First-Time Buyer Playbook: How to Choose the Best Online Mortgage Broker From Pre-Approval to Closing

Your Complete Guide to Navigating Online Mortgage Brokers in 2025

Buying your first home is one of the biggest financial decisions you’ll ever make, and choosing the right online mortgage broker can save you thousands of dollars and months of stress. In 2025, the mortgage landscape has transformed dramatically. Gone are the days of spending hours in bank offices shuffling paperwork. Today’s top online mortgage brokers offer AI-powered underwriting, one-day mortgage approvals, digital identity verification, and 24/7 support—but only if you know where to look.

The challenge? With dozens of online brokers competing for your business, each claiming to be “the best,” how do you actually choose? This playbook walks you through the entire journey—from understanding your options to closing day—with concrete decision criteria, real broker comparisons, and actionable checklists that will empower you to make the right choice for your situation.

[IMAGE PLACEMENT: After Intro – First-time homebuyer reviewing mortgage documents on laptop]

Stage 1: Understanding the 2025 Online Mortgage Broker Landscape

What’s Changed This Year

The mortgage industry in 2025 operates at unprecedented speed. Rocket Mortgage, the market leader by loan origination volume, now processes applications entirely online with real-time status visibility—a massive advantage for first-time buyers who want transparency. Better Mortgage has disrupted the market with its “One Day Mortgage” program, delivering underwriting decisions in just 24 hours, compared to the industry standard of 3-5 days. This speed matters because it reduces your uncertainty window and lets you move faster when you find the right property.

Meanwhile, loanDepot combines the best of both worlds: over 200 physical locations nationwide (perfect if you need in-person support) plus a fully digital application process. AmeriSave offers same-day pre-approval without a hard credit check, letting you get a rate estimate in minutes. Zillow Home Loans publishes daily rate updates for 16 different loan programs, giving you transparency that was unthinkable five years ago.

The key trend? Digital-first brokers are now offering hybrid experiences. You can start your application on your phone, upload documents via mobile, and still talk to a human if you need guidance. This flexibility is critical for first-time buyers juggling work, family, and home shopping simultaneously.

Broker vs. Lender: What’s the Difference?

A crucial distinction: online mortgage “brokers” (like Vantage Mortgage Brokers, which serves the Pacific Northwest) shop multiple wholesale lenders in real-time using internal pricing engines to find you the best rates and terms. Online mortgage “lenders” (like Rocket Mortgage or Better) are direct lenders—they underwrite and fund loans themselves. For first-time buyers, direct lenders typically offer faster processing and more transparency, while brokers excel at finding niche loan products for buyers with complex situations (self-employed, lower credit scores, etc.).

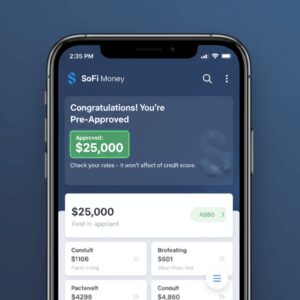

Stage 2: Pre-Approval—Your First Real Test

The Pre-Approval Checklist

Before you start house hunting, get pre-approved. This isn’t just a formality—it’s your competitive advantage in a tight market and a reality check on your budget. Here’s your checklist:

Minimum Credit Score Requirements (2025): Rocket Mortgage and loanDepot accept 620+ (conventional loans). AmeriSave requires 640+. Better Mortgage is more flexible at 580+, making it excellent for first-time buyers with imperfect credit. If your score is below 620, Better and Northpointe Bank are your best bets.

Down Payment Options: This is where online brokers shine. Better Mortgage requires just 3% down. Zillow Home Loans offers a special 1% down program for qualifying buyers—a massive advantage if you’re cash-constrained. loanDepot requires 5%, which is higher than competitors. Calculate what you can realistically afford; don’t stretch for a 20% down payment if it depletes your emergency fund.

Application Timeline: Better Mortgage: 3 minutes to start pre-approval. Rocket Mortgage: minutes to estimate. AmeriSave: minutes to prequalify. All three can deliver pre-approval letters within 24 hours. This speed matters when you find your dream home and need to make an offer immediately.

Hard Credit Check vs. Soft Check: Better Mortgage offers pre-approval without a hard credit check, protecting your credit score during the shopping phase. Once you’re serious about a specific property, you’ll authorize a hard check. This is a game-changer for first-time buyers who worry about credit impacts.

[IMAGE PLACEMENT: Middle – Comparison table showing broker features, rates, and down payment requirements]

Stage 3: Comparing Brokers—The Real Decision Matrix

The Five Dimensions That Matter Most

1. Speed-to-Close (Days to Funding): Better Mortgage’s 24-hour underwriting decision is industry-leading. Rocket Mortgage averages 3-5 days. loanDepot, with its physical branch network, can close faster for VA loans. For first-time buyers, faster isn’t always better (you want accuracy), but 24-48 hour underwriting decisions reduce your anxiety significantly.

