First-Time Buyer Playbook 2025: How Smart Buyers Stack 3% Down Mortgages, Grants, and Assistance to Shrink Cash-to-Close

Sticker shock on down payments is killing a lot of first-time buyer dreams right now. But the buyers who are still winning in 2025 are not the ones with big savings – they’re the ones who know how to stack multiple low-down-payment loans, grants, and assistance programs together to slash their cash-to-close.

This playbook walks you through how that stacking works in real life: using 3%–3.5% down mortgages, layering bank and state grants, and tapping local programs to turn a scary $25,000 cash requirement into something closer to $7,000–$10,000 – sometimes even less.

Why “Stacking” Is the 2025 Cheat Code for First-Time Buyers

Most people only hear about a single program at a time – a 3% down mortgage, or a state grant, or a local first-time buyer program. The real leverage comes when you combine them in a compliant way with the help of a lender who knows this space.

Here’s the basic structure many successful 2025 buyers are using:

- Primary loan: a 3%–3.5% down FHA or conventional mortgage.

- Layer 1 assistance: a state or city down payment/closing cost program (grant or silent second).

- Layer 2 assistance: a bank grant from national lenders (closing cost credits or down payment money).

- Layer 3: gift funds from family, or in some markets, negotiated seller credits.

When coordinated properly, these layers can cover most – and sometimes all – of the minimum down payment plus a big chunk of closing costs.

Step 1: Start With a 3%–3.5% Down Mortgage as Your Core

You need a flexible base loan type that plays nicely with assistance programs. In 2025, that usually means one of the following:

FHA Loan at 3.5% Down – The Flexible Workhorse

FHA loans typically allow a 3.5% down payment and are widely accepted by state and local down payment assistance (DPA) programs.[1][4] They’re often more forgiving on credit and debt-to-income than some conventional options.

Example on a $350,000 purchase:

- FHA minimum down (3.5%): about $12,250

- Typical closing costs (2%–3%): $7,000–$10,500

- Total cash needed before assistance: roughly $19,000–$22,750

On its own, that’s a big ask. But FHA’s compatibility with programs like the Chenoa Fund and state DPAs makes it ideal for stacking.[4]

3% Down Conventional – Great for Stronger Credit

Many lenders now offer 3% down conventional mortgages specifically geared toward first-time buyers. For example, Bank of America offers a 3% down payment fixed-rate mortgage that can be combined with its grant programs in eligible markets.[3][6]

Same $350,000 purchase with 3% down:

- Down payment (3%): about $10,500

- Closing costs: $7,000–$10,500

- Total before assistance: roughly $17,500–$21,000

With strong credit and income within program limits, a 3% down conventional loan can sometimes be cheaper over the long run than FHA and still stack with grants.

Step 2: Add State and Local Down Payment Assistance (Your Biggest Leverage)

This is where serious savings show up. Most states now run their own DPA or closing cost programs, often available only to first-time buyers or those who haven’t owned in the last three years.[1]

What State/Local Programs Usually Look Like

Typical features across many 2025 state programs include:[1][2][4][5]

- Eligibility: first-time buyer (or no ownership in 3 years), income and purchase price caps, primary residence only.

- Assistance type: grants (no repayment), forgivable seconds, or deferred-payment seconds.

- Coverage: often 3%–5% of the purchase price or loan amount; some fixed-dollar grants like $2,500–$10,000.[1][5]

Examples (just a few of many active programs):

- Chenoa Fund (national, used with FHA): provides 3.5% of the purchase price as a zero-interest second mortgage; can be forgiven after 36 on-time payments on the first mortgage.[4]

- Iowa FirstHome Down Payment and Closing Costs Grant: offers a $2,500 grant for down payment and closing costs.[5]

- Louisiana programs (via Louisiana Housing Corporation and local entities): often provide up to 4% assistance for down payment and closing costs on top of FHA or conventional mortgages.[2][7]

Most states also maintain a list of city or county-level programs, sometimes offering $5,000–$15,000+ to targeted buyers or neighborhoods.[1]

How Stacking Works With State DPA

Go back to that $350,000 FHA example with $12,250 down needed.

- Use FHA with Chenoa Fund (3.5%) to fully cover the required down payment.[4]

- Add a state or city program that covers another 3%–4% of the price toward closing costs and prepaids.[1][2]

Suddenly, a big portion of both your down payment and closing costs is covered by layered assistance, and your out-of-pocket might shrink to just your earnest money, inspection, appraisal, and any shortfall.

Step 3: Layer in Bank Grants and Lender Credits

National lenders have quietly become a major source of stackable assistance – but you usually only hear about it if you talk to a loan officer who specializes in first-time buyer affordability.

