Tired of Overpaying for Car Insurance? Unlock 2026 Savings with Telematics, Pay-Per-Mile, and Classic Policies – Compare Now Before Rates Spike!

Imagine slashing your car insurance bill by up to 40% just by proving you’re a safe, low-mileage driver. In 2026, the auto insurance world is exploding with telematics-driven options that reward your real habits, not outdated estimates. With usage-based insurance (UBI) surging 30% in recent years, savvy drivers are ditching flat-rate premiums for smarter, personalized plans.[2] But which fits you? We’ll break down traditional, UBI, and pay-per-mile models, spotlight top programs like Allstate Drivewise and Nationwide SmartRide, and guide you through side-by-side comparisons using real driver scenarios. Don’t miss out – millions are saving hundreds annually while rates climb elsewhere.[1]

The 2026 Insurance Revolution: Why Your Driving Data is Your Biggest Discount

Traditional policies charge a fixed premium based on age, location, and self-reported mileage – often overestimating your needs and inflating costs. Enter telematics, apps or devices that track acceleration, braking, speed, and miles via your phone or OBD-II plug-in. UBI uses this for discounts on standard policies, while pay-per-mile bills a base fee plus per-mile rates (e.g., $0.05-$0.15/mile). Root Insurance even bases entire policies on a test-drive period, averaging $900/year savings for qualifiers.[1]

Trends show UBI adopters save 10-25% on average, with programs like Progressive Snapshot delivering $231/year off.[1] Experts at Bankrate and MoneyGeek hail 2026 as the year low-mileage drivers (under 10,000 miles/year) dominate, especially post-pandemic commuters.[3] FOMO alert: If you’re still on traditional, you’re leaving money on the table as 30% UBI growth continues.[2]

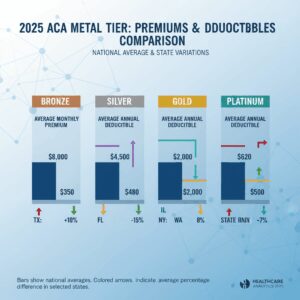

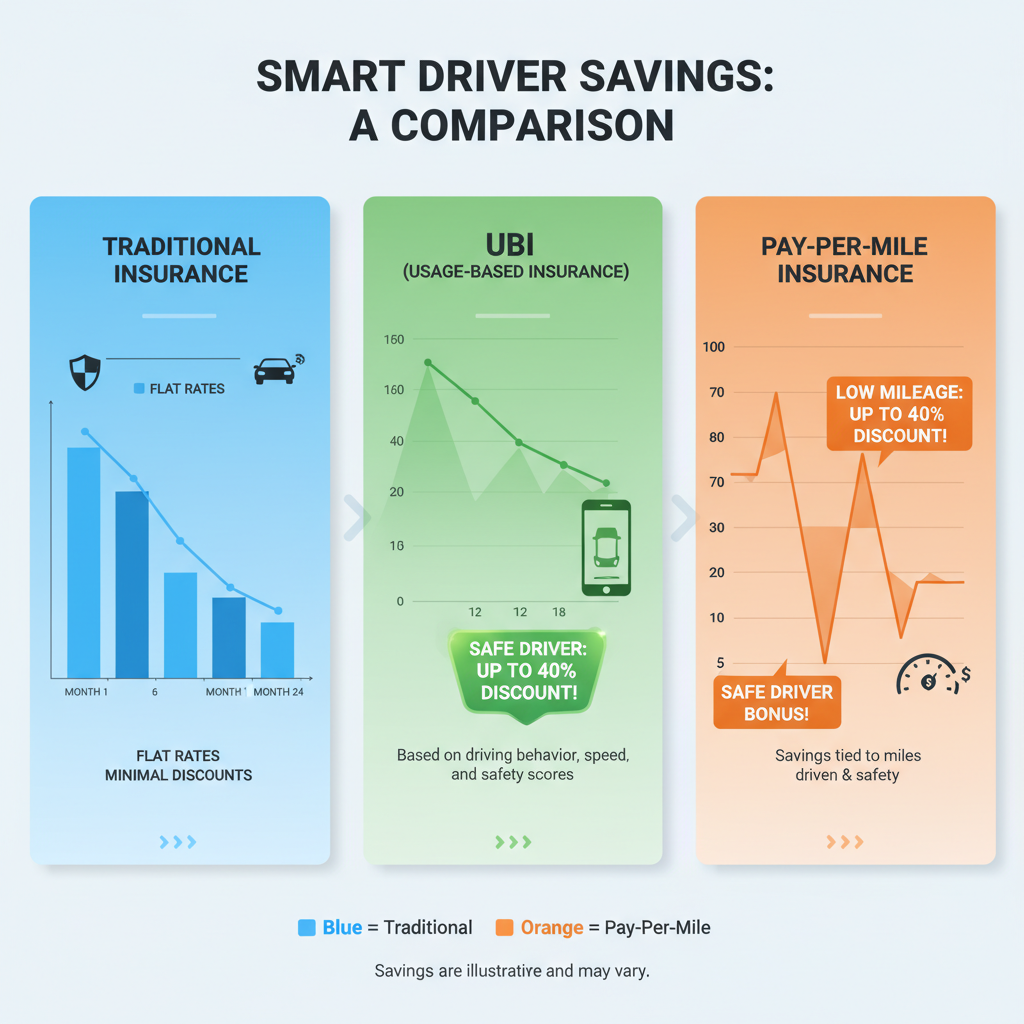

Strategic Image: Vibrant infographic comparing traditional vs. UBI vs. pay-per-mile savings charts, showing 40% discount peaks for safe drivers.

