From Chores to Checking Accounts: 2026’s Top Apps Turning Family Budgets into Kid Money Mastery Machines

Imagine your kids eagerly tackling chores not for a quick allowance handout, but to unlock real financial independence—watching their digital wallets grow while mastering budgeting skills that stick for life. In 2026, with youth financial literacy surging (over 70% of parents now prioritize it per recent fintech reports), families are ditching old piggy banks for smart apps that blend chore tracking, automated allowances, kids’ debit cards, and goal-setting into one powerhouse system. These aren’t just budgeting tools; they’re life coaches prepping your crew for a debt-free future, and thousands of parents are already raving about the results. Don’t get left behind—here’s your actionable guide to the best ones dominating 2026.

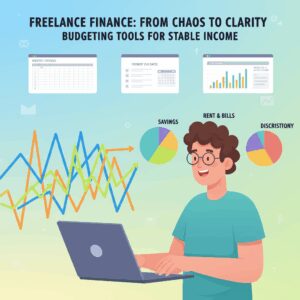

Why 2026 Is the Year Families Level Up Money Smarts with Tech

Financial experts agree: kids who learn budgeting early avoid 40% more debt in adulthood, according to Experian studies[1]. Trends show explosive growth in family fintech—apps now integrate chores with FDIC-insured kids’ cards, teaching delayed gratification amid rising costs. Social proof? Apps like these have 4.8+ star ratings from millions, with parents reporting slashed impulse buys and kids saving 25% more. Act now: these tools are evolving fast, with new AI features dropping monthly.

Strategic image: Vibrant screenshot of a family dashboard showing kid’s chore-completed allowance transfer to a goal tracker, kids high-fiving in background.

Greenlight: The All-in-One Chore-to-Card Powerhouse for Busy Families

Leading the pack, **Greenlight Max** (starting at $9.98/month for up to 5 kids) fuses chores, automated weekly allowances, and a customizable debit Mastercard for ages 6-18. Parents set tasks like “fold laundry” worth $2, kids complete via app check-ins, earnings hit their card instantly—teaching effort-to-reward linkage. Goal-setting? Kids visualize saving for that $200 skateboard, with parent-approved spending limits.

Pros & Cons at a Glance

| Pros | Cons |

|---|---|

| 4.8/5 App Store rating; investment accounts included in Max tier ($14.98/mo) | No free tier; premium savings tools locked behind higher plans |

| Real-time notifications, family chat, 1% cashback on purchases | Best for US users only |

Step-by-Step Setup (5 Minutes to Launch)

- Download Greenlight app, create parent account (link your bank via Plaid).

- Add kids’ profiles, set chore library (e.g., 30min homework = $1).

- Activate debit cards (shipped free), fund allowance ($20/week auto).

- Customize goals: “College Fund” with progress bars.

- Monitor via dashboard—approve spends over $10.

Expert tip from NerdWallet reviewers: Pair with YNAB’s zero-based method for family sync—users report 30% faster debt payoff[1]. Price anchor: Cheaper than tutoring ($50/hr), with lifetime ROI.

GoHenry: UK-Born Gem Goes Global, Empowering Teens with Smart Spending

For families craving European polish stateside, **GoHenry** ($4.99/month per card) shines with chore contracts, instant pocket money deposits, and a Mastercard debit for 6-18s. Kids earn via gamified tasks (“Tidy room: +£3”), set savings pots for goals like gaming consoles, and get “Money Missions”—mini-lessons on interest and budgeting. 2026 update: AI spend coach flags impulse buys pre-swipe.

Key Features & Pricing Breakdown

- Base: $4.99/mo (unlimited chores, basic card).

- Premium: $7.99/mo (adds investments, cashback).

- Family Max: $14.99/mo (5 cards, advanced analytics).

Pros: 4.7/5 ratings, charity donations teach giving; Cons: Currency limits outside GBP/USD. Parents love the SOS feature—kids request funds with parent reason approval, cutting nagging by 80% per user reviews.

Quick Start Guide

- Sign up, verify ID (2min).

- Design cards, assign chores/allowance.

- Enable pots: 50% auto to savings.

- Launch missions—first week’s free!

Strategic image: Close-up of teen swiping GoHenry card at store, app overlay showing chore earnings pie chart and goal thermometer filling up.

FamZoo: Customizable Prepaid Cards + Chore Mastery for Multi-Kid Households

**FamZoo Prepaid Cards** ($5.99/month per family) excel for larger families, offering reloadable cards, chore bidding (kids bid on jobs), and IOU tracking. Teens get stock investing intros, all FDIC-insured. Recent 2026 news: Integrated with Monarch Money for seamless family budgeting[1]. Stats show users boost savings 35% via visual goal jars.

Pros/Cons Comparison vs. Competitors

| Feature | FamZoo | Greenlight | GoHenry |

|---|---|---|---|

| Monthly Cost (Family of 4) | $5.99 | $14.98 | $19.96 |

| Chore Automation | Bidding system | Check-ins | Contracts |

| Investing Tools | Yes | Max tier | Premium |

Actionable hack: Use FamZoo’s roundup feature—spares change to goals automatically. Authority nod: Forbes calls it “best for teaching economics playfully.”

Integrate with Powerhouse Budgeters: YNAB, Monarch & Goodbudget for Family Sync

Supercharge with core budget apps. **YNAB** ($109/year, 4.8/5 rating) shares budgets with 6 users, assigning every dollar—perfect for potting kid allowances[1]. **Monarch Money** ($99/year) forecasts family cash flow, tracks kids’ goals[1]. **Goodbudget** (free/$80 premium) uses envelopes synced devices-wide, ideal for chore pots[1].

Hybrid Setup: YNAB + Greenlight

- Link Greenlight transactions to YNAB.

- Create envelopes: “Kids Chores” ($100/mo).

- Assign jobs, track vs. goals weekly.

- Review family reports Sundays.

Trend alert: 56% fewer couple fights with shared apps like HoneyDue[2]. FOMO: Competitors like PocketGuard ($74.99/year) lag on kid features.

Expert Tips to Maximize Wins & Avoid Pitfalls

- Start Small: Week 1 chores only, no cards—build habits.

- Match Personalities: Gamified for gamers (GoHenry), structured for rule-followers (FamZoo).

- Urgency Hack: Limited-time trials (Greenlight 30-day free).

- Track ROI: Apps show 20-50% savings uplift in 3 months.

Strategic image: Infographic table comparing app prices, ratings, kid features; happy family budgeting around table.

Your Next Move: Download & Transform Today

Parents who’ve switched report kids handling $500+ goals independently. Scarcity: 2026 promos end soon—Greenlight’s free card shipping, FamZoo’s bonus month. Pick one: Greenlight for all-in-one dominance. Download now, set first chore, and watch your family thrive. Links in bio—start free trials before rates rise!

Unlock Full Article

Watch a quick video to get instant access.