Bank of America: Down Payment & Closing Cost Grants

Under its Community Homeownership Commitment, Bank of America currently offers:[3][6]

- Down Payment Grant: up to 3% of the purchase price, capped at $10,000, for down payment in select markets. No repayment required, first-time buyers only.[3]

- America’s Home Grant: up to $7,500 in lender credits toward closing costs.[6]

These can be combined with a 3% down mortgage and, in some cases, with state or local programs if guidelines line up and the lender approves the structure.[3][6]

Other Big-Bank & Lender Grants

Several large lenders offer similar targeted grants (amounts and markets vary, but many fall in the $2,500–$10,000 range), often restricted to certain ZIP codes or income levels.[6] These programs change frequently, which is why talking to multiple lenders in 2025 is crucial.

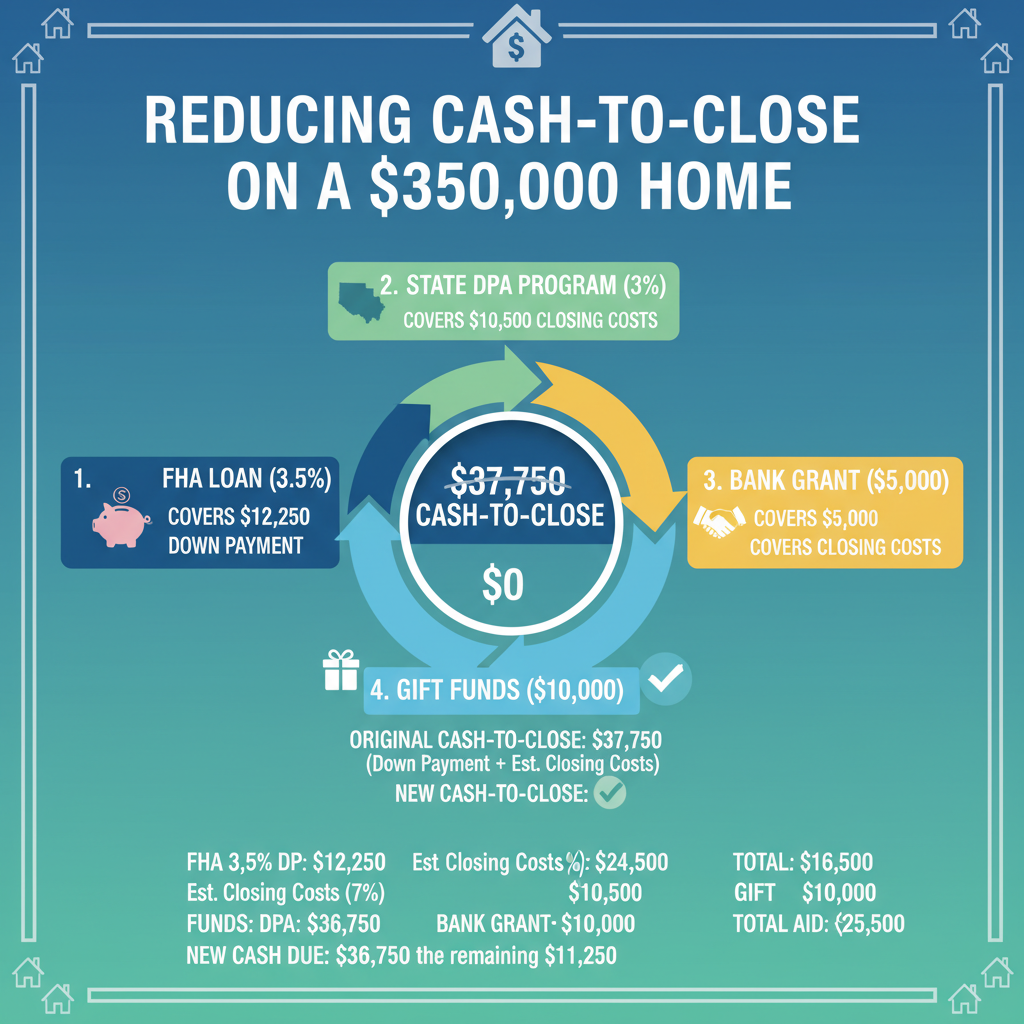

Step 4: Build a Real-World “Stacked” Deal Example

To see how this stacks up, here’s a realistic 2025 scenario for a first-time buyer:

Scenario: $350,000 Starter Home With Stacked Assistance

Assumptions:

- First-time buyer with mid-600s credit.

- Income within state DPA limits; buying a primary residence.[1]

- Property in a market where bank grants and state programs overlap.

