Cutting costs on monthly expenses often feels like a puzzle. Insurance premiums are a big piece.

Everyone needs insurance, but the sting of hefty monthly premiums can leave your wallet feeling a bit lighter. Imagine having extra cash each month—money saved from paying less for the same coverage. It’s not just wishful thinking; with the right strategies, reducing your insurance bills is within reach.

This article will guide you through simple, yet effective ways to lower what you pay for insurance without compromising on protection. From car insurance to health plans, we’ll uncover tips that can lead to more money in your pocket. Saving on insurance doesn’t require a magic trick; it’s about knowing where and how to look for savings. Let’s dive into practical steps that can help you shrink those bills and give your budget some breathing room. Keep reading to learn how to ease the financial load of insurance premiums and keep more money for yourself each month.

Evaluating Your Current Insurance Policies

It’s smart to check your insurance often. Ask yourself what you really need. Make sure you’re not over-covered. This can help lower your monthly payments.

Take time to look at different plans. Some may cost less but offer the same benefits. It’s worth checking out. You might find a better deal.

| Policy A | Policy B | Policy C |

|---|---|---|

| $50/month | $45/month | $40/month |

| Good coverage | Similar coverage | Basic coverage |

See? Just like that. You can compare and choose the best for you. Saving money can be easy.

Maximizing Discounts And Bundling Options

Insurance companies offer many discounts. Check these to save money. Some discounts are for safe drivers or good students. Others are for cars with safety features. Always ask your agent about discounts you can get.

Combine your insurance policies to save more. This is called policy bundling. When you bundle, you get one bill for all your insurance. It’s easier to manage. Plus, companies often give a big discount for bundling. Home and auto insurance are common to bundle. But you can bundle other policies too.

| Policy Type | Benefits |

|---|---|

| Home + Auto | Higher Discount, One Bill |

| Auto + Life | Save Money, Less Paperwork |

Improving Your Risk Profile

Everyone wants to save money on insurance. A good credit score can help. Pay bills on time to raise it. A high score means lower premiums.

Make your home and car safer, too. Install smoke detectors at home. Put in a good security system. For your car, get anti-theft devices. Safety features may lead to discounts. Check with your insurance company.

| Improvement | Benefit |

|---|---|

| Better credit score | Lower insurance costs |

| Home safety upgrades | Possible discounts |

| Car safety features | Less risk, more savings |

Exploring High Deductible Options

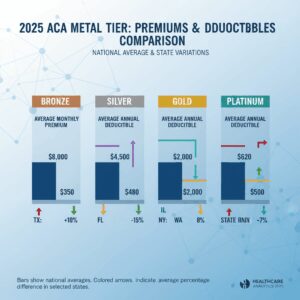

A deductible is the money you pay before your insurance starts to pay. Think of it like an entry fee. The higher the fee, the less you pay each month. Let’s talk numbers.

Choosing a high deductible can lower your monthly costs. But, it means you pay more if something happens. It’s a balance. You need to think, “Can I pay more upfront to save later?”

Imagine two plans. Plan A has a low deductible, so you pay more every month. Plan B has a high deductible, so you pay less monthly. If you don’t get sick often, Plan B could save you money.

To find out your savings, subtract Plan B’s monthly cost from Plan A’s. Multiply that by 12 for a year’s savings. Next, subtract Plan B’s deductible from Plan A’s. This shows if Plan B saves you money in the end.

Regularly Reviewing And Shopping For Insurance

Want to cut your insurance bills? Try annual policy reviews. Look at your coverage each year. Check for changes in your life that could lower costs. A new job, a safer car, or just getting older might help.

It’s smart to compare quotes from different insurers too. Prices can vary a lot. Get several quotes to find the best deal. You don’t have to wait until your policy ends. Look around and you might save money.

| Tip | Action |

|---|---|

| Review Policies | Do it every year. |

| Life Changes | Tell your insurer. |

| Compare Quotes | Shop around for deals. |

Conclusion

Saving on insurance doesn’t have to be tough. Simple changes can make a big impact. Compare plans and shop smartly. Bundle policies for discounts. Raise your deductible wisely. Pay attention to your credit score. Be proactive with safety features. Regular reviews ensure you’re not overpaying.

Remember, small steps can lead to big savings on your monthly premiums. Start today and see the difference in your wallet. It’s all about smart choices for a secure future. Save now, enjoy peace of mind later.

Unlock Full Article

Watch a quick video to get instant access.