2. Loan Variety and Specialization: Rocket Mortgage offers the widest variety of loan products, including rate buydowns and programs for renters (10% of yearly rent up to $5,000 toward closing costs). Guild Mortgage specializes in self-employed borrowers. PennyMac offers 15, 20, and 30-year terms with VA specialization. Better Mortgage covers conventional, FHA, and VA loans. For first-time buyers, conventional and FHA options cover 95% of needs; VA is crucial only if you’re military-connected.

3. Broker Fees and Transparency: This is where online brokers win big. Better Mortgage advertises “minimal fees.” AmeriSave charges a $500 application fee (higher than most). Rocket Mortgage’s fees are transparent on their website. Zillow publishes daily rates for all programs. Compare the total cost of the loan, not just the interest rate—a 0.1% lower rate might be offset by higher origination fees.

4. Customer Support Quality: Rocket Mortgage offers 100% digital application with live support available. loanDepot’s “Knowledge Café” provides educational resources. Better Mortgage’s fast turnaround reduces your need for support, but check their responsiveness on reviews. For first-time buyers, accessible support during evenings/weekends matters because you’re likely juggling this with work.

5. Rate Transparency and Daily Updates: Zillow Home Loans publishes rates for 16 programs daily. Chase Mortgage offers daily rate updates plus in-person advisor meetings. Rocket Mortgage shows your loan status in real-time. Transparency reduces the risk of surprise rate changes at closing.

Stage 4: The Vetting Process—Questions to Ask Each Broker

Once you’ve narrowed to 2-3 brokers, ask these specific questions:

1. “What is your average time from application to underwriting decision?” (Red flag if over 48 hours.)

2. “What are all fees—origination, processing, underwriting, title, appraisal?” (Demand a Loan Estimate within 3 days per federal law.)

3. “Can you lock my rate today? For how long?” (Rate locks typically last 30-60 days; confirm the terms.)

4. “What’s your minimum down payment for my credit score and loan type?” (Personalize this to your situation.)

5. “If my appraisal comes in low, what options do I have?” (This happens in ~10% of purchases; know the broker’s flexibility.)

6. “How do you handle appraisal contingencies and inspection periods?” (Critical for first-time buyers who need outs.)

7. “What’s your customer satisfaction score?” (PennyMac scores above average in J.D. Power 2025 Mortgage Servicer Satisfaction Study; ask for recent ratings.)

Stage 5: Making Your Final Decision

The Decision Matrix

Create a simple spreadsheet ranking brokers on: speed (1-5 stars), fees (total cost), loan variety (does it match your needs?), support quality (based on reviews and your test calls), and rate transparency. Weight speed and fees most heavily—these directly impact your wallet and peace of mind.

For most first-time buyers in 2025: Rocket Mortgage wins on loan variety and speed. Better Mortgage wins on minimal fees and fast underwriting. loanDepot wins if you want in-person support. Zillow Home Loans wins on rate transparency. Your choice depends on your priorities.

[IMAGE PLACEMENT: Before Conclusion – Happy first-time homebuyers outside their new home]

Stage 6: From Approval to Closing—What to Expect

Once you’ve chosen your broker and found a home, the timeline typically runs 30-45 days to closing. Your broker will order the appraisal, verify employment and assets, and pull your credit again (hard check). Stay in close contact—respond to document requests within 24 hours to avoid delays. Most online brokers now use digital document signing and digital ID verification, eliminating the need to visit an office.

At closing, you’ll sign final documents (often electronically), wire funds, and receive your keys. Your broker should have prepared you for the exact costs at this point—no surprises.

Your Action Plan: Start Today

First-time homebuyers who move decisively gain a massive advantage. Here’s what to do right now: (1) Get pre-approved with Rocket Mortgage or Better Mortgage this week—it takes 15 minutes and costs nothing. (2) Compare their Loan Estimates side-by-side, focusing on total fees and rate. (3) Call loanDepot if you want in-person support. (4) Check Zillow Home Loans if rate transparency is your priority. (5) Make your choice and lock your rate once you’re under contract on a home.

The difference between choosing the right broker and a mediocre one? Thousands of dollars, weeks of stress, and the confidence that you’re getting a fair deal. In 2025, with one-day mortgages, AI underwriting, and transparent pricing, there’s no excuse for settling. Your first home deserves better—and so do you.

Unlock Full Article

Watch a quick video to get instant access.