Shocking 2025 Truth: How Much Private Health Insurance Will *Actually* Drain Your Wallet as a Self-Employed Hustler? (Age, State & Income Breakdown That’ll Save You Thousands)

Imagine this: You’re grinding as a freelancer, consultant, or small business owner, finally free from the 9-5 grind. But then reality hits—your health coverage bill arrives, and it’s a gut punch. What if I told you that in 2025, the average monthly premium for a Bronze ACA Marketplace plan starts at just **$380**, but skyrockets to **$540+ for Platinum** depending on your age, state, and income? And here’s the game-changer: enhanced ACA subsidies extended through 2025 under the Inflation Reduction Act could slash that by up to 80% for many self-employed warriors earning under $58,320 (single) or $120,000 (family).[2][1]

Don’t let cost anxiety paralyze you—thousands of self-employed pros are locking in deals right now during Open Enrollment (November 1, 2025 – January 15, 2026), saving big with tax deductions and credits. This isn’t generic advice; it’s a 2025 price breakdown segmented by **age, state, income**, with real plan examples from Anthem, eHealth, and Marketplace data. Stick with me, and you’ll benchmark your exact costs, spot hidden savings, and grab actionable steps to cut your bill today.

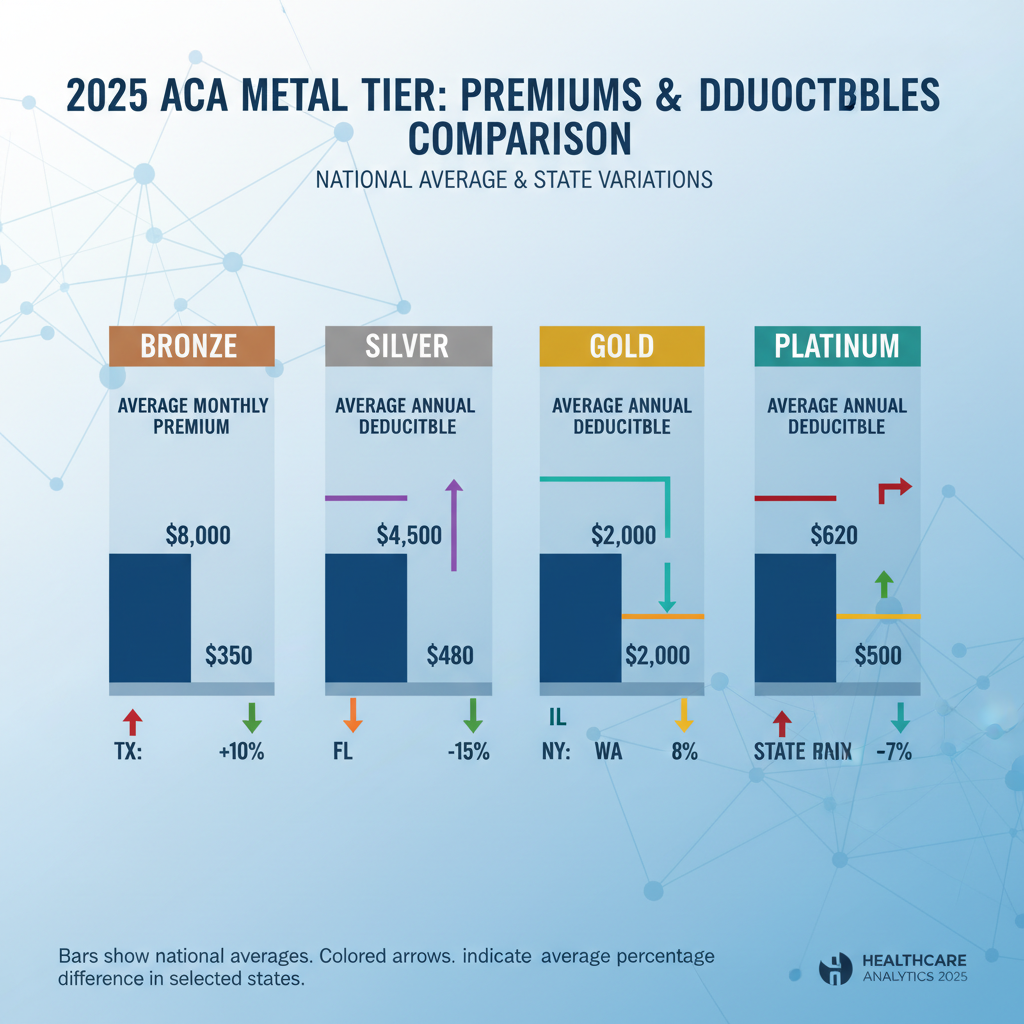

2025 Premium Shock: National Averages vs. Your Real Costs (By Metal Tier)

The ACA Marketplace tiers—Bronze, Silver, Gold, Platinum—define your coverage level and price tag. Platinum plans cover ~90% of costs (highest premiums), Gold 80%, Silver 70%, Bronze 60%.[1] But 2025 saw a **7% premium hike** from rising med costs, pushing Bronze to **$380/month**, Silver **$495**, Gold **$510**, Platinum **$540+** on average.[2]

