The Reality for Lower-Credit Borrowers in 2025

If your credit score sits below 650, you’re facing a harsh reality in today’s lending environment. Unsecured personal loan lenders are tightening their belts, with approval rates dropping and interest rates climbing to unprecedented levels. The Federal Reserve reported a 12.32% average interest rate on 24-month personal loans in Q4 2024, and that’s just the baseline—borrowers with fair or poor credit often face rates exceeding 25-36%.[1] Meanwhile, delinquency rates on unsecured personal loans have hit record highs, forcing lenders to become even more selective about who they’ll approve.

Here’s what most financial websites won’t tell you directly: if you have a credit score under 650, a secured personal loan might actually be your better option—not just for approval odds, but for your overall financial health. This isn’t about settling; it’s about playing the game strategically.

Why Unsecured Loans Are Becoming Unrealistic for Lower-Credit Borrowers

Lenders view unsecured personal loans as high-risk products. Without collateral backing the loan, they have only two recourse options if you default: sending your account to collections or suing you. Both damage your credit further, making recovery even harder.[7] Because of this elevated risk, most mainstream lenders now require a minimum credit score of 580 to qualify for an unsecured personal loan, and you’ll need a score of 700+ to access favorable rates.[4]

The math becomes brutal quickly. Consider this real-world scenario:

Unsecured Loan Example: $10,000 borrowed at 28% APR over 36 months = $11,606 in total interest paid. Your monthly payment: $322.

Many borrowers with credit scores below 650 don’t even get approved for unsecured loans anymore. When they are approved, lenders impose strict restrictions on how funds can be used, shorter loan terms, and lower maximum borrowing amounts (typically capped at $25,000-$50,000).[2]

The Secured Loan Advantage: Lower Rates, Higher Approval Odds

This is where secured personal loans flip the script entirely. By pledging collateral—whether it’s a savings account, vehicle, or investment portfolio—you dramatically reduce the lender’s risk profile. That reduction in risk translates directly into three concrete benefits:

1. Dramatically Lower Interest Rates

Secured personal loans typically carry interest rates 5-10 percentage points lower than unsecured alternatives.[1][2] For borrowers with poor credit, this difference is life-changing. While an unsecured lender might charge you 32% APR, a secured lender might approve you at 18-22% APR for the same loan amount.[2]

Using the same $10,000 example:

Secured Loan Example: $10,000 borrowed at 18% APR over 36 months = $2,919 in total interest paid. Your monthly payment: $303.

That’s $8,687 in savings over the life of the loan—money that could go toward building emergency savings or paying down other debt.

2. Higher Borrowing Limits

Secured loans often offer higher maximum borrowing amounts because lenders feel confident the collateral will cover their losses if you default.[3] If you need $25,000 for debt consolidation but can only qualify for $15,000 unsecured, a secured loan might unlock the full amount you need. Maximum borrowing typically reaches up to the value of your collateral—so if you have $30,000 in savings, you might borrow $25,000-$30,000.[4]

3. Easier Approval with Minimal Credit Requirements

This is the game-changer. Some secured lenders have no minimum credit score requirement at all.[4] Your creditworthiness becomes secondary to the collateral value. Lenders know that if you default, they can seize and resell your asset to recover funds. This removes the primary barrier that keeps lower-credit borrowers trapped in a cycle of rejection.

The Strategic Collateral Play: Minimizing Your Risk

The obvious concern: “Won’t I lose my assets if I default?” The answer is yes—but that’s only a risk if you borrow irresponsibly. Here’s how strategic borrowers approach this:

Use Non-Essential Collateral

Don’t pledge your primary residence or vehicle if you can avoid it. Instead, use a dedicated savings account or money market account as collateral. Many lenders will allow you to borrow against a savings account while keeping the account frozen but intact. You’re not risking homelessness or transportation—you’re using liquid savings as security.

Borrow Only What You Can Comfortably Repay

The collateral is insurance for the lender, not a license for you to over-borrow. Calculate your actual monthly budget and ensure loan payments fit comfortably. If you can afford $350/month, borrow only enough to keep payments at $300-$320. This buffer protects both you and your collateral.

Build Your Credit Simultaneously

Here’s the hidden advantage: secured personal loans report to all three credit bureaus.[4] Making on-time payments builds positive payment history, which is the single biggest factor in credit score improvement. Within 12-24 months of perfect payments, your score could improve by 50-100+ points, opening doors to unsecured refinancing options at better rates.

