High medical expenses can be overwhelming. Protect yourself by understanding your insurance, budgeting, and exploring available assistance programs.

Medical costs can escalate quickly, leaving many struggling with out-of-pocket expenses. Understanding the intricacies of health insurance is crucial for financial protection. Choose a plan that covers your needs and consider supplemental insurance for additional coverage. Budgeting for medical expenses ensures you are prepared for unexpected costs.

Research assistance programs that offer financial aid or discounts on medications and treatments. Staying informed and proactive can significantly reduce the burden of medical expenses.

Rising Medical Costs

Medical costs have increased over the years. In the 1960s, healthcare was cheaper. People paid less for doctor visits and medicines. Today, costs are much higher. Health insurance was not common back then. Now, almost everyone needs insurance. This helps cover high medical bills. Hospitals and clinics have become more advanced. But advanced care is expensive. New machines and treatments cost more money. Old trends show fewer people getting sick. Today, more people need medical help. Lifestyle changes have led to more health issues.

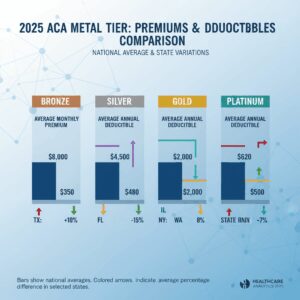

Medical expenses are now a major concern. In the United States, an average family spends thousands yearly. Insurance premiums have also increased. Many people struggle to pay these costs. Out-of-pocket expenses can be high. These include co-pays and deductibles. Emergency visits are very costly. Even simple procedures can be expensive. Some people avoid going to the doctor. They fear the high costs. This can make health problems worse. Medical debt is a big issue for many. Families often use credit cards to pay bills. This can lead to more debt. It’s important to find ways to save money on healthcare.

Understanding Insurance Plans

There are many types of insurance plans. Health Maintenance Organizations (HMOs) require you to use doctors within their network. Preferred Provider Organizations (PPOs) offer more flexibility. They let you see any doctor. Exclusive Provider Organizations (EPOs) are similar to HMOs. You need to stay within the network. Point of Service (POS) plans blend HMO and PPO features. You choose a primary doctor but can see others. High-Deductible Health Plans (HDHPs) have lower premiums. They come with higher deductibles.

Many people make mistakes with insurance plans. They don’t read the fine print. They miss key details. Network restrictions are a common issue. Some plans have limited doctor choices. High deductibles can lead to big out-of-pocket costs. People sometimes forget about copayments. These are fees you pay during visits. Prescription drug coverage can vary. It’s important to check the plan’s list of covered drugs.

Strategies To Lower Expenses

Preventive care helps avoid serious health issues. Visit your doctor for regular check-ups. Vaccinations and screenings are crucial. They help catch problems early. Early treatment usually costs less. Simple habits can help too. Eat healthy food and exercise regularly. This keeps your body strong and reduces doctor visits.

Generic medications cost less than brand-name drugs. They work the same way. Ask your doctor for generics. Pharmacists can help find cheaper options. Many stores offer discount programs for generics. Always compare prices at different pharmacies. Some stores have better deals. Buying larger quantities can also save money. Be sure to check expiration dates.

Navigating Medical Bills

Medical bills can be hard to read. Check each line item carefully. Look for errors or duplicate charges. Understand the terms used. Ask your doctor to explain any confusing terms. Compare the bill with your insurance statement.

Dispute any wrong charges right away. Call the billing department. Explain the problem. Provide evidence like receipts or insurance statements. Keep records of all conversations. Follow up until the issue is resolved.

Financial Assistance Programs

Government aid can help with medical bills. Medicaid is one such program. It helps low-income families. Medicare assists older adults and some disabled people. There are also CHIP programs for children. Each program has different rules. Check if you qualify. Visit official websites for more details.

Non-profits can also offer help. Many organizations assist with medical costs. The American Cancer Society helps cancer patients. HealthWell Foundation provides grants for medications. Look for local charities in your area. They might offer financial support. Always reach out and ask for help.

Protecting yourself from medical expenses is essential. Understand your insurance plan and consider supplemental coverage. Keep an emergency fund for unexpected costs. By staying informed and prepared, you can avoid financial stress. Take control of your health and finances to ensure peace of mind in uncertain times.

Unlock Full Article

Watch a quick video to get instant access.