Navigating credit card interest rates can be tricky. They can quickly escalate the cost of borrowed money.

Credit cards offer the convenience of buying now and paying later, but that flexibility comes with a price: interest rates. This invisible cost can sneak up on unwary cardholders, turning a manageable balance into a financial burden. In this guide, we’ll demystify credit card interest rates.

We’ll explore how they work and what you can do to keep them as low as possible. Whether you’re a credit card newbie or a seasoned shopper, understanding these rates is crucial to keeping your finances in check. By learning the ins and outs of interest charges, you’ll be better equipped to manage your credit card debt and save money. So, let’s dive in and learn how to minimize these costs for a healthier financial future.

Demystifying Credit Card Interest Rates

Credit card interest rates are like a fee you pay. You pay it for borrowing money. Credit cards have different rates. These rates can change. They depend on many things.

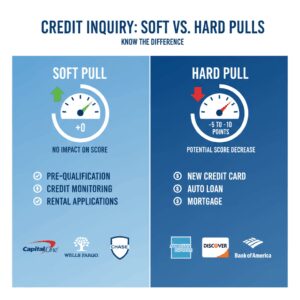

Companies look at your credit score to decide your rate. A good credit score means lower rates. A bad one leads to higher rates. They use a formula. This formula considers your score and other factors.

Types Of Credit Card Interest

Credit card companies charge you for borrowing money. Each type has a different interest rate. Let’s look at the main ones.

Purchase APR is the rate for things you buy. It’s applied when you don’t pay the full balance on time. Cards offer different rates, and shopping around helps.

Cash Advance APR is higher. You get charged this for getting cash from your card. Remember, extra fees often apply.

When you move a balance to a new card, that’s a Balance Transfer APR. Rates can start low but may increase. Read the terms first.

Penalty APR is the highest rate. It kicks in if you miss payments. To avoid this, pay at least the minimum, on time, every month.

Impact Of Apr On Monthly Payments

Your monthly interest depends on the APR. APR stands for Annual Percentage Rate. It shows the yearly cost to use a credit card. To find your monthly interest, divide the APR by 12. This gives you the monthly rate.

For example, a 20% APR becomes about 1.67% per month. Now, look at your balance. If your balance is $1,000, your monthly interest is $16.70. That’s 1.67% of $1,000.

Compounding can make you pay more. Compounding means earning interest on interest. Your card may compound daily or monthly. This can increase what you owe. To pay less, try to pay your balance in full. Or pay more than the minimum each month.

Navigating Promotional Rates

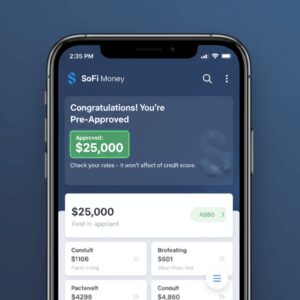

Introductory offers give low interest rates at first. Banks use these to attract new customers. These special rates are for a short time only. They make borrowing cheaper at the start.

Once the promotional period ends, the interest rate goes up. This means you will pay more money on what you owe. It’s important to know when the low rate will end. Plan to pay off the card before this time if you can. This way, you avoid higher costs.

Strategies To Lower Interest Payments

Paying more than the minimum can save you money. Each month, try to pay extra. This cuts down your balance faster. Less balance means less interest to pay.

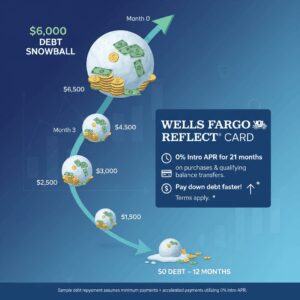

Consider balance transfer cards. These cards often have low rates for a set time. Move your high-interest balance to these cards. Watch out for transfer fees though.

Negotiating lower rates is possible. Call your credit card company. Ask for a lower interest rate. Be ready to mention your good payment history. They might say yes to keep you happy.

Understanding Your Credit Card Statement

Reading your credit card statement is key. It shows what you owe. It also shows your interest charges. These are extra costs for borrowing money.

Interest rates can be tricky. They can make purchases cost more. Your statement lists interest for each billing cycle.

- Look for “Annual Percentage Rate” or APR.

- This rate tells you the yearly interest.

- Check your balance. Lower balance means lower interest.

- Pay on time to avoid extra fees.

Remember, paying more than the minimum helps. It reduces your balance faster. This means you pay less in interest.

The Importance Of Good Credit Habits

Making payments on time is key. It helps your credit score. Late payments hurt it. Always aim to pay your credit card bill before it’s due.

Keep your credit use low. This means not filling up your card. A good rule is to use less than 30% of your limit. This shows you can handle your credit well.

Avoid taking on debt you don’t need. Think hard before buying things you can’t pay off right away. More debt means more to pay back. It can make it hard to save money.

Tools And Resources For Managing Interest

Many online credit card calculators exist. They help you know what you’ll pay in interest. Just enter your card’s rate and your balance. The calculator does the math. It shows how much interest adds up over time.

Financial planning apps can also help. They track spending and show ways to cut costs. Some apps even suggest how to pay off debt faster. By using them, you see how small changes can save money on interest.

Seeking advice can be smart. Consumer credit counseling offers free or low-cost services. They help you understand interest rates. Counselors give tips on managing credit card debt. They can also help make a plan to pay off what you owe.

Conclusion

Grasping credit card interest rates can save you money. Keep balances low and pay on time. Choose cards with low rates and understand the terms. Remember, knowledge is power. Use it to keep costs down. Smart moves mean less interest paid.

Stay informed, stay ahead. Your wallet will thank you.

Unlock Full Article

Watch a quick video to get instant access.