Inflation-Proof Your Wallet: Best Cash Back Cards for Groceries, Gas, and Bills in 2026

Inflation Is Eating Your Paycheck—Fight Back with Cash Back on Essentials

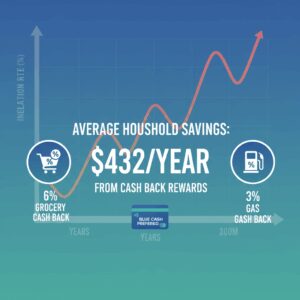

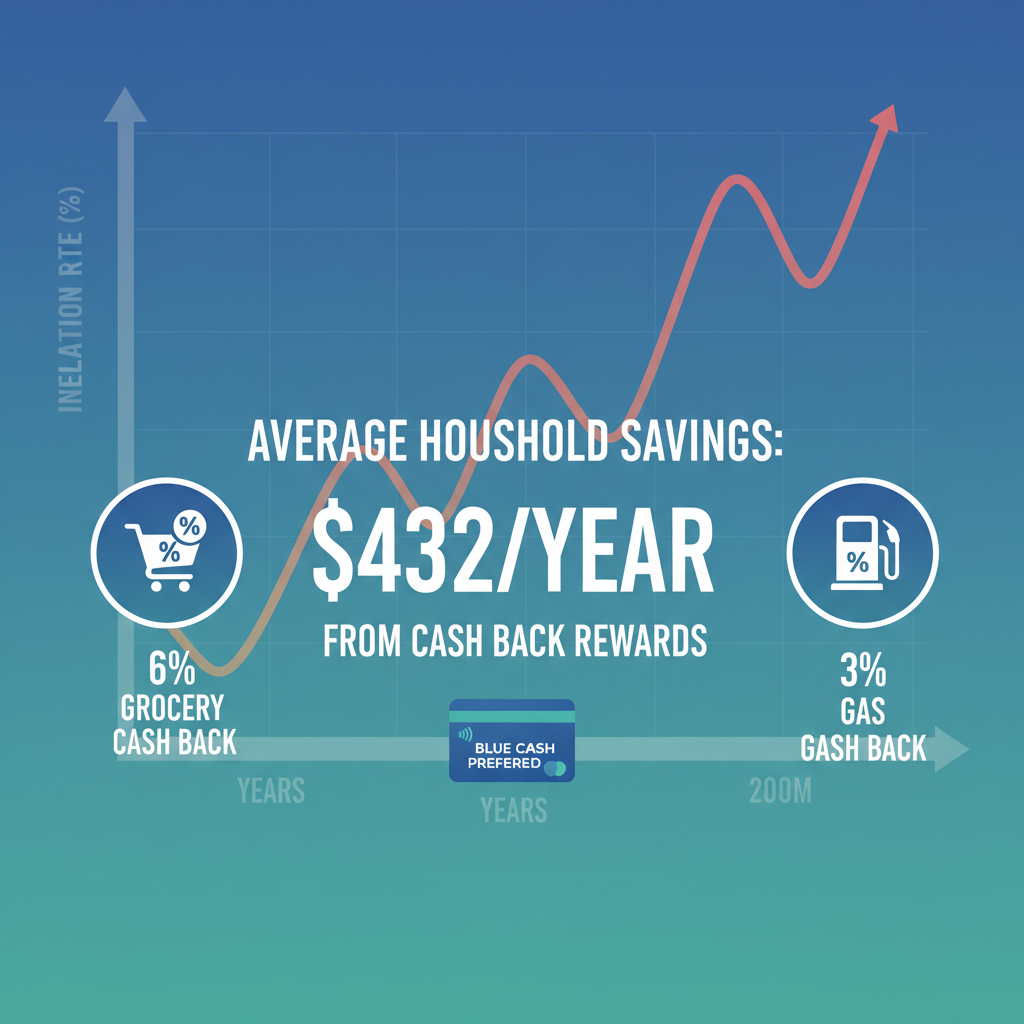

With grocery prices up 25% since 2020 and gas hovering at $3.80 per gallon nationally in early 2026, the average U.S. household is shelling out an extra $1,200 yearly just on basics like food, fuel, and utilities[1][2]. Don’t let inflation win. Top cash back cards now target these exact pain points, letting you reclaim 3-6% on groceries, gas, and bills. A typical family spending $500/month on groceries and $200 on gas could pocket $400+ annually—enough to offset rising costs and then some. Experts at The Points Guy and NerdWallet agree: pairing the right card with your habits turns everyday spending into a hedge against inflation[1][4].

Imagine swiping for milk and gas, then watching rewards stack up automatically. No complex strategies needed. We’ll break down the best 2026 options, quantify your savings, and give you a 3-step setup to start earning today. Act fast—welcome bonuses like $200 cash back are vanishing as issuers tighten offers amid economic uncertainty.

