Reviewing Your Mortgage in the New Year: Refinancing, Payments, and Financial Cleanup

The start of a new year is a natural time to review big financial commitments, and for many households, the mortgage is the largest of them all. After the holidays, budgets shift, priorities change, and long-term goals come back into focus. Reviewing your mortgage in January isn’t about making drastic moves—it’s about making sure your home loan still supports your financial health.

One of the first things to review is your current interest rate and loan terms. Many homeowners lock in a mortgage and then don’t revisit it for years. While refinancing isn’t always the right choice, understanding where you stand creates options. Interest rates, loan products, and personal finances change over time, and awareness is the starting point for smarter decisions.

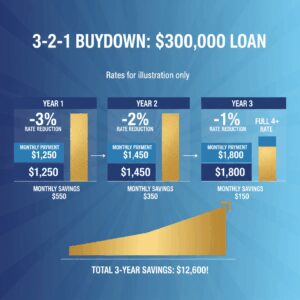

Refinancing is often top of mind, but it requires careful evaluation. Lowering your interest rate can reduce monthly payments or shorten the loan term, saving money over time. However, refinancing also comes with costs such as closing fees and appraisal expenses. Post-holiday review helps determine whether potential savings outweigh those costs based on how long you plan to stay in the home.

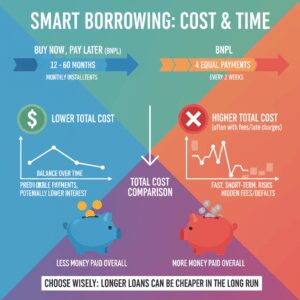

Another option to consider is adjusting payment strategy without refinancing. Making extra principal payments—even small ones—can significantly reduce interest paid over the life of the loan. If holiday expenses have settled and cash flow has stabilized, applying a portion of discretionary income toward principal can accelerate equity growth without locking you into a new loan.

January is also a good time to check escrow accounts. Property taxes and insurance premiums often change annually, affecting monthly payments. Reviewing escrow statements helps you anticipate payment adjustments and avoid surprises. If payments increased, understanding why allows for proactive budgeting.

Mortgage review should also include alignment with broader financial goals. If you’re prioritizing debt payoff, savings, or investments this year, your mortgage strategy should support those goals. In some cases, maintaining a lower monthly payment frees cash flow for higher-priority objectives. In others, aggressive payoff aligns better with long-term security. There’s no universal right answer—only what fits your situation.

For homeowners who experienced financial strain during the holidays, reviewing hardship options may be helpful. Some lenders offer temporary relief programs, payment modifications, or flexibility options during difficult periods. Exploring these early prevents stress from escalating later.

Insurance and protection also matter. Mortgage reviews often reveal outdated homeowners insurance coverage or mismatches between coverage and home value. Ensuring adequate protection safeguards both your property and your financial investment.

Another often-overlooked aspect is documentation and organization. Keeping mortgage statements, tax forms, and loan details organized simplifies future planning and reduces stress during tax season. A January cleanup creates clarity and saves time later.

Avoid the urge to make decisions based solely on headlines or market predictions. Mortgage choices should be grounded in personal finances rather than speculation. A calm review focused on numbers, timelines, and goals leads to better outcomes than reactive changes.

It’s also important to reassess whether your mortgage still fits your lifestyle. Changes in household size, work arrangements, or long-term plans may affect how you view your home and its financing. Reviewing these factors annually keeps decisions intentional.

A mortgage doesn’t need constant adjustment, but it does benefit from periodic attention. The post-holiday period offers a quiet window to assess, plan, and align without pressure.

Reviewing your mortgage in the new year isn’t about chasing the “perfect” rate or paying off the house overnight. It’s about ensuring that one of your largest financial commitments continues to work for you—not against you.

With thoughtful review and small adjustments, your mortgage can support financial stability, flexibility, and peace of mind throughout the year ahead.

Unlock Full Article

Watch a quick video to get instant access.