Policy Showdown: Traditional vs. UBI vs. Pay-Per-Mile – Who’s Winning in 2026?

Let’s compare the **three main types** with pros, cons, and real pricing from top providers. Data pulled from J.D. Power 2024 scores (industry avg: 821/1000) and 2026 updates.[1]

1. Traditional Policies: Reliable but Pricey for Low-Milers

Best for: High-mileage drivers (15k+ miles/year) who want simplicity, no tracking.

How it works: Fixed annual premium based on estimates. Example: For a 50-year-old with a 2019 Hyundai Elantra (full coverage: $50k/$100k BI, $50k PD, $1k deductibles), quotes average $1,200-$1,800/year via sites like Insurify.[4]

Pros: No apps, predictable billing. Cons: No habit-based discounts; overpays low-milers.

Top pick: Geico or State Farm base plans – but upgrade for telematics to save 25-30%.[1]

2. Usage-Based Insurance (UBI): Rewards Safe Habits, Nationwide Reach

Best for: Safe drivers averaging 10k miles/year who brake smoothly and avoid night drives.

How it works: Track 3-6 months via app; discounts apply if safe (e.g., no hard brakes). Rates may rise for risky behavior in some programs.

| Program | Best For | J.D. Power | Savings | Availability |

|---|---|---|---|---|

| Allstate Drivewise | Crash detection fans | 818 | Up to 40% | All except AK/CA |

| Geico DriveEasy | Instant discounts | 837 | Up to 25% | 37 states + DC |

| Nationwide SmartRide | No rate hikes | 842 (top score!) | Up to 40% | Most states |

| Progressive Snapshot | Broad access | 816 | $231 avg/year | Most states |

| State Farm Drive Safe & Save | Existing customers | 820 | Up to 30% | Most states |

| Root Insurance | UBI-only fans | N/A | $900 avg/year | 34 states |

Bankrate experts recommend Nationwide for no-risk savings – social proof from 842 J.D. Power score.[1] Liberty Mutual’s RightTrack also shines at $38/month starters per Clearsurance.[5]

3. Pay-Per-Mile: Ultimate for Rare Drivers

Best for: Retirees, work-from-home pros under 5k miles/year.

How it works: Base fee ($20-50/month) + per-mile (e.g., Nationwide: $0.08/mile, 250-mile daily cap). Full coverage like traditional.[3]

Pros: Pay only for use; ideal for second cars. Cons: Logging miles required; higher per-mile for risky drivers.

Top pick: Nationwide SmartMiles – MoneyGeek’s #1 for 2026, blending UBI safety discounts.[3]

Strategic Image: Side-by-side app screenshots of Drivewise, Snapshot, and SmartMiles dashboards showing real-time scores and savings projections.

Real-World Scenarios: Which Policy Wins for You?

Scenario 1: Suburban Mom, 10k miles/year, safe driver (2019 Elantra). Traditional: $1,500/year. Switch to Geico DriveEasy: Instant 10% off + 25% telematics = ~$1,050. Save $450![1][4]

Scenario 2: City Retiree, 4k miles/year. Pay-per-mile Nationwide: $30 base + $0.08/mile = $350/year total. Traditional? Double that. Urgency: Low-mile rates rising 15% in 2026.[3]

Scenario 3: Young Commuter, variable habits. Root test-drive: Qualify for $900/year if safe – or stick traditional at $2,000+.[1]

Step-by-Step: Compare Quotes Side-by-Side in Under 10 Minutes

Top sites like Insurify deliver real-time quotes from 40+ carriers without spam (per their 2026 tests).[4] Actionable guide:

- Prep data: VIN, mileage estimate, driving history. Use sample profile: 50yo female, clean record, 10mi/day commute.[4]

- Hit comparison sites: Insurify.com, The Zebra, or NerdWallet – input details for traditional/UBI/pay-per-mile options.

- Enroll in telematics: Download apps (e.g., Progressive Snapshot) during quoting for instant previews.

- Compare apples-to-apples: Full coverage quotes; check J.D. Power scores. Example: Snapshot $231 savings vs. Drivewise 40%.[1]

- Lock in: Sign up for trial periods (Root: 2 weeks). Authority tip: Bankrate says start with Nationwide for zero-risk.[1]

Pro tip: Bundle with home for extra 10-20% off. Scarcity: Limited spots in exclusive UBI trials![5]

Expert Tips to Maximize 2026 Savings

- Avoid hard brakes/night drives for max scores – apps grade in real-time.[1]

- Low-mile? Prioritize pay-per-mile; MoneyGeek confirms 50%+ cuts.[3]

- Read fine print: Some (Allstate) hike risky drivers; choose no-risk like SmartRide.[1]

- Switch now: UBI growth means better deals before traditional rates jump.[2]

Strategic Image: Step-by-step screenshot collage of Insurify quote comparison, highlighting UBI discounts for a sample driver.

Your Move: Compare and Save Hundreds Today

Why wait? Top performers like Nationwide (842 J.D. Power) and Root ($900 avg savings) are enrolling fast.[1] Head to Insurify or your insurer’s site right now – enter your details, test-drive a telematics app, and watch savings stack. Join thousands saving 30%+ in 2026. Your wallet will thank you!

Unlock Full Article

Watch a quick video to get instant access.