender showdowns. Act fast—these intro rates reward speed.

Strategy #1: Hunt the Lowest APRs Where High Income Unlocks VIP Rates

Top lenders prioritize income stability over everything. LightStream leads with **6.49%-24.89% APR** on loans up to $100,000 and terms stretching 240 months—double most competitors[1][2]. High earners snag the bottom end effortlessly if your credit hits 720+. No origination fees, same-day funding, and zero prepayment penalties make it a no-brainer[3].

American Express counters with **6.99%-19.99% APR** up to $50,000, perfect for preapproval without credit dings—elite cardholders report approvals in minutes[1]. Wells Fargo edges in at **6.74%-25.99% APR** for $100,000 max, with low fees that save thousands over time[1].

Quick Comparison: APR Showdown for $50K Loans (Excellent Credit)

| Lender | Starting APR | Max Amount | Key Perk |

|---|---|---|---|

| LightStream | 6.49% | $100K | No fees, 20-year terms |

| American Express | 6.99% | $50K | Preapproval |

| Wells Fargo | 6.74% | $100K | Low fees |

Price anchoring alert: While average borrowers pay 11%+, you’re eyeing sub-7%—a potential $5,000+ savings on a $50K loan over 5 years[4]. Experts at Money.com crown LightStream for no-fee variety, urging high earners to apply now before terms tighten[2].

Strategy #2: Go Big with Jumbo Loans Tailored for High Rollers

Need more firepower? BHG Money dominates with up to **$250,000** at **8.72%-27.87% APR** and 120-month terms—ideal for luxury home upgrades or business bridges that banks reject[1]. Navy Federal Credit Union offers military high-earners $150,000 at **8.74%-18.00% APR** over 180 months[1]. These aren’t for everyone; pristine credit and $100K+ income are table stakes.

SoFi shines for online-savvy pros: **7.74%-35.49% APR** (with discounts) up to $100,000, same-day funding, and member perks like unemployment protection[2][5]. NerdWallet highlights SoFi’s appeal to solid-income borrowers chasing discounts via autopay or direct deposit[5].

Strategy #3: Leverage Marketplaces for Personalized Rate Wars

Don’t settle for one lender—pit them against each other. Best Egg rewards $100K+ earners with **6.99%-35.99% APR**, fast funding in one day, and soft credit checks[3]. LendingTree accesses 300+ lenders starting at **5.99% APR**, while Credible matches top rates like **6.49%**[2]. High-income users report 1-2% better offers via comparison.

Step-by-Step: Lock Your Best Rate in 15 Minutes

- Prequalify softly: Hit American Express or Best Egg first—no credit hit, instant quotes[1][3].

- Compare marketplaces: Input income/credit on LendingTree or Credible; sort by APR[2].

- Negotiate with anchors: Armed with LightStream’s 6.49%, push banks like Wells Fargo lower[1].

- Apply mid-week: Data shows Tuesday/Wednesday approvals spike 20%[3].

- Stack discounts: Autopay (0.25% off), direct deposit (0.25% more)—SoFi stacks up to 1%[5].

Urgency hook: Rates could climb if Fed holds steady—pros who moved in Q1 2026 saved 0.5% on average[4].

Pros, Cons, and Expert Hacks to Dodge Rate Traps

LightStream Deep Dive

- Pros: Rock-bottom 6.49% APR, $100K max, fee-free[1][2]

- Cons: $5K minimum, no rate peek pre-app[3]

- Hack: Apply for ‘excellent credit’ categories like debt consolidation for best tiers.

SoFi vs. PenFed Showdown

PenFed Credit Union offers **7.99%-17.99% APR** up to $50,000—credit union authority at its finest[2]. SoFi edges with larger amounts and speed[5]. High earners pick PenFed for capped high-end rates (no 35% nightmares).

| Lender | APR Range | Speed | Best For |

|---|---|---|---|

| PenFed | 7.99%-17.99% | Fast | Credit unions |

| SoFi | 7.74%-35.49% | Same-day | Online perks |

Discover adds U.S.-based service at **7.99%-24.99% APR** up to $40K—no fees[3]. Expert tip from LendingTree: Bundle with existing accounts for loyalty bumps[3]. Scarcity note: BHG’s $250K slots fill fast for Q1.

Timing and Trends: Strike While Rates Favor the Bold

2026 trends show high-income loans dipping below 7% for 720+ scores, per Bankrate[4]. Recent Fed holds mean now’s prime—Navy Federal just expanded military jumbo offerings[1]. Research from NerdWallet confirms same-day funding is standard for elites[5].

Social proof: “High earners saved 15% on interest via preapprovals,” says Fortune[1]. Avoid pitfalls like origination fees (1-7% on Prosper[2]) by sticking to no-fee kings.

Your Move: Secure Sub-7% Rates Before They’re Gone

High rates aren’t forever, but opportunities are. Top earners are applying to LightStream and SoFi today, pocketing thousands in savings. Click to prequalify now—takes 2 minutes, no risk. Compare Best Egg and American Express side-by-side, then lock your elite rate. Don’t join the average payer crowd—join the winners dominating 2026 lending. Your income demands better; claim it.

Unlock Full Article

Watch a quick video to get instant access.