Comparing Your 2025 Options: A Practical Framework

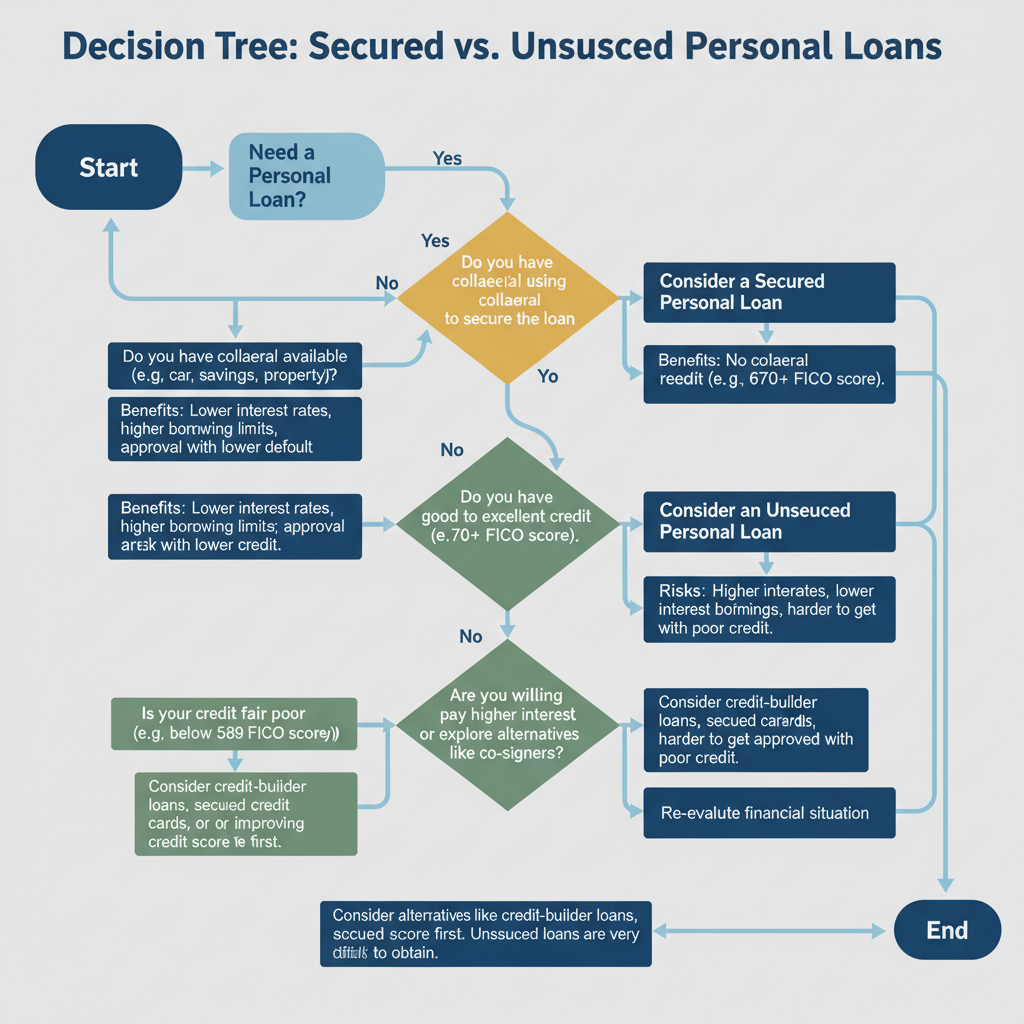

When evaluating secured vs. unsecured loans with a credit score under 650, use this decision matrix:

Choose Secured If: You have collateral available, need approval odds above 80%, want to save thousands in interest, or need a loan amount higher than $20,000. You’re willing to use the loan strategically to rebuild credit.

Choose Unsecured If: You absolutely cannot risk any assets, have recent credit improvements pushing you toward 650+, or only need a small amount ($5,000 or less). You’re comfortable with higher interest rates in exchange for zero collateral risk.

The 2025 Lending Environment: Why Now Matters

Current market conditions actually favor the secured loan strategy. With unsecured delinquencies at record highs, mainstream lenders are pulling back on approvals for lower-credit borrowers entirely. Simultaneously, specialized secured lenders are actively competing for this market segment, offering better rates and faster approval times to capture market share.

This creates a window of opportunity: secured lenders are hungry for applications, which means faster processing, more flexible terms, and better negotiating power for you. This advantage likely won’t last as market conditions shift.

Your Action Plan: Getting Approved This Week

Step 1: Gather documentation of available collateral (savings account statements, investment account statements, vehicle title).

Step 2: Calculate your actual monthly budget and determine maximum comfortable monthly payment.

Step 3: Apply to 3-4 specialized secured lenders simultaneously to compare offers within 24 hours (multiple applications within 14 days count as one inquiry).

Step 4: Negotiate terms—ask about rate reductions for auto-pay enrollment or larger collateral pledges.

Step 5: Set up automatic payments immediately upon loan funding to ensure perfect payment history.

The Bottom Line

If your credit score is under 650, secured personal loans aren’t a consolation prize—they’re often the superior financial product. Lower interest rates, higher approval odds, and the opportunity to rebuild credit simultaneously make them strategically superior to fighting for an expensive unsecured loan you might not even qualify for. The key is using them intentionally: borrow conservatively, use non-essential collateral, and commit to on-time payments that rebuild your credit profile. In 2025’s tightening lending environment, this strategy could save you thousands while opening doors to better financial products within 18-24 months.

Unlock Full Article

Watch a quick video to get instant access.