Personal loans can be a versatile financial tool, offering a range of uses from consolidating debt to financing a major purchase or funding a personal project. However, choosing the right personal loan requires careful consideration of several key factors to ensure you secure the best terms and avoid potential pitfalls. In this blog post, we’ll explore essential factors to consider when choosing a personal loan and provide tips to help you make an informed decision.

1. Determine Your Loan Purpose

Before applying for a personal loan, clearly define your purpose for borrowing. Understanding why you need the loan will help you determine the amount you need and the type of loan that best suits your needs. Common purposes for personal loans include:

- Debt Consolidation: Combining multiple debts into a single loan with a lower interest rate can simplify your payments and reduce your overall interest costs.

- Home Improvements: Financing home renovations or repairs can enhance the value of your property and improve your living space.

- Major Purchases: Personal loans can help fund significant purchases such as a vehicle, appliances, or travel expenses.

- Emergency Expenses: Unexpected medical bills, car repairs, or other emergencies may require immediate financial assistance.

Knowing your loan purpose will guide your decision-making process and help you select the most appropriate loan option.

2. Assess Your Credit Score

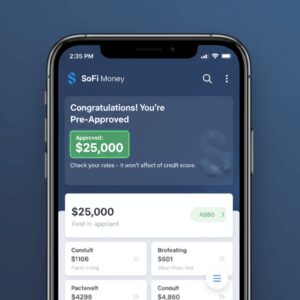

Your credit score plays a crucial role in determining the terms and interest rates of your personal loan. Lenders use your credit score to evaluate your creditworthiness and the likelihood that you will repay the loan. Here’s how your credit score affects your loan options:

- Interest Rates: Higher credit scores typically qualify for lower interest rates, which can significantly reduce the cost of borrowing. Conversely, lower credit scores may result in higher interest rates or limited loan options.

- Loan Terms: A strong credit score can also improve your chances of securing favorable loan terms, such as longer repayment periods or higher loan amounts.

Before applying for a personal loan, check your credit report and address any issues that may affect your score. Consider improving your credit score by paying down existing debt, correcting inaccuracies on your credit report, and avoiding new credit inquiries.

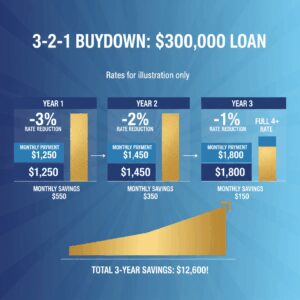

3. Compare Interest Rates

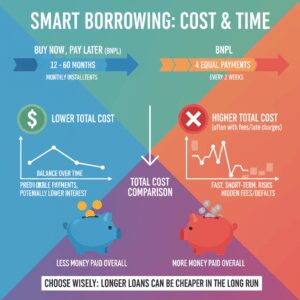

Interest rates are a critical factor in determining the overall cost of your personal loan. When comparing loan options, consider both the annual percentage rate (APR) and the interest rate:

- Annual Percentage Rate (APR): The APR includes both the interest rate and any associated fees, providing a comprehensive view of the loan’s total cost. It’s an essential figure to compare across different loan offers.

- Interest Rate: The interest rate is the cost of borrowing expressed as a percentage. Lower interest rates result in lower monthly payments and less overall interest paid over the life of the loan.

Shop around and obtain quotes from multiple lenders to compare interest rates and APRs. Consider both traditional banks and online lenders to find the best rates and terms for your personal loan.

4. Understand Fees and Charges

Personal loans may come with various fees and charges that can impact the total cost of borrowing. Common fees to be aware of include:

- Origination Fees: Some lenders charge an upfront fee for processing your loan application. This fee is typically a percentage of the loan amount and can affect your overall loan cost.

- Prepayment Penalties: Check whether the loan has prepayment penalties, which are fees charged for paying off the loan early. Avoid loans with prepayment penalties if you anticipate the possibility of paying off the loan ahead of schedule.

- Late Fees: Understand the penalties for missed or late payments. Ensure you can manage the loan payments within your budget to avoid additional charges.

Review the loan agreement carefully to understand all fees and charges associated with the loan. Factor these costs into your decision-making process to ensure you choose a loan with manageable and transparent terms.

5. Evaluate Loan Terms and Repayment Options

Loan terms and repayment options significantly impact your financial commitment and flexibility. Consider the following aspects when evaluating loan terms:

- Loan Amount: Ensure the loan amount meets your needs without exceeding what you can comfortably repay. Borrow only what is necessary to avoid taking on more debt than required.

- Repayment Period: Personal loans come with varying repayment periods, typically ranging from one to seven years. Longer repayment periods result in lower monthly payments but may increase the total interest paid over time. Shorter periods have higher monthly payments but reduce the overall cost of borrowing.

- Monthly Payments: Calculate the monthly payment amount based on the loan amount, interest rate, and repayment period. Ensure the payment fits within your budget and does not strain your finances.

- Flexibility: Some loans offer flexible repayment options, such as the ability to make extra payments or adjust the payment schedule. Consider whether these options are important for your financial situation.

6. Research Lender Reputation and Customer Service

The lender’s reputation and customer service quality are essential factors to consider when choosing a personal loan. Research potential lenders by:

- Reading Reviews: Check online reviews and ratings from other borrowers to gauge the lender’s reputation and customer service quality.

- Comparing Lender Options: Consider both traditional financial institutions and online lenders. Online lenders often offer competitive rates and faster processing times, while traditional banks may provide more personalized service.

- Contacting Lenders: Reach out to lenders with any questions or concerns you may have. Evaluate their responsiveness, willingness to provide information, and overall customer service experience.

7. Review the Loan Agreement Thoroughly

Before finalizing your loan application, carefully review the loan agreement to ensure you understand all terms and conditions. Pay attention to:

- Interest Rate and APR: Verify the accuracy of the interest rate and APR quoted.

- Fees and Charges: Confirm the details of any fees and charges associated with the loan.

- Repayment Terms: Review the repayment schedule, including the monthly payment amount, due dates, and total loan term.

- Loan Conditions: Understand any conditions related to loan approval, disbursement, and repayment.

Choosing the right personal loan involves careful consideration of several key factors, including your loan purpose, credit score, interest rates, fees, loan terms, and lender reputation. By evaluating these factors thoroughly and comparing loan options, you can make an informed decision and secure a loan that meets your needs while minimizing costs. Take the time to research and understand the terms of your personal loan to ensure you make a choice that supports your financial goals and provides peace of mind.

Unlock Full Article

Watch a quick video to get instant access.