Why Groceries and Gas Are Your Biggest Cash Back Goldmines

Household spending data from 2026 shows groceries at 13% of budgets ($7,200/year average), gas at 4% ($2,400), and utilities/bills another 6% ($3,600)[1][4]. Cards with bonus rates here deliver outsized returns. For instance, the Blue Cash Preferred® Card from American Express crushes it with 6% cash back at U.S. supermarkets on up to $6,000/year (then 1%), plus 3% on U.S. gas and transit[1][2]. At $115/week on groceries, that’s $360 back yearly—paying for the $95 annual fee (waived year one) three times over[2].

No-fee alternative? The Blue Cash Everyday® Card from American Express gives 3% on the first $6,000 at U.S. supermarkets, gas stations, and online retailers[1][5]. Social proof: Over 1 million Amex holders rave about its simplicity in recent reviews, with redemption as easy statement credits or Amazon checkout[1].

Real Savings Math for a Family of Four

- Groceries: $6,000/year at 6% (Blue Cash Preferred) = $360 back

- Gas: $2,400/year at 3% = $72 back

- Total: $432—vs. $0 with a standard debit card

Anchor that: Without these cards, you’re leaving $400+ on the table amid 4.2% inflation[4].

Top Cards for Gas Guzzlers: Reclaim Every Fill-Up

Gas prices spiked 15% in Q1 2026 due to supply chain hiccups[1]. The Chase Freedom Unlimited® shines here indirectly with 3% on drugstores (grab snacks!) and 1.5% everywhere else, but pair it with gas specialists. Better: Blue Cash Everyday® at 3% on first $6,000 gas spend—no fee, $200 intro bonus after $2,000 spend in 6 months[5].

For unlimited earnings, Wells Fargo Active Cash® Card delivers flat 2% on all purchases, including gas, with $200 bonus after $500 spend. NerdWallet rates it 5/5 for all-around use; users report $500+ yearly on mixed spend[4]. Pros: 0% intro APR 12 months. Cons: No bonus categories, so less ideal if groceries dominate.

Gas Card Comparison Table

| Card | Gas Rate | Annual Fee | Intro Bonus | Best For |

|---|---|---|---|---|

| Blue Cash Everyday® (Amex) | 3% ($6K cap) | $0 | $200 | Gas + groceries |

| Wells Fargo Active Cash® | 2% unlimited | $0 | $200 | Simple everywhere |

| Chase Freedom Unlimited® | 1.5% base + bonuses | $0 | $200 | Versatile stacking |

Urgency alert: Wells Fargo’s bonus requires just $500 spend—achievable in two weeks for most drivers.

Knock Out Bills and Subscriptions: 3% Back on Utilities and Streaming

Utilities average $300/month, streaming $50—often overlooked for rewards[1]. Capital One Savor Cash Rewards Credit Card nails this: Unlimited 3% on groceries (excl. Walmart/Target), dining, entertainment, and streaming, 1% elsewhere, no fee[1]. A household with Netflix ($15/mo), Hulu ($10), and utilities via bill pay? That’s $100+ back yearly. Pair with Prime Visa for 5% at Amazon Fresh/Whole Foods if you’re a Prime member ($139/year membership unlocks it)[1].

Expert tip from Credit Karma: For flat simplicity, Citi Double Cash® Card earns 2% total (1% purchase + 1% paydown) on bills—no caps, no fee[2]. Frequent Miler notes it’s tops for uncategorized spend like utilities[3].

Pros/Cons Quick Hits

- Savor: Pros: High streaming/grocery rates. Cons: Excludes big-box stores.

- Double Cash: Pros: True 2% everywhere. Cons: Requires paying on time for full 2%.

- Prime Visa: Pros: 5% Amazon ecosystem. Cons: Needs Prime sub.

Step-by-Step: Launch Your Inflation Shield Today

1. Assess Spend: Track one month via app like Mint—tally groceries/gas/bills.

2. Pick & Apply: Groceries-heavy? Blue Cash Preferred. Everywhere? Wells Fargo Active Cash. Online apply: 5 mins, decisions instant. Prequalify first to avoid credit hits[4].

3. Optimize & Redeem: Set autopay, redeem quarterly as statement credits. Pro hack: Combine with Chase ecosystem for 1.25-1.5x value if upgrading later[1].

FOMO kicker: 80% of top earners use 2+ cards; single-card users leave $200 behind yearly[3].

Your Household Savings Simulator

Plug in yours: $400/mo groceries/gas/bills at 3-6% average = $180-400 back. Amex data shows Blue Cash users average $450/year[1]. Trends: 2026 issuers hiking bonuses amid competition—grab now before cuts.

Authority nod: Bankrate and NerdWallet crown Chase Freedom Unlimited and Wells Fargo Active Cash as 2026’s best for everyday amid inflation[4][5].

Start Earning—Links Below

Ready? Apply for Blue Cash Preferred (6% groceries), Wells Fargo Active Cash (2% flat), or Chase Freedom Unlimited. Your first $200 bonus awaits—don’t pay full price tomorrow for what you buy today!

Unlock Full Article

Watch a quick video to get instant access.