Managing debt can be tricky. Finding a smart strategy is key.

A personal loan for debt consolidation can be that strategy, but is it always the right choice? Let’s explore. Tackling multiple debts is no small task. It often feels like a juggling act, trying to keep all the balls in the air.

One solution that many consider is taking out a personal loan to consolidate their debts. This means bringing various debts under one roof, potentially with a lower interest rate and a single monthly payment. The idea sounds simple, but the decision is significant. It can lead to a smoother financial path or add bumps along the way. Our aim is to discuss when it’s wise to use a personal loan for this purpose. We’ll weigh the benefits against the drawbacks. This ensures you make an informed decision suited to your financial landscape. Let’s dive into the pros and cons to see if this debt consolidation method should be part of your financial strategy.

Introduction To Debt Consolidation With Personal Loans

Debt consolidation can help manage multiple debts. By combining debts, you pay one monthly bill. This simplifies your finances. Personal loans often have lower interest rates than credit cards. They can be a smart choice for paying off high-interest debts. Let’s explore the reasons to consider a personal loan for this purpose.

- One easy payment instead of many

- Possible lower interest rates

- Fixed repayment period helps with budgeting

- Can improve credit score over time

Personal loans offer a clear payoff plan. They have set monthly payments and a fixed end date. This makes it easier to see when you will be debt-free. It’s important to check loan terms. You should find a loan with a lower rate than your current debts. Always read the fine print.

The Right Time For A Personal Loan

Assessing your debt situation means checking your bills. List all your debts. Note the interest rates. See if they are high or low. Check your credit score too. A good score can mean lower loan rates.

Think about your monthly budget. Can you pay your debts as they are now? If it’s tough, a personal loan might help. It can bundle your debts into one payment. This can make it easier to handle.

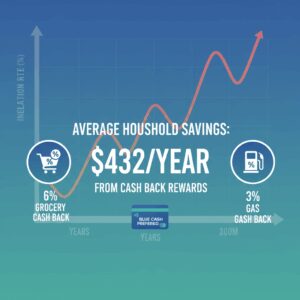

Financial health is key. Low-interest personal loans save you money. But they need a high credit score. If your score is low, rates may be too high. This could cost you more in the end.

Advantages Of Using Personal Loans

One key advantage of personal loans is the ease of managing debt. Instead of several bills, you only have one monthly payment. This can make budgeting simpler and reduce the chance of missing payments.

Another plus is the chance to save money. Some personal loans offer lower interest rates than credit cards. This means you might pay less over time.

Your credit score can also benefit. Moving debt to a personal loan might improve your credit utilization ratio. This is a big part of your credit score. Just remember, applying for a new loan does create a hard inquiry on your credit report. This can lower your score a little at first.

Drawbacks To Consider

Thinking about using a personal loan for debt consolidation? It’s important to know the risks. One big risk is falling into more debt. It’s easy to feel relaxed about money after consolidating. This can lead to spending more than before. Suddenly, you might find yourself owing more money.

Fees and penalties are also something to watch out for. Some loans have extra costs. These can add up and make your debt bigger. Always check for any hidden fees before signing up.

There might be better options than a personal loan. Sometimes, talking to a debt advisor helps. They can point you to other ways to handle your debt. Maybe a plan that fits your budget better. Always explore all options before deciding.

Making The Decision

Understanding your financial goals is key to debt control. Ask yourself what you aim to achieve. Is it to reduce monthly payments? Or maybe to pay off debt faster? Your goals guide your choices.

Speak with a financial advisor for expert advice. They can help you see if a personal loan fits your situation. This step is wise before making big financial moves.

Creating a plan for debt freedom is essential. List your debts. Note the interest rates. A personal loan might save on high-interest debts. Yet, remember to consider loan fees. They can add up.

Conclusion

Deciding on a personal loan for debt consolidation isn’t easy. Think about the pros and cons. Personal loans can simplify payments and reduce interest rates. But, they also require discipline and a stable income. Always compare loan terms before deciding.

Talk to a financial advisor for personalized advice. Remember, your financial health matters most. Choose wisely to manage your debt better.

Unlock Full Article

Watch a quick video to get instant access.