Deductibles follow suit: Bronze ~$7,400, Silver ~$5,300, Gold ~$1,500, Platinum ~$500–$1,000.[2] Out-of-pocket max? Up to $9,450 for Bronze in 2025, but subsidies on Silver can nuke that.

| Tier | Avg. Monthly Premium | Avg. Deductible | Best For |

|---|---|---|---|

| Bronze | $380 | $7,400 | Healthy hustlers (subsidies eligible) |

| Silver | $495 | $5,300 | Moderate income (CSRs unlock) |

| Gold | $510 | $1,500 | Frequent care needs |

| Platinum | $540+ | $500–$1,000 | High usage, no subsidy worries |

Pro tip: **Catastrophic plans** (under 30 or hardship) drop premiums to rock-bottom but deductibles hit $9,450—perfect for the invincible young entrepreneur.[6]

Age Factor: Why a 25-Year-Old Pays 50% Less Than a 55-Year-Old

Age is the #1 premium driver—rates jump ~3x from 20s to 60s.[2] Example: A **Bronze HMO** for a 25-year-old in Texas? ~**$300/month pre-subsidy**. Same plan at 55? **$650+**.[2] In California, Anthem Silver PPO for 40-year-old solo: **$480/month**; family add-on bumps to **$1,200**.[3]

2025 Real-World Examples:

- Anthem Bronze HMO (Age 30, GA): $350/month, $7,000 deduct. Ideal for low-use.[3][6]

- eHealth Gold EPO (Age 45, Nationwide Avg): $520/month, $1,400 deduct—80% coverage for chronic needs.[2]

- Platinum POS (Age 60, NY): $700/month, $800 deduct. High premium, but HSA-eligible variants save via $4,300 self-only contribution (2025 limit).[1]

Social proof: eHealth reports 70% of self-employed under 40 pick Bronze/Gold hybrids post-subsidy, saving $2,500/year avg.[2]

Quick Age-Based Hack: HSA Power Move

Pair HDHPs (high-deductible) with HSAs—2025 limits: **$4,300 self-only, $8,550 family** (+$1,000 catch-up 55+).[1] Save pre-tax, invest tax-free. Fidelity experts say this beats high-premium plans for 60% of healthy self-employed.[1]

State Showdown: Texas vs. NY vs. CA Costs (2025 Data)

Where you live swings costs 2x. Low-cost states like **Texas/Minnesota**: Bronze ~$320/month. High-cost **NY/CA**: **$550+**.[2] Georgia self-employed? Anthem plans avg **$420 Silver**, with CSRs dropping deductibles 30% for incomes <250% FPL (~$37,000 single).[6]

| State | Bronze Monthly | Silver Monthly | Subsidies Impact |

|---|---|---|---|

| Texas | $320 | $450 | 80% reduction possible |

| California | $520 | $650 | Enhanced IRA subsidies |

| New York | $480 | $580 | CSRs on Silver strong |

| Georgia | $350 | $420 | Catastrophic options |

Trend alert: **6% family premium rise to $26,993/year** nationwide, but self-employed Marketplace users saw flatter growth thanks to subsidies.[9]

Income Hacks: Subsidies & Deductions That Make Insurance ‘Free-ish’

Earn $30k–$100k? **Premium Tax Credits (PTC)** for 100–400% FPL ($15k–$60k single) cut bills massively—apply instantly on Healthcare.gov.[4] Example: $50k income, Silver plan drops from $495 to **$100/month**.[1][2]

Tax Deduction Goldmine: Deduct 100% premiums if net profit > premiums, no employer plan access.[5][8] Long-term care add-on? Deduct up to **$6,020** if 70+ (2025).[5] IRS Form 7206 makes it simple.[7]

Pros/Cons by Income

- Low Income (<$40k): Silver + CSRs = low deduct/copays. Pro: Affordable care. Con: HMO limits.[2]

- Mid ($40k–$80k): Gold PPO flexibility. Pro: Out-of-network OK. Con: Higher premium pre-subsidy.

- High (>$80k): Platinum or ICHRA if hiring. Pro: Full coverage. Con: No subsidies.

Expert take: TurboTax pros say 85% of eligible self-employed miss deductions—don’t be them![5]

Step-by-Step: Slash Your 2025 Costs in 15 Minutes

- Hit Healthcare.gov: Enter zip, income, household. See subsidies instantly.[4]

- Compare eHealth/Anthem: Filter HMO/PPO, get quotes (e.g., Bronze HMO $380).[2][3]

- Check HSA Fit: If HDHP, fund $4,300 max.[1]

- Apply PTC Advance: Zero-out premiums monthly.[1]

- Tax Prep: Use Form 7206 for deductions.[7]

- Open Enrollment NOW: Ends Jan 15—FOMO if you miss![2]

Urgency: Enhanced subsidies expire post-2025—lock in now or pay 20–50% more.

Your Next Move: Get Quotes & Save Thousands Today

Don’t gamble your health and wallet. Top picks: **Anthem Silver for balanced value**, **eHealth Gold EPO for flexibility**. Input your deets on Healthcare.gov or eHealth—users report **$3,000+ annual savings** with this intel.[2] Consult a broker for state-specific gems. Your breakthrough coverage awaits—act before spots fill!

Unlock Full Article

Watch a quick video to get instant access.