The Side Hustler’s Credit Card Playbook: Points, Perks, and Pitfalls

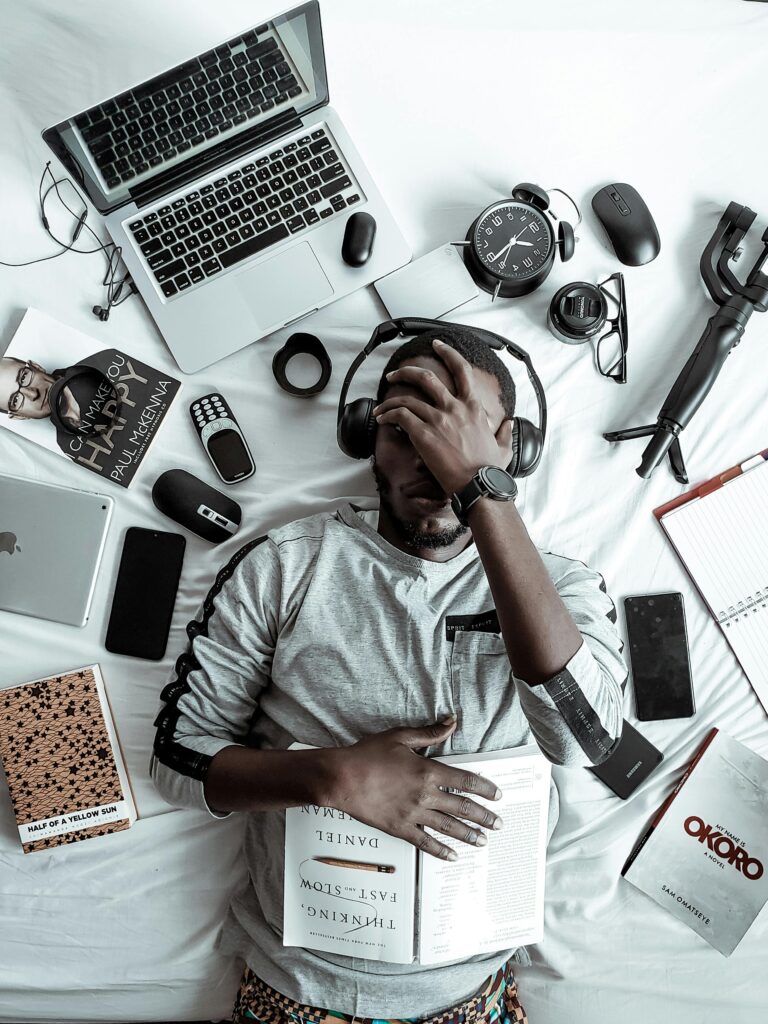

In today’s hustle culture, it’s not uncommon for someone to have a full-time job, a weekend Etsy store, a YouTube channel, and maybe even a dog-walking gig on the side. The rise of side hustles has reshaped how we work — but it’s also quietly transforming how we use credit cards.

Credit cards, once viewed solely as tools for emergencies or splurges, are now becoming strategic financial assets for part-time entrepreneurs. When used wisely, they can fund business expenses, unlock travel perks, and even provide short-term cash flow. But when misused? They can derail your hustle just as fast.

Here’s your playbook for navigating credit cards in the side hustle era — without falling into a debt trap.

Why Side Hustlers Love Credit Cards

Side hustles often come with upfront expenses: photography gear, crafting supplies, marketing costs, software subscriptions, or packaging materials. Inconsistent income means it’s not always easy to pay for everything out of pocket — which is where credit cards come in.

But today’s side hustlers aren’t just borrowing — they’re earning. The right card can deliver:

- Cash back or points on business expenses

- Introductory 0% APR offers that help with short-term financing

- Purchase protection and extended warranties

- Separate records for tracking business spending

That last point is key: separating your business and personal spending is essential for tax season, budgeting, and scaling.

Best Credit Card Perks for Hustlers

If you’re self-employed or freelancing, look beyond generic consumer cards. Some small business and freelancer-friendly cards offer niche perks that are actually useful. Look for:

- Cash Back on Business Categories

Cards like the Chase Ink Business Cash or American Express Blue Business Cash offer boosted cash back on categories like internet, advertising, or office supplies — stuff side hustlers use all the time. - Travel Rewards

If your hustle involves travel (think conferences, photography, or content creation), cards with points or miles like Capital One Venture X can turn your business expenses into free flights and hotels. - 0% APR Intro Periods

Need to invest upfront in inventory or equipment? Cards with 12–18 months of no interest let you pay over time without pressure — as long as you’re disciplined.

Pitfalls to Avoid

Let’s be real: credit cards can backfire fast. Here are the common traps to dodge:

- Carrying a balance beyond the intro period: Once that 0% APR ends, you could be stuck with a 20%+ interest rate.

- Using points as an excuse to overspend: Spending $1,000 to earn $50 in points only makes sense if you were going to spend the $1,000 anyway.

- Mixing personal and business expenses: It seems harmless — until tax season hits or you’re trying to analyze your business budget.

- Not planning for the bill: Credit cards aren’t income. Have a realistic plan to pay it back, even if your hustle income is unpredictable.

Credit Building = Business Building

Many side hustlers eventually dream of going full-time or securing a small business loan. Smart use of credit cards can actually build your business credit profile, especially if you open a card under your business name and EIN.

Strong credit (personal and business) can open doors to:

- Higher credit limits

- Better loan terms

- Vendor lines of credit

- Opportunities to scale faster

Credit cards aren’t evil — and they’re not free money either. For the savvy side hustler, they’re a powerful tool for managing expenses, earning rewards, and building credibility. But only if you’re strategic.

So before you swipe, ask yourself: Is this helping me grow or just helping me spend?

With the right card, the right mindset, and a clear plan, your credit card could be your hustle’s secret weapon.

Unlock Full Article

Watch a quick video to get instant access.