Stacking structure:

- Primary loan: 3.5% down FHA loan.

- Layer 1: Chenoa Fund at 3.5% of purchase price to cover minimum down payment (~$12,250).[4]

- Layer 2: State program providing 3% of purchase price toward down payment/closing (~$10,500) as a forgivable or deferred second.[1][2]

- Layer 3: Bank grant – e.g., $7,500 closing cost credit plus up to $10,000 down payment grant if using a qualifying 3% down conventional instead, in a Bank of America eligible area.[3][6]

- Layer 4: $3,000 gift from family plus a negotiated $3,000 seller credit.

If structured properly (and within each program’s rules), the buyer may only need to bring a fraction of the original $19,000–$22,750 estimate to the closing table – potentially under $8,000, sometimes less. Your exact numbers depend on interest rates, taxes, insurance, and program rules in your area, but the architecture is repeatable.

Step 5: Where to Actually Find These Programs

Here is a focused action plan to avoid getting lost in Google searches:

1. Start With a National DPA Directory

Use a national guide that maintains current state-by-state DPA lists. For example, The Mortgage Reports maintains an updated page of down payment assistance programs and grants by state, outlining common eligibility rules and sample programs across the U.S.[1] FHA.com also provides a catalog of FHA-compatible grants and assistance.[4]

2. Go Directly to Your State Housing Finance Agency

Every state has a housing finance agency (HFA) or similar entity that runs official programs. Common names include “Housing Finance Authority,” “Housing Corporation,” or “Housing and Finance Agency.”

On their site, look for sections labeled:

- “First-time homebuyer programs”

- “Down payment and closing cost assistance”

- “Homeownership programs”

As examples, states like Iowa and Louisiana publish clear program details, including minimum credit scores, maximum purchase prices, and how much assistance is offered.[2][5][7]

3. Check City and County Programs

Many cities and counties layer additional help on top of state programs.

- Some parishes and counties offer 3%–4% DPA grants tied to a 30-year fixed-rate mortgage.[2]

- Local first-time buyer programs may add $5,000–$12,000 in forgivable assistance for targeted buyers (teachers, first responders, etc.).[1]

These local programs often require homebuyer education and working with approved lenders, but that structure is exactly what makes stacking possible.

4. Talk to Lenders Who Actively Market DPA

Not every loan officer is fluent in stacking. When you shop lenders, specifically ask:

- “Which down payment assistance programs do you actively work with in my state?”

- “Can you combine your bank’s grants with state or city programs?”

- “Can you quote scenarios with FHA, 3% down conventional, and assistance layered in?”

Cross-check what they tell you with independent sources like your state HFA website and national guides.[1][4][5]

Common Rules and Gotchas When Stacking

Stacking is powerful, but you have to stay inside the lines.

- First-time buyer definition: many programs define this as not owning a home in the last three years, so you may qualify even if you owned in the past.[1]

- Income & price caps: exceeding these can disqualify you, so have a lender run precise numbers early.

- Occupancy: most assistance requires you to live in the home as your primary residence, often for a set number of years.[1][2][4]

- Repayment triggers: forgivable or deferred loans may become due if you sell, refinance, or move out before the required period.[2][4][5]

- Education requirements: many programs require a HUD-approved homebuyer education class.[1][8]

Action Plan: What You Can Do This Week

If you want to be one of the buyers who actually gets into a home in 2025 instead of waiting on the sidelines, here is a clear, practical next step list:

- Day 1–2: Look up your state housing finance agency and download their first-time buyer/DPA program guides.[1][4][5]

- Day 3: Make a short list of two or three local or state programs you likely qualify for (based on income, credit, and location).

- Day 4–5: Schedule calls with at least two lenders – one major bank that offers grants (like Bank of America)[3][6] and one local lender that advertises DPA expertise.

- Ask each lender to design at least two stacked scenarios for you: FHA + DPA and 3% down conventional + DPA + grants.

- This month: Complete any required homebuyer education course so you’re program-ready when you find the right home.[1][8]

Why You Can’t Afford to Wait

Most assistance programs have limited funding, geographic restrictions, and annual budgets. When funds run out, the program pauses or closes until the next funding cycle.[1][4][5] Meanwhile, each month of rent is money you never get back.

Buyers who move first – and who understand stacking – are the ones locking in homes while others assume they “need 20% down.” In 2025, that assumption is expensive.

Call to action: Spend one evening this week building your personal stack: identify your state program, one or two local options, and at least one bank grant. Then talk to a lender who can plug them into FHA or 3% down conventional options. Your future self will thank you every time you make a mortgage payment on a home that’s actually yours.

Unlock Full Article

Watch a quick video to get instant access.