Holiday Spending Without the Stress: Budgeting Tips That Protect Your New Year Goals

The holiday season is a time of celebration, generosity, and tradition. But it’s also one of the most expensive times of the year. Between gifts, travel, food, and seasonal activities, spending can add up quickly — sometimes without us realizing it. By the time January arrives, many people feel the weight of financial regret, higher credit balances, and delayed goals.

The good news? With some intentional planning and practical strategies, you can enjoy the holidays fully while keeping your finances secure. The right budget helps you stay stress-free now and start the new year strong.

Set a Realistic Holiday Spending Plan

A successful budget begins with knowing exactly how much you can afford to spend — not how much you want to spend.

Start with three steps:

- Review upcoming income and essential bills

- Determine a fixed holiday spending limit

- Break that limit into categories (gifts, travel, food, décor)

This makes every purchase part of a plan instead of a surprise hit to your bank account.

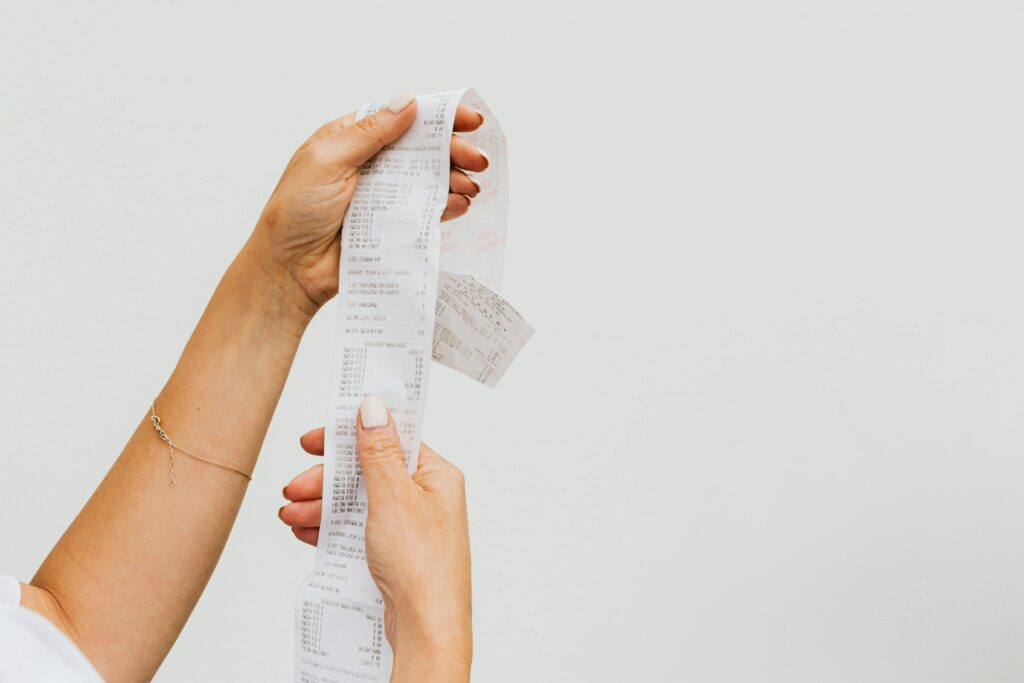

Track Purchases as You Go

Budgeting only works if you keep an eye on your spending. A simple way to stay accountable is to log expenses as they happen.

You can use:

- A note on your phone

- A budgeting app

- A paper list kept in your wallet

Tracking prevents forgetting — and overspending — especially during busy holiday shopping trips.

Use Cash or Debit for Non-Essential Purchases

Swipe-now-worry-later is tempting during the holidays. Paying in cash or debit for items like décor or stocking stuffers reduces the chance of carrying debt into the new year.

If credit is needed, choose wisely:

- Only swipe when you have a clear repayment plan

- Avoid using multiple cards at once

- Watch for promotions that turn into impulse spending

Your January self will thank you.

Take the Pressure Out of Gift-Giving

Many people overspend because they feel obligated to buy a gift for everyone. Instead, consider alternatives that maintain the joy of giving without damaging your budget.

Helpful ideas:

- Family or office gift exchanges instead of multiple individual gifts

- Handmade or personalized presents

- Experiential gifts like shared outings or a homemade dinner

Most people appreciate thoughtful gifts more than expensive ones.

Prepare for Price Fluctuations and Last-Minute Purchases

Holiday shoppers often chase deals but end up spending more overall. Planning ahead reduces risky impulse buys.

To stay ahead:

- Compare prices before making big purchases

- Shop early to avoid rush-price increases

- Keep a small “buffer” in your budget for surprises

Knowing you have wiggle room eliminates panic spending.

Avoid “New Year Debt Hangover”

Debt from November and December often delays goals like:

- Saving for emergencies

- Paying down loans

- Planning travel or major purchases

Protect your momentum by committing to a debt-free holiday. If borrowing is unavoidable, set a realistic payoff timeline before you commit.

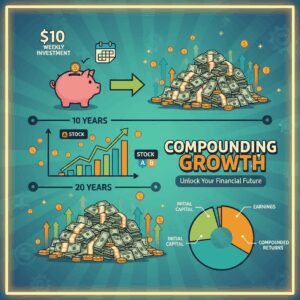

Look Ahead While You Celebrate Today

The holidays come once a year — but your financial goals are year-round. Finding balance means enjoying the moment while keeping your future in mind.

Simple reminders:

- Pause before each purchase and ask, “Is this worth it?”

- Celebrate traditions that cost time, not money

- Share experiences that truly matter

A thoughtful budget ensures joy doesn’t disappear when the bills arrive.

Enjoy the Holidays Without Financial Stress

Smart spending during the holidays isn’t about missing out — it’s about making the season meaningful without a financial burden. When you plan ahead, track your choices, and stay true to your goals, you gain both peace of mind and the ability to celebrate freely.

This year, give yourself a gift too: a January with confidence, not credit card anxiety. Your future goals deserve just as much attention as your holiday celebrations — and with the right budget, you can honor both.

Unlock Full Article

Watch a quick video to get instant access.