Navigating the world of personal loans can be tricky. Myths and misconceptions often cloud the truth.

Before applying for a personal loan, it’s crucial to separate fact from fiction. Many believe that personal loans are fraught with hidden traps or that they’re only for those with perfect credit scores. Others think that the interest rates are always sky-high or that the application process is too complex to navigate.

These myths can deter people from seeking financial help when they need it most. Over the next few paragraphs, we’ll address these misconceptions head-on. We’ll explore the realities of personal loans and provide you with the knowledge to make an informed decision. Whether it’s understanding credit score impacts, interest rates, or the borrowing process, this post aims to empower you with clarity and confidence as you consider your lending options.

The Myth Of Perfect Credit Score

Lenders know that a credit score is just one part. They check other things to decide. They see your job history and how much you earn. They also look at how much you spend. This helps them understand if you can pay back.

To improve your chances, show a stable job. Have a regular income. Keep your debts low. Even with a lower score, these can help. Show that you save money. It tells lenders you are careful with money.

Remember, a good score helps but it’s not everything. Show lenders you’re good with money. This can help you get a loan.

Interest Rates Misconceptions

Many people think credit scores are the only factor for rates. This isn’t true. Your income, debt, and loan amount also matter. A high credit score helps. But lenders look at other things too.

Want a lower rate? Compare lenders. Show you have a steady job. Pay down debts. Choose a shorter loan term if you can. All these might help.

The Fallacy Of Loan Use Restrictions

Many people think personal loans are only for certain things. This is not true. You can use personal loans for many reasons. For example, people use loans for home repairs, medical bills, or to pay off other debts. Weddings and vacations are other common uses.

Sometimes, a lender may limit how you use the loan. Yet, these cases are not common. Most of the time, you can use the money for any personal need. It is important to check with the lender before you apply. This helps make sure you can use the loan for your planned purpose.

| Loan Uses | Often Allowed? |

|---|---|

| Home Repairs | Yes |

| Medical Bills | Yes |

| Debt Consolidation | Yes |

| Weddings | Yes |

| Vacations | Yes |

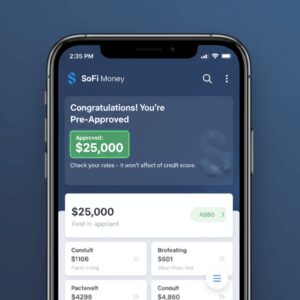

Misunderstandings About Loan Approval Times

Many people think getting a loan takes a long time. That’s not always true.

Loan approval can be quick. Some get it in just a day. Others might wait a week. It depends on the lender and your details.

Want a faster loan approval? Here are tips:

- Check your credit score. Make sure it’s good.

- Fill out forms correctly.

- Give all needed documents.

These steps can help speed things up. Remember, each lender is different.

Debunking The Need For Collateral

Many people think you always need collateral for a loan. This is not true. Personal loans can be unsecured. This means you don’t need to promise your things to the bank. You can get money without risking your car or house.

Sometimes you need cash fast. Maybe for a medical bill or a broken car. An unsecured loan can help here. You get the money quick. No need to prove you own something worth the loan.

| Need Collateral? | Loan Type |

|---|---|

| No | Unsecured Personal Loan |

| Yes | Mortgage, Secured Loan |

Remember, lenders look at your job and credit score. They decide if you can pay back. Good credit can mean better loan terms. No collateral needed.

Conclusion

Debunking personal loan myths is crucial for making informed choices. Understand terms, interest rates, and eligibility before you apply. Loans are tools, not traps. They aid in financial needs when used wisely. Research is key. Don’t let misconceptions stop you from exploring loan options.

Always read the fine print. Ask experts and make smart decisions. Your financial health matters. Knowledge empowers you to borrow confidently. Remember, the right loan can be a helpful ally in your financial journey.

Unlock Full Article

Watch a quick video to get instant access.